The impressive growth of Bitcoin and cryptocurrency is unprecedented, financial wizardry depending on who you ask. At the time of writing this blog, Bitcoin marketcap currently stands at $75,739,690,716 while the marketcap of Goldman Sachs currently stands at $85.10 billion. Astonishing growth for a financial alternative that is less than a decade old compared to a multinational financial institution that was founded 1869.

We can go further an compare the charts of Bitcoin and Goldman Sachs for the last 5 years an it reveals some interesting findings.

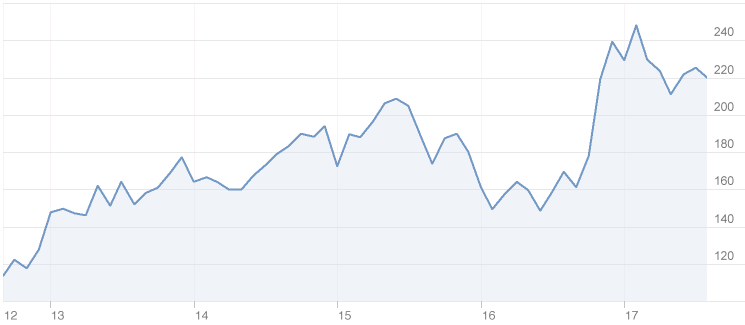

Chart of Bitcoin

Chart of Goldman Sachs

There are many points that can be noted from the graphs, but I would like to just talk about 2017. What a year it has been for Bitcoin, it has seen an impressive +782.72% increase in price from this time last year, a +68.98% increase from last month alone while Goldman Sachs is up +19% from its high of 37% it achieved in February following post election Trump rally.

Interesting enough, the guys from Wall Street have been complaining of "low volatility" which reflected in an historic miss on earnings from Goldman Sachs that greatly impacted their stock price. Certainly, the daily volatility of Bitcoin and other cryptocurrencies are raising quite a few eyebrows and just maybe the boys with the deep pockets could join the party. But who knows, probably some are already dancing as the cryptocurrency space continues to gain media traction.

We have seen the likes of Japan, China, Russia, India and many European countries begin the adoption phase in 2017 with other countries opening up dialogues. An while the likes of Goldman Sachs continue to expand their empire to other countries Bitcoin still has one main advantage, anyone can open an account. Among other great attributes that Bitcoin offers is the fact that it is immune to inflated currency that Central banker print that lose value with time.

For those involve in financial management that utilized financial instrument from Goldman Sachs or other financial banks that return 5% a year interest or others who have saving account that offer 0.5% per quarter, not to mention that fact the value of your deposit actually decreases with time as the purchasing power becomes less, Bitcoin offers competitive ROI. It's almost crazy to think that someone who invested USD100.00 in Bitcoin in 2010 are millionaires as we speak. I wonder how much of those with that deposit in banks are valued now? Chances are, these days with banking fees, their deposit are probably in the negative or close to it.

One of the big problems facing banks like Goldman Sachs and depositors doing banking with other banks are the fact that interest rates are so low and it is "way way way" below the rate of inflation. To break this down, if I deposit USD 1000 at Goldman Sachs or any other financial institution, it would still be USD 1000 in two year but what it can actually purchase would be significantly less. Probably most of you realize that your 100USD brings home significantly less from the supermarket than it did 1 year ago, that's one of effects of inflation. Just from this, you could see the kind of business that Bitcoin can take away from the likes of Goldman Sach and other commercial banks if customers choose to put some of their savings into Bitcoin.

I don't want to bore you further with my blog, but base on the fundamentals behind Bitcoin I expect Bitcoin marketcap to sail pass Goldman Sachs. This should also give us some perspective on Steemit, a social media platform comparable to the likes of Facebook that has a marketcap of 492.61 billion dollars. Steemit is very much in its infancy and I hope the day when Bitcoin surpasses Goldman Sachs marketcap that the Steemit Inc team would be energized to make this product even better. To the early adopters, the ones reading this post, this could easily be your investment of a lifetime, that Steem Power would be like owning preferred stock/shares but greater as you are equipped to empower others.

Goldman Sachs recently told its institutional clients: "Whether or not you believe in the merit of investing in cryptocurrencies (and you know who you are), real dollars are at work here and warrant watching."

That's what I tell my dad when trying to get him to invest!

Nice post.

Upvoted.

Thank you, welcome to resteem the post...certainly is, well it has gone pass the likes BlackRock Inc and other investment firms that people put millions into to get a 5% return, so who knows, probably it makes sense to invest directly into it rather than throw money at those big money managers that struggle to offer 5% ROI

Goldman Sachs criminals

Nice article, daudi. Sorry I'm a bit late to the comment party. Busy week.

No problem man thanks for the support, don't forget to check the one concerning ethereum as it has surpass Deutsche Bank, next week we could see Bitcoin surpass Morgan Stanley and Goldman Sachs as the wage growth was weak but NFP was ok so I am expecting a pull-back on the banks next week but we could also see some profit taking when Bitcoin hit 5000 this weekend but we see how things go, I do another blog soon, expecting a run for Bitcoin Cash when there is a profit taking on Bitcoin...thanks for the support man, appreciate it

I'll check it out!

Yep, I've been buying Bitcoin cash from about $650 all the way down. I'm hoping for a big pop there soon, but I don't know what will trigger it yet.

A pop is in the making, once we start with a pull back in BTC profit taking expect BCH to go on a run, for now the attention is on BTC 5000 and then profit taking... I see Litecoin year end of of USD 150 - 200 the lighting network and sentiment around it is quite positive an they are pulling off a deal of a lifetime with multi-chain switch, I am writing on it now, gathering the data

I think LTC is a pump and dump, really. It's only seeing use because Bitcoin sucks so much right now with the fees and delays, and people aren't ready for Bitcoin Cash at places like Coinbase.

You right on the head of nail, I think the LTC team may tap into the BTC volume if they can get the multi-chain swap going, it could be only way out of the ridiculous fees...this market is purely speculative nothing fundamental, SegWit isn't turning out what it should be, with fees and transaction time at an all time high...BCH still lacking the political support to gain traction but things could change, if sentiments get positive we could see the other big players jumping on board

It looks like Bitcoin's fees are certainly dropping down a bit, along with the price.

Bad news for Bitcoin Cash that the Bitcoin mempool cleared out.

Great insightful post . Bitcoin is poised for a big growth ahead with most issues resolved. Hope to see the magical 10000 USD mark soon :)

Valuable Information in BTC . Great post.100% upvote

Great topic. great graphs for financial bitcoin. like and resteem

Thank you, please resteem