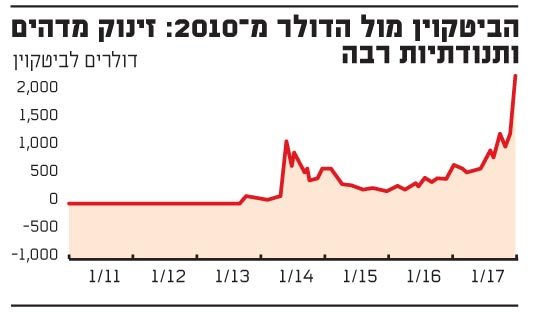

The popularity of the virtual currency is increasing against a background of more than 400% growth in value in the past year. The instability that characterizes it is a warning sign that must be taken into account

Bitcoin, the virtual currency, has returned to fashion in a big way - but is it suitable for everyone?

A simple glance at the wild vibrations of this coin confirms that to meet them, the brave investor needs an iron stomach. In short, this is not the investment channel for average mom and dad. But the digital currency, which has been racing lately, setting a series of highs of trading, is still intriguing for novice investors who have no idea what Bitcoin or blockchain is - the universal documentation of all transactions or transactions. Any computer with Bitcoin software has a coded copy of the transaction book in its system, which is one of the advantages of Bitcoin and blockchain - their safety in the eyes of the investor.

But this plan can cost you dearly. This company from Sherman Oaks collects a one-time fee of 12.5% on account of $ 5-100 thousand for the opportunity to hold Bitcoin in a deferred tax account. This commission mainly finances the holdings of digital wallets. On the right side, there is no transfer fee or account termination. The funds are held at Kingdom Trust, a $ 100-a-year custody fund for its service, regardless of the amount.

"We have 400-500 customers, with an average account of $ 50,000, and they are usually people who want to diversify into non-traditional assets because they do not believe in central banks and are afraid of hyperinflation because of all the monetary stimulus of recent years," says Chris Klein, CEO of Bitcoin IRA.

But Samuel Lee, founder of the SVRN asset management company in Chicago, says investors who want to hold the Bitcoin should be very, very careful. "Bitcoin is still a baby property, of less than 10 years of existence, and its price is determined by speculators," he says. "Unlike stocks, when prices go up and down with business cycles, bitcoin prices go up and down in much shorter periods, which usually last about a year," he says.

According to Michael Harris, author of "Convincing Technical Analysis," Bitcoin tends to be particularly volatile. The price of this currency collapsed more than 90% in 2011 and again by 80% in 2015

In other words, $ 100,000 invested in Bitcoin at the beginning of 2011 would have dropped by less than $ 10,000 at the end of that year - a fluctuation that a normal investor can not suffer or absorb. A responsible investment adviser would not have mentioned the word Bitcoin to his clients.

Moreover, Bitcoin is exposed to hackers who exploit loopholes on certain sites to access digital wallet, despite the intrinsic safety of the currency itself.

In January 2015, about a year after the problems of the Bitcoin Mt. Gox began, the price of Bitcoin touched a floor of less than $ 200 a currency. In February 2014, Mt. Gox, which was one of the first and largest betcoin stock exchanges, stopped the pitcoin pull from it. She claimed that the bug in the BitKine software could manipulate the transfer data.

Last week Bitcoin was trading for the first time at $ 2,200. $ 1,000 invested in 2010 in Bitcoin is now worth $ 35 million. You can check the exchange rate yourself, according to the BTCUSD code.

Bitcoin Against the dollar from 2010 graph below.

Whats up @daniford I just followed and up voted. Hope you will stay with me & follow me.

Thanks buddy, i just followed you! hope to see you again on Steemit.

good advice

Thanks!

Good points in this post. Interesting to see I'm not the only one that is thinking about this. The crypto space brings the biggest group of uneducated investors with it. This group will only grow. I was researching a way to find more info about the current cryptocoins on the market. Do you know this interesting site? https://www.coincheckup.com They seem to give this complete indepth analysis of all cryptocoins. For example: https://www.coincheckup.com/coins/Bitcoin#analysis To check Bitcoin Detailed analysis