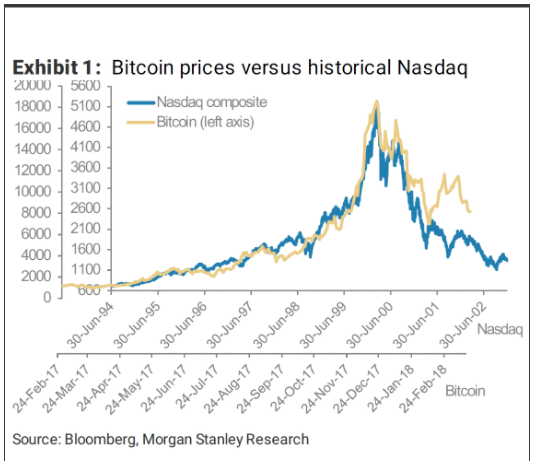

Morgan Stanley recently noted similarities in the rise and fall of Bitcoin prices and the historical rise and fall of Nasdaq index during the dotcom crash.

The Nasdaq fell 78% from peak to trough, in the dotcom sell-off from 2000 to 2002.

If the similarities in Bitcoin prices and historical Nasdaq index continue, Bitcoin will bottom in the $4000's. Down almost 80% from the $20,000 peak.

Note that per Morgan Stanley analysis, Bitcoin prices are changing over time at a rate 15X the rate of change for the historical Nasdaq index.

If Bitcoin pricing continues to mirror the historical Nasdaq index and the rate of change for Bitcoin prices stay at 15X the rate of change of the historical Nasdaq , we will see Bitcoin prices back to $20K within two years.

Many similar dynamics are in place between the two crashes.

Similar dynamics will also drive the pricing recovery for Bitcoin.

Dotcom pricing in 2000 and Bitcoin pricing in late 2017 both went up in an exponential increase due to mass euphoria, as part of the hype cycle of new technology.

Dotcom prices crashed in 2000 - 2002 and Bitcoin prices crashed in early 2018 as the hype cycle was revealed. The new technology underlying the hype was NOT ready for prime time.

Dotcom prices recovered and made new highs, as the technology matured and changed the world we live in.

The internet became pervasive, starting from 2002.

Bitcoin and crypto prices will recover and make new highs, as the technology is given time to mature and will change the world we live in.

Blockchain and distributed ledger technology will become pervasive, starting from 2019.

Distributed ledger changes the world by changing the nature of trust. Third parties that currently provide trust and skim points off transactions based on their trust services, are going to be toast in the new world (e.g. banksters and many financial services companies).

STEEM On!!

DaveB

p.s. I'll be back in Jun 2019 to confirm that Bitcoin prices are back to at least $20,000

Interesting but the dot com bubble was when the market was quite big, relative to the currently very small cryptocurrency market cap. I do think Bitcoin could hit $4k but if the big money comes back in, it might not take long to go to new high. I think there might be a bigger, longer lasting crash when the cryptocurrency market is much bigger.

Nasdaq lost $5 trillion of market cap in the dotcom collapse. Peak in cryptos was about $800Billion, and we may bottom at $100Billion. So Dotcom crash was only 7X as large as Crytpo crash might turn out to be.

7X is still a big difference. But it is not 100X different or even an order of magnitude different

The dot com crash was worldwide, none of my shares in the UK were on the Nasdaq. If you consider 18 years of inflation and the bigger money market that cryptos are in, it's still relatively much less inflated.

if the price of BitCoin continues to drop..that makes it easier for poor folk like me too buy.

Will be easier for everyone with fiat to get in if coin prices are 40% lower.

Me, even poorer than you. It is best if bitcoin price drops to 0.01 cent USD like back in 2009. Then I will buy 1000 btc. Ha ha

As the saying goes “there is no honor amongst thieves”. If it does drop, I think other whales come in and will be greedy and start the upturn — they didn’t want to wait. Look what the top 50 LTC wallets have been buying every 15 minutes — 470k LTC coins every 15 minutes — weak hands to the whales https://mobile.twitter.com/ltcwhalewatcher?lang=en

Sad but true. Those that have just gets more.

That is the way of the world I guess.

Mhh interesting. I think Bitcoin will be much more violent then the the 2000 bubble and much more impactful fundamentally to society.

So I don't love the comparison. I think its fine to do when looking at the bubble, but fundamentally i think these markets will be very different as the internet was not as foundational of a technology as bitcoin.

BTC is not a foundational technology. Blockchain and distributed trustless ledgers are foundational.

Hard to believe blockchain will be bigger than the internet. Internet allowed connecting 5 billion people that were otherwise not connected. Blockchain will just cut the margin for transactional middleman that shave points in exchange for providing trust in exchanges, e.g. banks

seems like the time is coming again where we will see some new highs who know ;)

Soon, the bounce will happen 7-10 days ...

Good info...my level for weeks has been $6000 for a bounce.

I'm not looking for a dead cat bounce. I'm looking for a new bottom

$4 800? Its on the 78,6 FIB retracement.

$4800 happens to be the average cost of producing a new BTC in the US.

So perhaps that will be the new low?

Time will tell

Great post and yes I agree that both charts look similar but I would say that history repeats itself but never in the same way!!!

Insightful. Repeat will not be a perfect copy of history, it will be an echo of history

The problem with this graph here is that you are comparing two completely different asset classes. Although they are both great representations of bubble scenarios I don't think the price of BTC can go that low for one main reason: the physical cost to MINE BTC.

Least expensive countries to mine Bitcoin

Venezuela — $531

Trinidad and Tobago — $1,190

Uzbekistan — $1,788

Ukraine — $1,852

Myanmar — $1,983

The price to mine BTC in USA in 2018 is $4,758

http://fortune.com/2018/03/07/bitcoin-mining-costs-global-south-korea-venezuela/

So the potential for BTC price to drop into the $4K range is not going to be limited by the costs of mining.

Also, consider that with Soros entering the BTC market place, he is most well known for making lots of money for SHORTING.

So Soros can makes lots of money by shorting, and if you are going short the most money to be made is by shorting BTC all the way down to $0.

Remember the BTC futures market do NOT settle with real BTC.

So if you NOT settling with real BTC, then the futures price for BTC can go to $0; Soros can make a few more billions, and crash the crypto market down to nothing

What do you mean by least expensive country to mine btc

Do you mean by electricity cost?

I am from Myanmar? Our country has hot weather.

Mining equipment can be easily heated.

Read the article from Fortune to get full background. I assume cost is mostly the long term cost of power, and the short term startup cost of buying your mining rig

We need a $4 800 to have a good strong bounce for an ATH. May to July will be wild. Stay strong all of you. Next 7-days will be telling.

Verbal diarrhea worthy of any truly famous sports personality. It's all about being focused for the next game. We're going to work as a team and take it one game at a time. No time like the present to make a big difference.

"Next 7 days will be telling". More telling than the previous 7, or how about the following 7 after we get beyond the immediate next 7?

LOL

Watch out for George Soros. He loves to SHORT and take down an entire asset class or an entire currency.

That bounce to an ATH may not be what Mr. Soros has planned for cryptos.

@crisdevilgamer Upvote & Follow me @crisdevilgamer