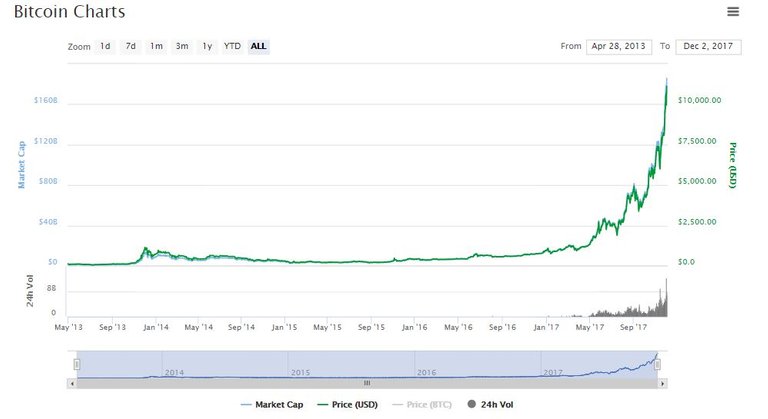

We have been enjoying a bull market ride for Bitcoin and cryptos in general through 2017. Especially with the recent symbolic new all-time high of $10k per Bitcoin, many are starting to talk about a bubble. With a near-vertical market chart like this:

It is a certainly a very good question to ask yourself. I think anyone will agree that this is not a trend that can be considered ‘normal’ or ‘sustainable’ in long term, as we have learnt from history. I would like to clarify that whilst I do believe we're in a price bubble right now, I'm not saying that Bitcoin as a technology is a bubble, quite the contrary - Bitcoin is the next technological revolution and for the forseeable future I don't see it going away!

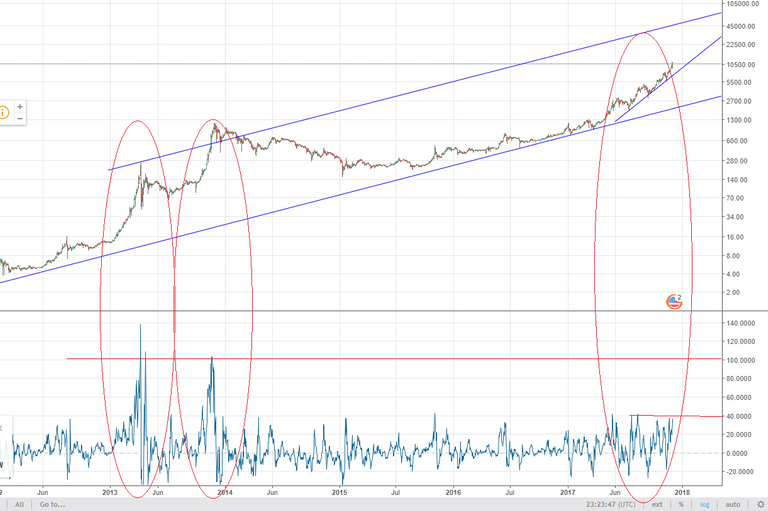

If you look at Bitcoin’s log chart, it’s clear that the trend is moving away from the long term trend line. However, looking at this chart you will see that we tend to be in a ‘mild bubble’ most of the time. The concern starts to arise when it’s getting too big.

So the million dollar question is: When is it going to burst?

As deadly as a bubble can be, if you are lucky to exit at the right time…man, it will be a ‘unicorn’ moment in your investment career! Epic! However, if you leave it too late, you will see a big hit to your portfolio value.

In this article I’m looking at a couple of strategies to help you hedge your bets. I am also looking at some facts and analysing what might be the potential size of the current bubble.

word of caution: Please note that I am not a financial expert and this is not a financial advice. I do not take any responsibility over how you chose to apply the information contained in this post.

Strategy number 1: HODL

Now, for an asset that is Bitcoin, I would argue that if you’re happy to hold for the next 5 years then you don’t even need to worry about this bubble. This bubble will come and go within the next couple of years. Couple years after that, the price will eventually even out and Bitcoin will be back on its long term trend (assuming it hasn’t been destroyed by the institutional investors or overtaken by another crypto).

This is a safer, less risky strategy and by consciously deciding to this approach, you won’t be fazed much when the market turns.

Strategy number 2: Cash in! Cha-ching!

This strategy is about cashing out before the bubble bursts. The beauty of this strategy is that in an event that you will be ‘too late’ to exit, you can always fall back on strategy 1.

The risk is that you exit too soon and you might end up losing money.

We must try to answer few critical questions that will help us decide what we believe the current situation holds for us.

- How big is this bubble going to get?

- When is it going to burst?

If you read up on various bubbles in history, you will usually find that they tend to get much bigger and last much longer than anyone can expect. In order to determine the ‘size’ of the bubble we can study historic data to help us determine some reference points that will give us a better view on the subject.

If we look at the previous Bitcoin bubble from 2013 we can notice few things:

- The first part of the bubble has sent the price from $13 to $228, a 17x increase. It started in January 2013 and run until April 2013

- After that, the price corrected for a couple of months and then from October to December it went from $200 to $1134, so nearly 6x

- If we combine both of these bubbles together we get:

o Bubble started in January and ended at the end of Nov = 11 months

o Bitcoin went from $13 to $1134 = 87 times increase!

Today, when we look at Bitcoin's log scale we can see that it had been nicely trailing near the long term trend line until April this year. This was at around $1000 mark. Today, we’re at $10k per Bitcoin, so a 10x increase in 7 months. We can say that now we’re roughly at around half the size of the first bubble in 2013.

If history was to repeat itself, we would need to see a rapid vertical growth in a span of around two months that would take the price to around 55k on the moderate end, or around 100k on the high end. Now, it sounds crazy and we might not get anywhere near these levels. To reach 100k per Bitcoin the total market cap would have to grow to $1.67 trillion dollars, so about 10x from where it’s at now.

The current trend is definitely slower paced than the previous ones and it is also correcting a lot more on its way, de facto making it ‘healthier’. It’s ironic, as these corrections this year were mainly due to some ‘adverse’ announcements, such like ICO and exchange ban in China. So the things that were meant to ‘sabotage’ Bitcoin have actually helped it grow steadier and bigger.

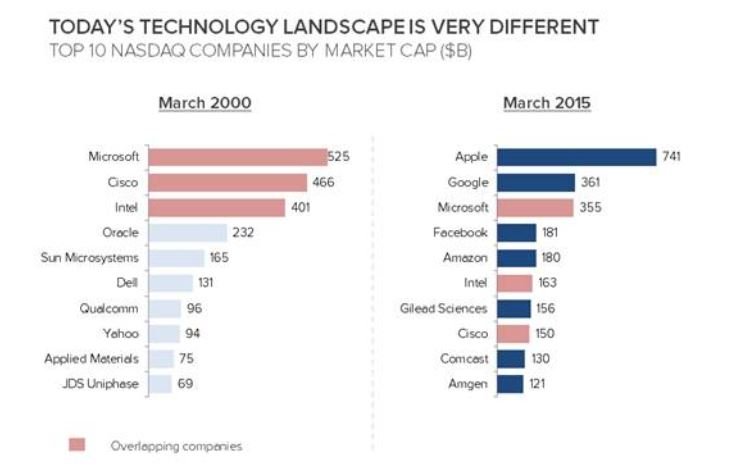

We can also reference the “dot com” bubble as it’s probably the closes we can get in terms of finding similarities:

- It was related to a ‘boom’ of new applications using this new, miraculous technology called ‘the Internet’

- “Dot com” avalanche of IPO’s is very similar to today’s latest fashion: new ICOs

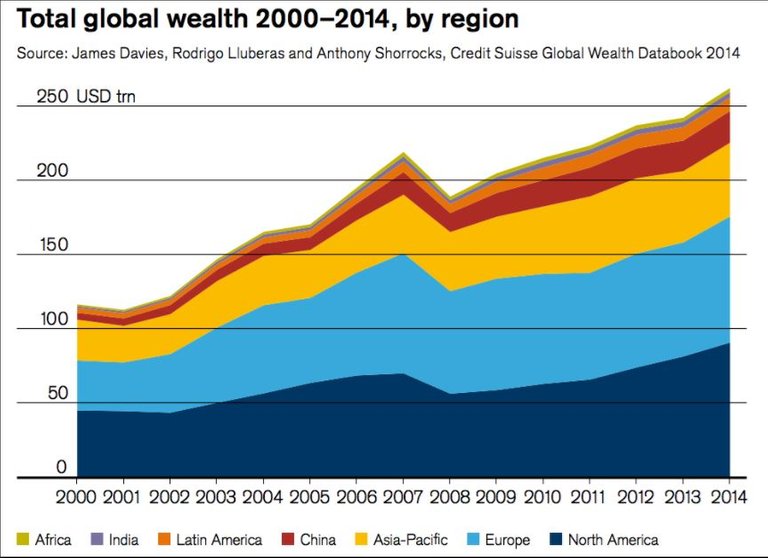

In case of ‘dot coms’, at the peak of the market, combined internet stocks for 280 companies were valued at $2,948 trillion. When the bubble burst, it had fallen to $1.193 trillion, with a loss of $1.755 trillion. So we can say that the ‘value’ of the bubble was $1,755 trillion.

Today’s total market cap for all crypto currencies is at $328 billion. So it is 5 times less than the value of the ‘dot com’. Obviously, the total value of wealth has increased since 2000 and it is now roughly 2.5 more than it was back then. So you could argue that the value of the ‘dot com’ bubble in today’s terms would equal to 2.5 x $1,755 = $4,387. In this case, the total market cap for crypto is 13 times smaller than the ‘dot com’ bubble right now…does that mean there is plenty of room to grow still? Time will tell.

The graphic below shows Microsoft topping the chart of ‘dot com’ companies with highest market caps, 525 billion. In 1996 Microsoft’s Market Cap was at 72 billion. So it has increased just over 7 times in 3 years during the bubble.

Bitcoin’s market cap today is at $185 billion, a ten time increase from March 2017. If we compare it to Microsoft’s market cap at time of the bubble, we can see that it is 2.8 smaller. Bitcoin also holds a bigger market share of the total crypto market (55%), compared to Microsoft’s 12% at the time.

Of course, we’re not comparing apples to apples here but I do think that it puts things into perspective somewhat. This bubble has set a precedent and the current bubble could grow to equal or bigger size. This is not to say that it will.

We have learned a few things so far:

- We’re currently about 20% of size of the dot com bubble

- We’re about half way in size compared to the ‘first’ bubble of 2013

- The growth is much steadier and slower than that of both bubbles in 2013

2. How do we know when it’s going to burst then?

This is the question everybody wants to know the answer for. So far, looking at the charts it looks like the pace of growth is a good indicator of when the burst is going to happen. If you look at the ROC indicator you can see some pretty good correlations there with the moment of ‘pop’.

As you can see from the picture below, the ROC indicator hit 100% during the previous bubbles both times spot on.

If we look at where ROC is at today, we can see that it is around 40% mark, so nowhere near the concern levels yet.

It remains to be seen how this bubble will play out. It may gain even more speed and send the trend line hyperbolic very quickly, which will turn all the flags red. It can also pace itself down, flatten out a bit and go away without an echo. Nobody knows what's going to happen, but armed with this information you should stay vigilant and continue to monitor the situation to see how it develops.

Hopefully the reference points in this analysis will help you to gauge how the bubble is developing and whether there is still a room for it to grow.

Please give this post a like and share if you found it useful!

Bitcoin is NOT a bubble.

https://steemit.com/bitcoin/@farq/why-bitcoin-is-not-in-a-bubble

Thanks for your comment! I agree Bitcoin is not a bubble! It's here to stay. However it does experience 'bubbles' in price along the way, which is a fact, as it already happened to BTC in the past.

Nice post! I upvoted and followed you. Can you check my last blog post about crypto: https://steemit.com/cryptocurrency/@cryptoizotx/crypto-market-sentiment-update-december-3-2017 ?