Recently, when Bitcoin's price has started to fall sharply, I have heard more and more opinions that it must not fall below the profitability of digging. Many people believe this, but it is not true, as I am going to explain clearly and logically.

Cost of electricity

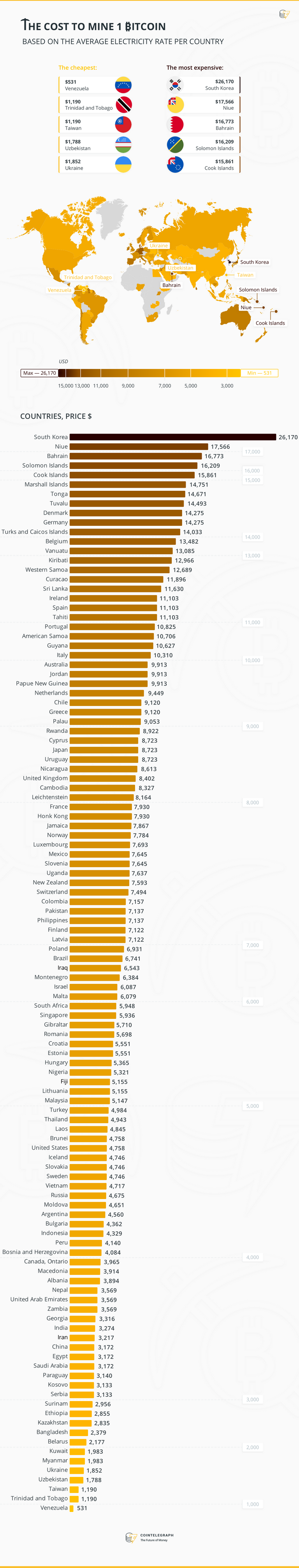

Excluding the purchase costs of miners, the cost effectiveness of excavations depends mainly on the price of electricity. The price per 1kWh is very different in the world (at the end of the article I put a big infographics with a comparison of electricity prices in different regions of the world).

The cheapest electricity is available The city of Sichuan in China is the "capital" of the Bitcoina Mine because of its cheap electricity. There are also large mines in Washington because there is a hydroelectric power station nearby.

In the vicinity of such power plants, it is most profitable to build mines. The cost of electricity transfer is negligible, as are the problems with bringing enough power to the mine. The price of 1kWh for such mines is only ~3 cents! As we can see for the tycoons in digging the costs are disproportionately low than for an ordinary "digger"

The Bitcoin price is not driven by the cost of digging. The cost of digging is in line with Bitcoin's price!

First of all, what happens when the cost of BTC mining reaches the break-even point? First of all, mines with the most expensive current simply switch off the excavators. That is logical. Home amateur excavators often make the mistake of not turning off excavators when the cryptovalent value has fallen sharply... They claim that they will hold the cryptovalent they have dug at the highest cost and sell it back in the future when it gains in value. This is a completely uneconomical and erroneous way of thinking. For example, if I use electricity for 1000 USD per month and during this time I dig a cryptovalent for 900 USD it is much more profitable to switch off the excavators and instead of paying for the electricity, buy the same cryptovalent :) In total, we will buy more for 1000 USD than we dig up. Another thing is that the mines are not speculating and are being forced to make continuous investments by selling the cryptovalent machines they have dug up. If they do not invest in the expansion of the mines, the competition will simply start to overtake them...

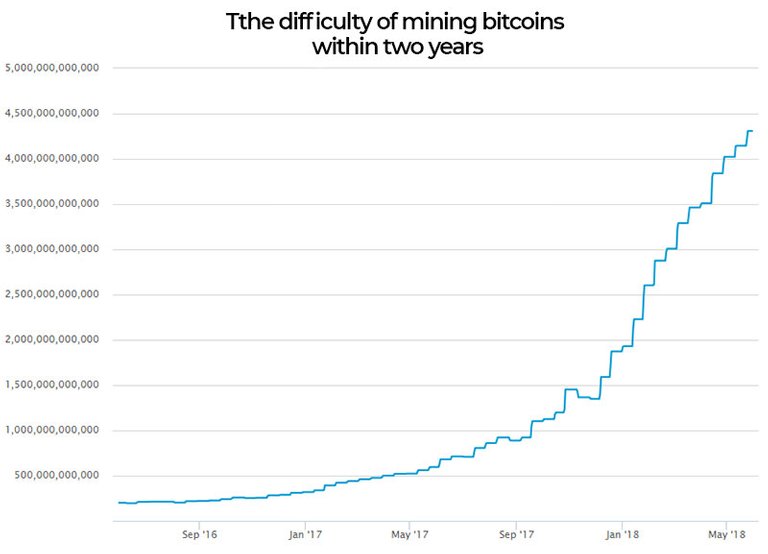

Mines with the most expensive current are starting to shut down their excavators. As Bitcoin's price falls, more and more mines will shut down their excavators. The result? The difficulty of digging will decrease, and so will the cost of excavation of 1 BTC. As we can see, even if the BTC price had fallen to $1,000, the mining cost would have equalled that price. Most mines would shut down their excavators, only the cheapest would be left and the cost of mining would again be around $1000.

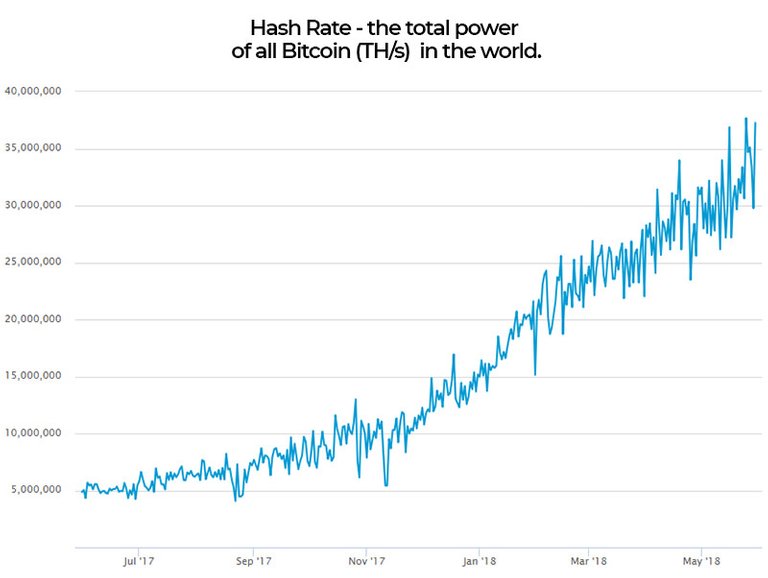

As we can see, the current limit for digging profitability is completely irrelevant, and the cost of excavation of 1 BTC strives for the BTC price. In 2017, Bitcoin's price rose very rapidly, and Bitmain was the largest customer of a state-of-the-art semiconductor factory, TSMC, ordering more than 20,000 silicon wafers per month. It is also here that nVidia, AMD, frame memory manufacturers and many others order their chips. The profitability of BTC excavations in 2017 was very high, because with the increase in BTC value, excavator manufacturers, mainly Bitmain, were not able to produce enough excavators to meet the demand for them. Nevertheless, the difficulty of digging BTC has increased by 8.5 times over the past year.

Bitcoin price

The price of bitcoin is regulated by the market. The Bitcoin price is regulated by speculators on the stock exchanges. They are not miners and are not interested in the current cost of BTC mining. Will the traffickers who sell the BTC causing its price to fall stop it from doing so? Some invisible force? ;)

In conclusion. When the price of 1 BTC drops below the break-even point, the break-even point is moved downwards, as the price drops, by switching off the excavators. There is no complete justification for the price of 1 BTC not to fall below any value.

The cost of excavating 1 BTC worldwide. The infographics come from the website www.cointelegraph.com