Friday | 31th August 2018

Good Day all my beloved students & steemians. Inside this daily commentary I will share the short-term technical outlook and trade ideas for Bitcoin, Ethereum and Litecoin.

Previous commentary refer here: http://bit.ly/btcethltc300818

Previous commentary refer here: http://bit.ly/btcethltc300818

My core strategies refer here: http://bit.ly/taicorestrategies

My core strategies refer here: http://bit.ly/taicorestrategies

WARNING

WARNING

Do not attempt to use any of the trade ideas contained within unless you have attended my classes and understood the risk and money management behind these ideas.

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Want to own Bitcoin rather than ETF trading, check the two link below:

Honey Miner : https://honeyminer.com/referred/59hvc

Honey Miner : https://honeyminer.com/referred/59hvc

CryptoTab : https://get.cryptobrowser.site/2402149

CryptoTab : https://get.cryptobrowser.site/2402149

You can also follow my FITS:

You can also follow my FITS:

Facebook - http://bit.ly/danielang_fbpg

Instagram - http://bit.ly/danielang_ig

Twitter - http://bit.ly/danielang_twitter

Steemit - http://bit.ly/danielang_steemit

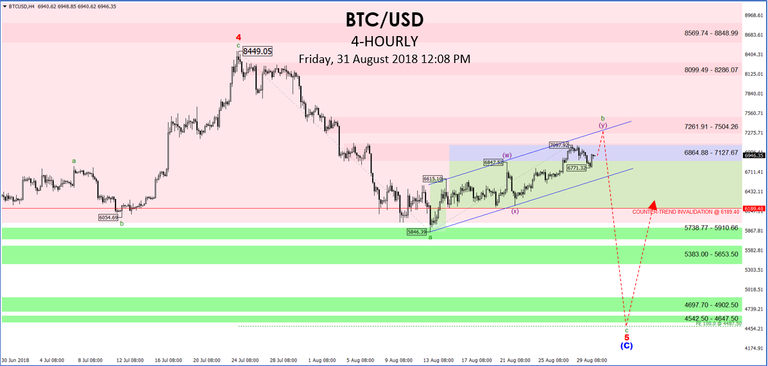

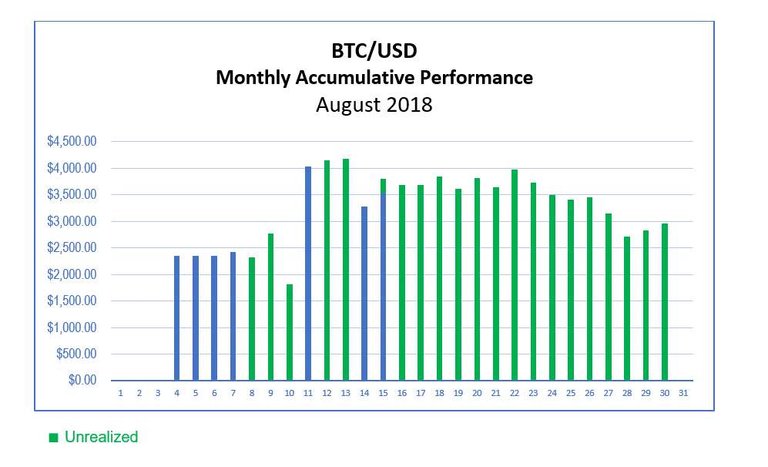

BTC/USD

BTC/USD

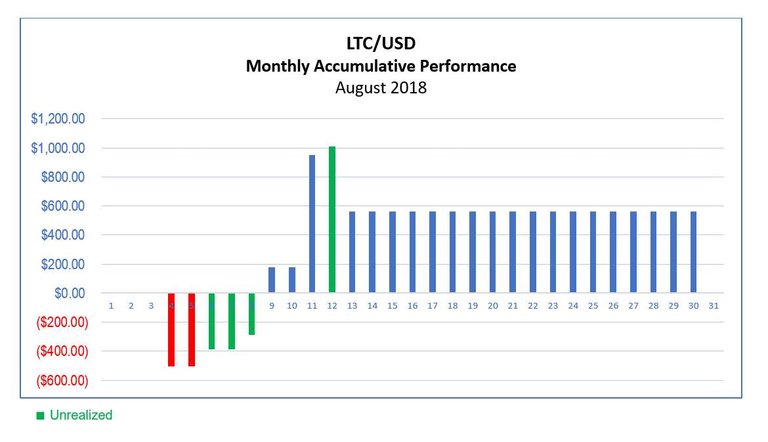

BTC’s rebound to near the $7100 on Wednesday did not lasts. Yesterday’s fall to $6771.32 proved that the slope is slippery and for BTC to maintain its momentum rebounding, it needs a catalyst - something that is solely lacking now.

Still, unless yesterday’s low is taken out decisively, the risk of another rally above the $7100 mark cannot be ruled out completely. Regardless of whether there is another rally attempt, the view that this rebound from $5846.39 is seen as a technical correction to the decline from the July 25 high of $8449.05 and that an eventual resumption of the fall is expected. As can be seen in the 4-hourly time frame, such a decline may target the demand zone at $4542.50 - $4647.50.

A break below the rising channel in the hourly time frame and a subsequent break below $6189.40 would bolster this bearish view.

Once again, it must be reiterated that this next leg down is seen as the ending phase of the decline from the July 25 high of $8449.05 and a major reversal is anticipated next.

TRADE IDEAS

TRADE IDEAS

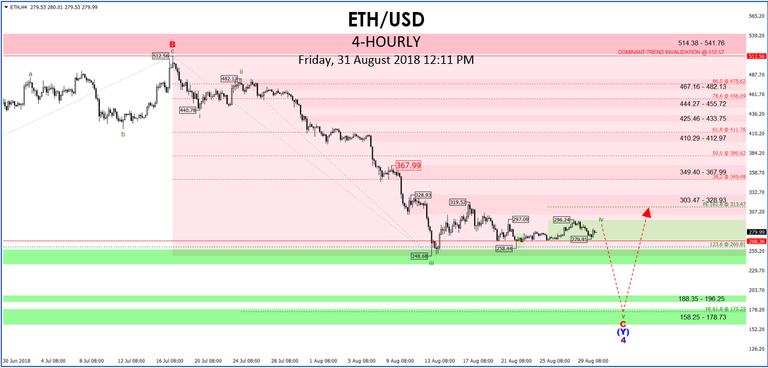

ETH/USD

As mentioned previously, the odds of ETH having hit a peak at $296.24 on Tuesday is better-than-good. As such, the decline we witnessed over the last two days is not unexpected. Also, the rebound from the August 18 low at $248.68 is probably incomplete but is in a terminal phase.

In the hourly time frame, it is likely that the decline from $319.52 is unfolding as a triangle and the overnight rise from $270.91 is probably entering the last leg and may target $290.98 before resuming its medium to long term decline.

Too eased back from yesterday’s high of $296.24. So far, this pullback is in 3-waves and is therefore seen as corrective in nature. A break below $266.93 is the confirmation that the corrective phase is over, and the long-term decline is resuming.

If so, the August 14 low at $248.68 is likely to be challenged. As noted at along, this anticipated fall could well be the terminal drop to complete the entire decline from the July 18 high of $512.56.

While the hourly time frame target is at $208.15, the possibility of an extended fall towards $158.25 - $178.73 as seen in the weekly time frame chart cannot be ruled out.

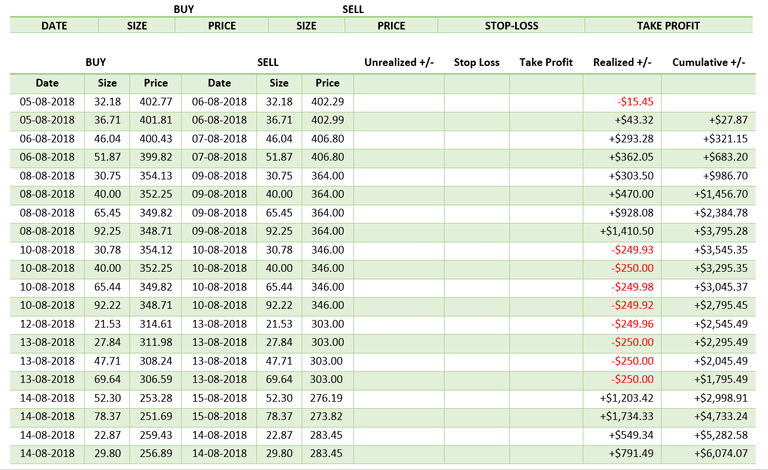

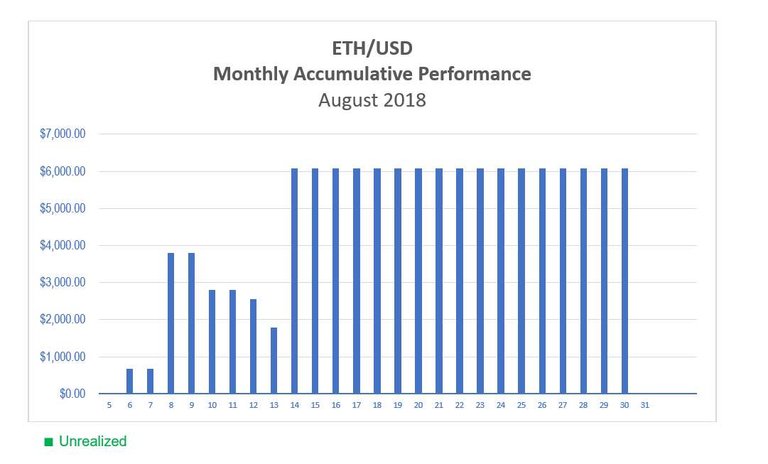

TRADE IDEAS

TRADE IDEAS

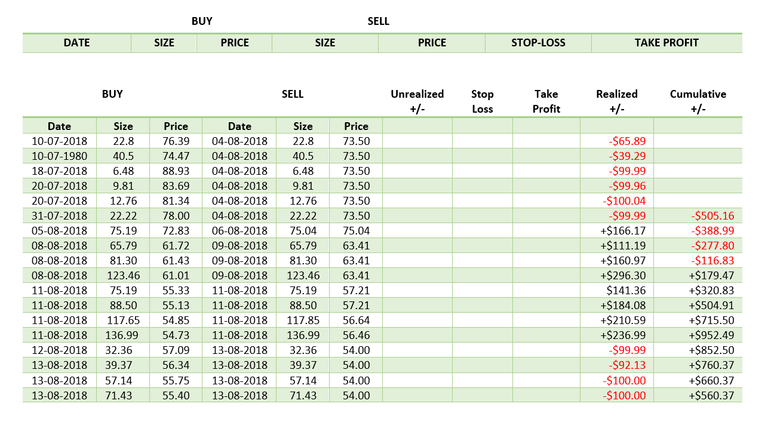

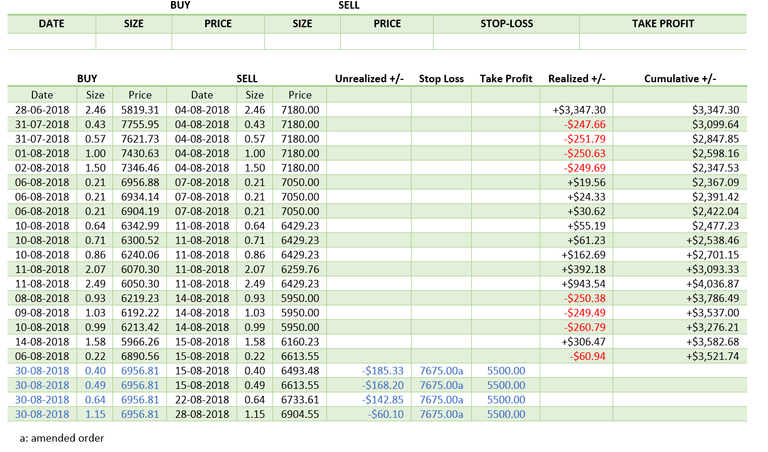

LTC/USD

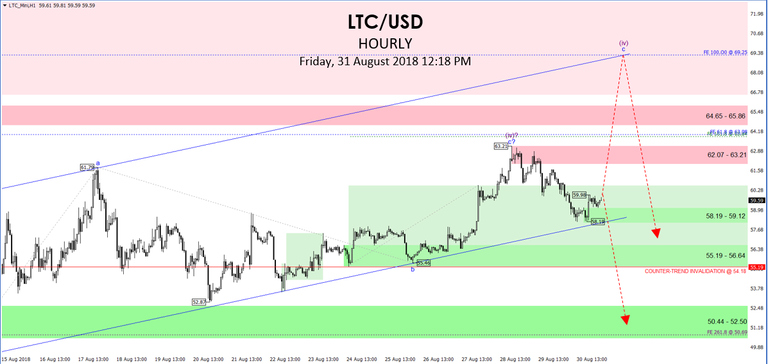

LTC’s decline to $58.19 last night failed to break below the rising counter-trend line (CTL) as seen in both the 4-hourly and the channel support in the hourly time frames.

At this point, it is unclear if a top was in place at $63.21. Unless there is a sustained fall below these support lines, the risk of another rally attempt cannot be ruled out. In the event of another rally from last night’s low, the focus is on the equality measurement of $48.77 to $61.79 from $55.46 at $69.25. Regardless of whether there is another rally attempt, the rebound from $48.77 is seen as a correction and another decline into new low is expected.

Just like BTC and ETH, this anticipated resumption of the fall from the May 6 high of $183.28 may extend towards the area between $33.84 - $39.65 (see weekly time frame chart) before a major reversal occurs.

TRADE IDEAS

TRADE IDEAS