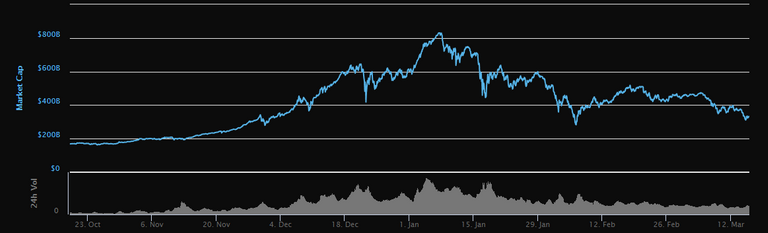

Bitcoin and the cryptocurrency space as a whole has had a rough March. Bitcoin has fallen from above $11k to around $8k while altcoins have bled even worse as Bitcoin dominance rises.

As always, we're all looking for reasons why the market has fallen but I wanted to issue a key reminder that I (emphasis on I) still view Bitcoin and all other cryptocurrencies as a bubble. Very few of them fulfill the lofty goals people have set for them, with Bitcoin in particular hardly being used as a payment mechanism because of:

- Security concerns with holding private keys

- Immutability is a double-edged sword: Returns are a pain and mistakes can't be rectified

- The UI is awful if you can't use payment request QR codes

- The fees are volatile

- While payments may settle quicker than traditional systems when the network isn't under heavy load, the fact there are no "takebacks" or ways to "correct" a mistake after settlement means that it is inconvenient for merchants to accept zero confirmation transactions

- Price is volatile

- etc.

As a result, most merchants just use processors like Bitpay which instantly convert Bitcoin into USD, which in that case, is it really accepting Bitcoin anymore? It's just another method for accepting USD.

Several of these arguments hold up for all other cryptocurrencies as well, even if some solve the issues of speed of settlement and fees. Even for cryptoassets that aim to be platforms, like Ethereum, generally offer almost no decentralized applications that have any real use. It's also worth noting that decentralization is really not well-fit for mass adoption - Normal people NEED customer support and ways to fix mistakes, which truly decentralized projects can't offer reasonably.

The point isn't that blockchain technology isn't meaningful or useful, just that these cryptoassets aren't worth even remotely close to what they are being priced as today - so price doesn't need a whole lot of reason to fall for those who feel convinced for certain that the space is undervalued.

As for some catalysts that COULD be contributing to prices coming down, we discuss:

- Mt. Gox trustee fears

- Google Ad Ban

- US Congressional Hearing on ICOs

On the positive side, we discuss the first live beta implentation of Lightning by Lightning Labs. I'm super excited to see how it behaves in practice. Based on the amount of nodes we had using Lightning prior to this, it should be interesting to see what developers do now with the Lightning Lab implementation.

It's unfortunate that this news is overshadowed by price action (and yes, I am aware that I am contributing to that), but I encourage everyone to keep a close eye on what occurs on the main net and what developers have to say.

What are your thoughts on the market? I'd love to hear them - Thank you for watching / reading!

agree for the altcoins

Market cap means shit...

"Bitcoin is not used for payments" - maybe by you. I use it. And I bet even you use it for long term store of value.

Yep. People being happy to buy for cheap are right. Bitcoin is cheap and it was cheap at 19k too...

I think crypto is in a speculative bubble so the boom bust behaviour we are observing is not surprising. However the technology paradigm shift is not going away and as enhancements to the ecosystem such as the lightning network start proving themselves we will see increased adoption and consequent price uplift.

I don't believe so, I don't really think the technology being adopted means price goes up at all. If Bitcoin didn't have so many decimal points then yes, for it to be used more widely the price would need to go up, but it has many decimal places and so it's price certainly doesn't need to go up to be usable.

I agree with @cryptovestor that Bitcoin overall will not sustain these crazy prices long-term as people wake up and realize that these cryptocurrencies are not worth the prices and market capitalization that they currently have.

We could end up looking back in a year or so and asking ourselves what the hell were we thinking lol.

First of all, the market rose in the first place because of the ads and everyone knowing about bitcoin, cause a tremendous peak in price. But the moment everyone started to see a crash, everyone also paniced.

Second, the price is too high right now, and we can see that because people only invest in crypto because of the rewards and don't think of the risks.

Third, I think that the blockchain system can and will be used in the future.

Unfortunatly, the prices are caused by people, and if the prices lower, people can't handle a crash, because they only see their value decreasing, and if people withdraw their money, causes the dip.

We can also see that the market has now much lower 24h volume (beeing it today $16 623 182 325).

We can see a HUGE dip in the global charts, it almost hitted 850 billion dollars, and now it sits at 330 billion because of all the crashes.

But either way, I agree with the post, tell me your opinion on my comment, thanks!

I agree many people just got in it because it was the thing to do with out knowing what there were getting into. That is what created the rise so fast that no one knew what hit them. Now I think people are saying what did I do and want out because they were not really into it in the first place. That is why the market is plunging like it is. Great posting and comments keep it up and steem on.👍👏👏👏👏👏

thank you for your support!!! I really appreciate it!

Something that has become very frustrating for me on crypto space is the number of people who call themselves bitcoin maximalists or hyper bitcoinist and such and believe bitcoin is gold v2.0 and if you don't like the volatility the market is probably not your place... Interestingly, the more I get to know these kind of ppl the more I realize they don't have an skin in the game. Meaning, they talk about bitcoin and HODL like gold v2.0 while they have very tiny portions invested into it...

I am not against bitcoin and cryptos in fact, I truly love the technology but I cannot see the usecase and I think bitcoin and cryptos more than empowering the poor would actually weaken them at least couple of generations until cryptos develop to a level where manipulation and volatility would not take place anymore.

Just think about the poor people of Zimbabwe who bought bitcoin over 15k with huge premiums... Just imagine how poorer they have become ... It's interesting how no one talks about it anymore...

People should chill and be neutral about things.

I do actually not agree with your comment. Because everyone gets pushed down when the market crashes, and everyone handles it a different way, but everyone feels fear to lose everything, no one wants to lose money. Of course, you have to be self-aware that you might lose everything, but the fact that you said "if you don't like the volatility the market is probably not your place... " is wrong, because if the markets go down, no one likes it, and if the markets go up, people who don't understand how this works just get greedy and tend to lose their money. "People should chill and be neutral about things." I agree, but it's inevitable to be neutral when we are talking money.

This news below is literally hours ago. This doesn't make Gold a non reliable asset, doesn't affect the value of person holding it, or make gold lose its use case.

I feel that this argument is on the same lines of "why do we need space exploration when there are people starving" argument. Not the same context but I can't help but see the similarity of these arguments.

A, everyone owe it to themselves to learn about market cycles before investing in anything. Including gold. Regardless of the asset you cannot expect any asset to only grow forever.

B, this needs to be compared to how hyperinflated their currency is in the first place. Zimbabwe's peak month of inflation is estimated at 79.6 billion percent in mid-November 2008. I know that's not the case right now but it is what resulted into this:

It goes without saying that you shouldn't invest all you have into crypto, regardless of whether you're poor or rich. There's a wrong time to invest in every asset. It's not like people who invested in crypto in the US or UK or somewhere else are better off. People have sold their houses or took a second mortgage just to invest in bitcoin at 20k and got rekt. For instance people have been calling Bitcoin dip to current levels since Dec 2017. If you fail to do the research, or ignore all the knowledgeable people in this space and put in everything you have who can you really blame but yourself? And I say that with the deepest sympathy to everyone who is invested in it and lost.

And if you're saying that now, the future is going to be even more bleak. Some analysts contend that there will be a centralization of the PoW coins toward one coin. Meaning people who have invested in smaller altcoins are going to be completely rekt at some point. What can you do right now to tell them to stay off of those coins? You don't even know if it's really going to happen. What if they turn out to be right and you turn out to be wrong and they become poor because of it?

I strongly disagree with your comments on the senate hearing. Overall the politicians were very interest and wanted to get educated. Calling them idiots is completely irrational. Of course it was not their field of experience, but it shouldn’t be. They are the experts in getting the right information and that was exactly what they did. They are working closely with the experts on the field and are trying to establish the right set of rules to help the industry as a whole and not harm it.

The only exception of course was Mr. Sherman, who didn’t understand anything what so ever.

You should watch the video of the hearing!

Thanks for another good video @cryptovestor. Appreciate the logic behind your belief it is a bubble. Got a question though, why is steem going down more quickly than btc when steem has actual intrinsic value?

While I generally agree with your thoughts and find myself in a similar position regarding being fully invested, I think it is important to note that current prices reflect the expectation of future value. Whereas a stock could be modeled to be the present value of cash flows, you can assume that some of these assets reflect a discounted future expected value given the realization of the adoption and use case of their corresponding technology. These valuations are currently reflected in the tug of war that is currently demand vs supply. It reminds me of the early valuations from Amazon when it took them years to turn a profit; despite that, they had multi-billion dollar valuations along with stock price volatility that sent the price soaring and crashing within a 18 month period. Technology continues to advance exponentially and the crypto space and its blockchain technology may be the next broad based application that grows in huge steps.

I do feel more positive for the future than last summer. Reasons:

So my view is positive and I believe that after the G20 summit, price will recover, since regulation wont kick in immediately and it wont be that bad as most believe. Regulation could be the door opener for the next bull market.

I generally love your videos, and this one too, but we can discus about lot of things in it. First I do realize that almost none of cryptocurrency are not used for what they are made for, and that is true but I do not see that as a weakness because for me that is just a evolution in product. And second thing about bubble, prices of cryptocurrency and marcet cap, I do not know is this bubble or not, or are they overpriced or not but generally who knows that? Price is just a number and because this is relatively new technology you can not say is this bubble or not. It could be, but then again everything in life is possible. We yet need to see where all of this is going.

Why are u willing to increase your position at 5 or 6 thousand if u think this is still a bubble?

Because the plankton will think that's "cheap" and start to bid it up again. It doesn't mean there's any legitimate reason for there to be support in that price range.

Hello Crypto Investor,

Thank you for your deep insight into the crypto market. I agree with most of your points.

I have been struggling to find a simple to use, yet 100% accurate Mac-compatible software to track the positions within my crypto portfolio. I have been disappointed with CoinTracking and CryptoCompare at their inaccuracy.

I also tried the Blockfolio on my wi-fi only cell phone. Again, I am not able to enter certain transactions; I am not able to select certain exchanges. Worst of all, due to poor wi-fi connection - I can not even access the app most of the time.

So, what software do you use to track your crypto positions within your portfolio? At this point, I don't believe there is a perfect software for that. Hence if would be helpful if you could go over the pros and cons, that would save me hours of frustration.

Thank you.

Unfortunately, bitcoin maximalists and such refuse to accept that there are still many things wrong with Bitcoin and crypto ... Many! There is no real usecase for cryptos yet just like you said.

It's very ironic that we call it cryptocurrency but it is not a currency at all especially bitcoin... How can it be with all the volatility? After getting a few rich and many poor? The fact is cryptos have become an speculative asset which (yet) don't have any practical use yet... Unless the market cap increases to over +2 trillion and cryptos become less speculative we cannot see them functioning as currencies at least in my opinion.

You are a wizard and your messages keep me firmly grounded. How are we feeling long term on cryptos though?

The voice of reason.

Once again, I don't agree with your pessimism. UX is easily fixed, the real important thing is the core innovation behind it. All innovations started with poor UX, including the internet. There is huge potential, and that drives the price.

You don't even mention that the real bubble is the dollar. Certainly the dollar will soon be worth less than an authentic copper penny of yesteryear. (pre 1982) Think about that.

And that the INFLATED prices of cryptos are what is required to build out the infrastructure to scale up and make crypto usage practical. It didn't happen by chance and didn't require coercion to finance this new industrial sector. Human Action has employed those resources that were available to create "the Absurd market cap" we see today.

The Stock Market is a trailing indicator -- rigged, thwarted and controlled to protect those industries that have "made it" in today's world. While the crypto space is looking forward to an unknowable future.

Thanks for the warning reminder!

It looks like you have people that admires you mate : https://steemit.com/blockchain/@steem-buzz/lightning-strikes-why-bitcoin-is-still-a-bubble

With the price in a downtrend, I think we can see a bear market in the works here with more and more people abandoning ship once they see a lack of returns for their investment.

Always making me think out of the box. Thanks.

Lightning IS going to work. The radical Bitcoin maximalists are pouring all their energy into it rn. I take pride in having asked your opinion on Lightning in one of your previous posts. Lightning has the potential to charge that bubble with some value, pun intended.

Love your videos, I have watched all of them.

My thoughts:

Investopedia defines a bubble as: "a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior."

I agree that the fundamentals of Bitcoin are subjective but I would say that right now we do not have an "exuberant" market.

Calling this market a bubble makes it sound as if it is destined to pop and Bitcoin's value go to zero.

I would avoid the word "bubble" since IMHO it is inaccurate.

While the price may drift down to 5k, if adoption becomes widespread, demand alone (without undue exuberance) could easily push it way above 20k.

You're the best opinion editorial out of the popular crypto youtubers. It's the closest to the reality and wow I'm a pretty turned off by some respected ones doing TA and whatever else justifying price movements and so on. Casino is what it is. It's been a fun education on herd mentality being new to this market.

"There's a bunch of idiots trying to regulate idiots!" - This sentence says it all. Like someone that only understands English trying to teach Chinese.

I've always appreciated and shared your skepticism about crypto valuations but you always make the same point - overvalued, overvalued, overvalued. Your videos contain incredulity with how much money there is in this young tech, and also betrays a incredulity with yourself being invested also, which is like listening to your arguments with yourself. Its therapeutic for the people watching your videos (like myself). This is my long-winded way of thanking you for your videos!

The market is volatile precisely because it is trying to find out the true value of crypto - and i think it actually won't come to a conclusion until we move from potential use-cases to actual use-cases. My guess is that the market will not wise-up about current valuations of 'premature' tech, but rather will only sober when actual use-cases are realized. Which means this is far away. Far, far away.

Totally agree with ur thoughts that Bitcoin without a doubt is a Bubble. It has no use case and its worse than useless. Its bubble gonna pop sonner than later.

Just want to know ur thoughts on US dollar Bubble. The multi-trillion dollar debt that is looming over US citizens.

You always say thar cryptocurrencies are a bubble, so investing in it is pretty risky. How would you try to predict when the bubble collapse to sell before you lose your investments?

I think the sentiment about cryptos is a bit too pessimistic in this episode, of course it can be a short-term bubble, but then again cryptos are not going away, and the price also reflects the future potential not just the current state of development and adoption. This is similar to stocks, where the stock price also prices in the future. That's totally normal and not worrisome. I think that cryptos have huge potential in the long-term.

In my honest opinion, yes, the whole cryptocurrency market is a giant bubble, it will burst sooner or later, just like the dot com bubble bursted, but the thing is... even though it bursts there will be coins that won't disappear, the dot com bubble bursted and some companies decreased a lot in price, but look at the winners now... google, youtube, amazon, they all won and are now big companies.

So what am i saying by this: Yes, the bubble will burst sooner or later, but there will be some coins that won't die out, we just need to find those that won't die and invest in them!! The only one i'm 99% sure won't die is VET, the rest of the coins i really don't know, i can see some problems in BTC, i can see some problems inETH, etc... So let's just hope we are all investing in the ones that prevail in the end!

Thanks! Great video, a breath of fresh (and realistic) air

I think that in the net assessment at the moment there are way more reason for the market to keep on moving down (for fundamental reason and technical reasons), there for although the lightning beta is exciting and a step in the right direction, it is still a small step that will change nothing in the fundamentals, when it will move out of beta and in to the general use then it might make a difference.

I'm a business owner and I can tell you, that every word of this is correct. I'm also a crypto, we'll say enthusiast. I think the tech is awesome and will eventually change the world. However, there is no way I could ever accept Bitcoin as a payment system for all of the reasons mentioned here as well as a few more. The marketing purpose he mentions is literally the only reason to do it. Since the market has gone down so much, there isn't as much attention on it anymore, so even that idea is gone.

To me, the future of crypto is in the platforms and security features. As a form of payment, I don't see it ever being useful. Unless governments start allowing you to pay your taxes with Bitcoin. At that point though, it kind of defeats the entire purpose behind Bitcoin because it will have become a fiat currency.

I dont agree... people say gold is a bubble but it's it really the only bubble is see is fiat currency. Saying the cryptocurency market is a bubble is abit premature I think as it's a totally new market and can not be compared to any other market. I do agree with the market being overvalued but and most of the coins don't have a working product or service that is try and tested is very true but the same could be said about the internet back in 1993. Most of the 98% crap coins are gonna die and the real projects that have real value will shine in the end. As a investor you have to take calculated risks otherwise you will never be successful. Even if 1% of the projects succeeds that could be the next gold mine. But your right only invest what you are willing to lose that way you don't worry too much.

When you talk about a market cap of hundreds of billions, I completely agree, but there was an article by JPMorgan that determined the net inflow of all cryptoassets since inception to be north of $6 billion. Now, the accuracy of this is of course questionable, but how can we talk about bitcoin being overvalued at $150 billion, when in reality it could just be $2-3 billion. The markets are so volatile, and the spread can sometimes be so wide, that I think it is not a big stretch to argue that realistically the net inflow can not be bigger than $10-20 billion.

The message is that it's all about the speculation. And I agree with it. It's extremely difficult to estimate the value of the crypto, so I think it will be speculative asset for a while.

I'm just holding SBD so I can power up when its value gets a huge bump upwards.

#optimism

When I thought I was smarter than the average joe and you remind me I'm actually Joe himself. Thanks

Thanks for sharing my friend...

I'm resteemed and upvote...

what do you think about this?

https://np.reddit.com/r/BitcoinMarkets/comments/84n8l0/big_day_for_bitcoin_lightning_goes_live_on_mainnet/dvrsj6p/