Since Bitcoin and blockchain technology started out almost 10 years ago it has come a long way. Early adopters have seen unbelievable profits in recent months if they held onto even just a few coins since purchasing them for pennies or even a few hundred dollars. This trend has turned small time investors and even regular blue-collar workers with an interest in new technology into millionaires and billionaires.

We have also seen in the recent half century, that the wage gap has been growing greater and greater between rich, middle class and poor folks in the US. The output of production is growing greater and greater with automation and technology making us better and more efficient at our jobs, yet worker compensation is not keeping up with the profits they produce.

(Every year workers create more and more, but barely see much more money in their paychecks)

It is often debated that corporations are responsible for this gap and that they are greedily not paying workers what they deserve in order to give bonuses and raises to very high/top level positions like CEO's who arguably, don't need nor deserve more money at all, and in fact do all that they can to enlarge the gap further. (We are not here to debate the facts of whether this is true or not)

This leads to the question, how will greater adoption of crypto currencies effect this gap? It is well documented in recent months that world governments are nervous about crypto currencies and potential effects it could have on an economy. One of the biggest fears government express is the lack of regulated government control. Without having a hand in how coins and tokens are traded and maintained, we could see a very similar situation as the Great Depression. A free market is good in theory, but it has been historically shown this leads to monopolies, expansions of credit that become unmanageable, underhanded business tactics and an overall exploitation of the average working class people.

(Would you trust these people to manage themselves without regulations?)

Before we make any assumptions or come up with any kind of answer, we need to understand how our current model of economics works in most of the wealthy developed nations around the globe. We are currently using a neo-classical model that emerged in the 19th century. William Stanley Jevons, Leon Walras, Carl Menger are considered the fathers of neo-classical economics as most of the foundation is based on their writing.

The foundation of neo-classical economics is a heavy mixture of microeconomics and Keynesian economics. To make it simple, we're going back to highschool supply and demand. If you didn't completely flunk economics class, this is a rather simple concept on it's own. The more demand and the less supply the more something should cost and the less demand and more supply means something should cost less. However that is not where it stops, and this is where most average hourly workers understanding stops and a large misunderstanding of how our modern economic model comes into play.

The biggest critique made by economist is that a lot of neoclassical economics relies on implication and assumption. Fiat currencies that we use now are not backed by gold and/or silver like most economic structures of the past. It is backed entirely by trust. This means that 1 USD or 1 Euro is worth only what we as a society deem it is worth. This leads to a very big problem. How much currency should we allow in circulation and how much is it worth?

Once upon a time, federal mints decided how much money should be in circulation. It was decided that a currency should represent the amount of gold and/or silver a country has in it's reserve. So for simplicity sake, lets say 1 USD = 1 gram of gold. The federal reserve holds 1 trillion grams of gold, therefore 1 trillion USD are put into circulation. If more gold is mined or is somehow lost, USD need to be printed or pulled from circulation to accurately reflect the gold held by the reserve.

Lets look at what happens now. Federal mints generally don't print money anymore, at least not in the straight forward way as above. Now governments rely on Centralized banks because these big banks (Rothchild, JP Morgan, Etc.) own treasury bills, government bonds and other assets tied to government. This put them in a position to essential hold governments hostage. How so; you may be wondering. Lets put it this way, should a big bank like JP Morgan decide that they want to allow more loans to go out, they don't simply reinvest money they have, rather they pressure governments to print more money to meet the demand for loans. This creates more nation debt because now there is more currency in circulation thus lowering the value of said currency.

Why don't governments just say "No"? There lies the biggest problem. Because these banks own so much of government assets and they have the ability to sell them, if they choose to sell at a low value, the entire government looses value. Much like how the crypto currencies we love so much work, the value is based on sell orders. If it's selling high, the price stays high, if it's selling low, the price drops to the new low. We see very good example of this in pump and dump coins.

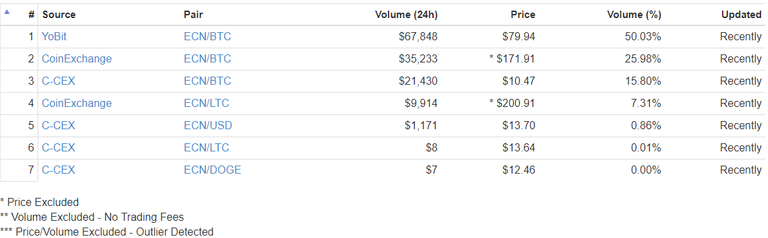

As we can see above, in the most recent pump and dump by e-coin, a few outliers threw the value of the coin far higher than it was actually worth. This was accomplished by a whale or group of whales buying and selling back and forth to each other at exorbitant prices to artificially raise the value so they could dump them on unsuspecting investors who don't know any better. The banks can do the same thing with government assets that they own except they can low ball a sale rather than pump the sale and it will crash the entire value of said assets. The power of fear is stronger than the power of trust. We saw this happen in the Recession, banks forced government to print more money to loan to the housing and auto industry or else face an economic collapse of the fiat USD.

Why would a bank want to sell off an asset at a low price? Wouldn't it hurt them too? Not exactly. The banks are the ones holding the most gold and silver now, so they own real money while giving us fake money (fiat) that represents the debt we owe them. In the US it is estimated that only about 3% of our money is real money tied to something with real value (gold and silver) the other 97% is a debt owed to the banks who hold the gold and silver (again, the real money) so they actually wouldn't loose anything. Should the fiat collapse, they still hold the real wealth and would at worse, loose the debt that is owed to them by a nation, but the debt is unpayable to begin with anyway. Should the debt get closer to being payed off, they create more fiat to fulfill more loans thus raising the debt of the entire population of a nation. A vicious circle of unpayable debt is created and no nation can stop it.

Why is gold valued so much anyway? It's just a hunk of metal. The reason humans have used gold for centuries as a store of value is because of it's limited existence. You can't make more gold. Lets say we managed to mine all the gold out of the earth's crust and there is absolutely no more gold to be mined, and we have 100 trillion ounces of gold, for the rest of time 1 ounce of gold will always be worth the same because the supply can no longer be moved (excluding the lose of gold via disaster or something). With paper fiat, this is no longer the case. We can continue printing and printing until the value of 1 USD is worth what is today 1 penny.

Enter the Bitcoin. As most of us know, there is a limited supply of Bitcoin. That supply will never increase, thus the value remains the same. 1BTC = 1BTC just like 1 gram of gold = 1 gram of gold in our example above. The only things that will change in price are products and services themselves via supply and demand.

(It's not really that simple right? Yes, it actually is.)

As things stand, it appears that Bitcoin and other coins and tokens are becoming worth more and more each year, after all, the value compared to the USD is going up and up and sells for more and more, so clearly Bitcoin is going up in value right? Not really. In one sense it is because adoption is happening. As coins and tokens are adopted people see more value in them so the value seems to be going up, but what is really happening is a recognition as a store of value. This brings the coins and tokens to the value it should actually be worth. Paired with the ever diminishing Fiat, it creates an illusion that a 5 cent investment made in 2009 became worth 20k at it's peak. If we where to pair bitcoin against a gold standard the moment it was invented and made it the national currency, the value would have barely increased because the value of gold didn't really change. Adoption of bitcoin would have still made it's store of value go up, but it wouldn't go higher than it's value unlike the Fiat. This is why crypto markets are so volatile. Limited supply coins and tokens like Bitcoin are being compared to a currency that doesn't really have any real intrinsic value nor a limited supply. If we printed 1 trillion USD today, Bitcoin would moon past it's ATH with no problem, but it wouldn't actually be worth more. It would just be worth more USD, but that wouldn't help if a $1 loaf of bread became worth $1000.

The biggest mistake people are making when it comes to crypto is the paired values making coins appear worth more when nothing actually changed. They are being treated like stock, when in reality they are a currency first and foremost. You wouldn't buy 100 billion in a brand new poor countries fiat currency that has no limited supply in the hopes that it becomes worth more, that makes no sense. So why would you do that with a crypto currency?

What should we be doing and how will this lessen the wealth gap? We should be turning out fiat into cryptos we believe in and holding them while supporting adoption and NEVER trading them back to fiat. You will be essential trading in your fake money (fiat) for a real store of value. Just like the folks who buy gold and see it's value "increase", you will actually just be putting your labor into a currency that hold a real value and will not decrease. If you put USD into a saving account that has a 4% interest rate a year, that isn't going to help if the value of the dollar is decreasing by 6% each year. You will be losing money, not gaining it. Coins like Bitcoin and metals like gold and silver are immune to this due to a limited supply.

If we the people all got together and created an adoption of crypto currencies that rivals or matches the fiat, we would see more of the fruits of our labor being payed to us. Our money in our pocket won't be decreasing in value day after day while it is in our wallets and not invested in stocks and bonds. Should supply and demand stay exactly the same for bread today as it will be in 10 years, the same amount of currency is needed. Bread costing .0000001 BTC will still cost .0000001 BTC because there is no inflation. This makes the cost of living stay the same for basic necessities we can mass produce with ease and luxuries with very limited supply have a reasonable value dictated by a fair market, and we become more capable of mass production, the cost would decrease.

It has become abundantly clear that those who control fiat are the same folk who talk about a "crypto bubble" bursting. They are doing 1 of 2 things. They either A) spreading FUD to keep the layman away from crypto so fiat remains powerful and they remain in power. Or B) They are treating crypto like stocks and assets, which it is not and thus makes no sense to treat it as such.

For the average man, crypto currency is the key to his shackles of debt. Given enough time and enough support from society, the fiat will die and with it, the global debt. A new form of gold standard will be instated and the filthy rich banker who lives off of your debt will no longer be worth anything.

Great article. It will be interesting to see if there will be more than one crypto that gets huge global adoption or just BTC. Personally, I think currencies attached to other platforms (like Steem! :-D) have the best chance of really ramping up the value for the common man.

Thank you very much for your input! I will be doing an article later this week/early next week going over the value of having so many currencies attached to specific platforms (like Steem) and how they could positively effect a trading market in ways we have never seen in human history.