Last week saw the The Group of Central Bank Governors and Heads of Supervision come into agreement with regards to the Basel 3 post crisis regulatory reforms, which is also known as ,Basel 3 End Game.

It is said that risk and returns are core pillars of the Financial System and the banking industry, and from that stance, I would like to make a case for the implementation of Bitcoin and other related digital currencies as part of the capital requirements for the relevant institutions of which play an integral part in the business and economic cycle, a cyclic down turn which has a proven record of continuously throwing a rope to those that tend to never be on the short end of the stick.

A major failure that the Chair and committee have continuously made in the planning and implementation has been in the lack of understanding and the understatement of the impact none compliance of capital requirements has on the stability of the ,and not limited, to financial system and credibility of the petro/euro-dollar.

The conditions of which the Basel Accord was formed in 1974 no longer represents nor reflect the stage at which the world has now progressed too as part of the evolution of finance, and therefore due to old rules for a new game, we have seen that this has resulted in dire financial and political turmoil, a result which can be seen a stone throw away through the detrimental re-engineering of financial instruments which resulted in the exponential financial crisis.

Due to the structuring of the present vertical banking system, I find that is will remain highly improbable to ensure compliance of the financial institutions of power due to the multiple ways that models may be formed or restructured within each bank to meet the regulatory requirements while at the same time undermining the initial purpose. The introduction of a variety of other decentralized assets which may also have the characteristics of currencies as part of the additional buffer ,above the already suggested percentage requirements to which liquidity can be created not only allows for a more efficient manner of creating liquidity, but also forms part of a dynamically hedged strategy and portfolio rebalancing, the impact which immediately results in the inclusion of the majority of middle and lower class tax paying and law abiding citizens of each country. Such an implementation allows you both conditions of a tax benefit instrument and an equity instrument when needed. It is with great understanding that there is a high level of minimal understand and high levels of double standards in the use of terms such as risk, which has been used to describe the new forms of assets/currencies when banks such as Deutsche bank have been leveraged as high as 50%, which is an unacceptable level of exposure for a multinational.

Such an implementation has a less distorted view and provides a more realistic aerial perspective to financial economic activity due to the limited capabilities of centralized manipulation such inflation rate targeting and much more.

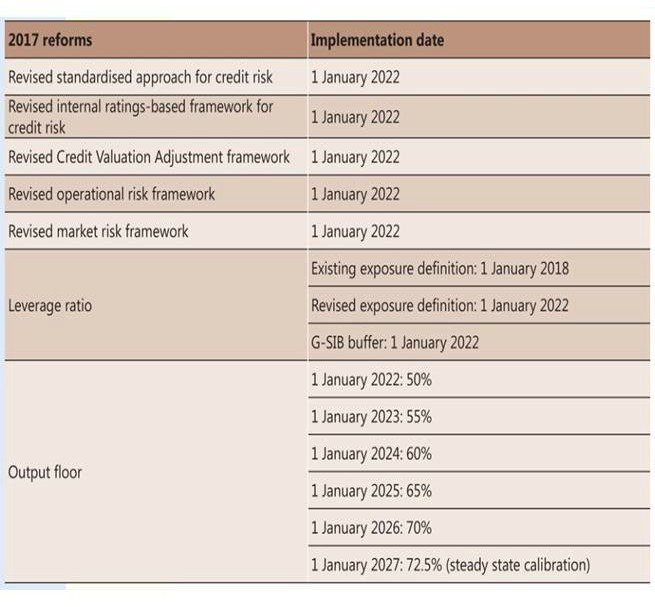

Below are calendar dates to take note of:

Congratulations @cybermechanic! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!