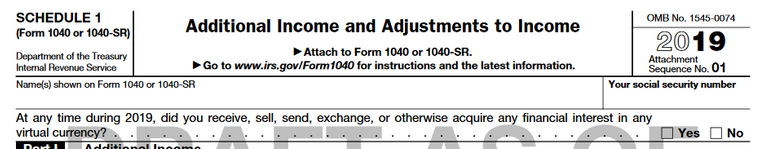

The IRS has updated Schedule 1 of Form 1040. Now taxpayers are required to disclose on their tax forms if they had transactions with crypto and other virtual currencies.

Form 1040 is the tax document that individuals file their Federal income return on to report their obligations.

Even acquisitions of crypto assets is reportable if there were no sales for FIAT/exchanges for other crypto (i.e. buying and HODL'ing).

https://www.irs.gov/pub/irs-dft/f1040s1--dft.pdf

This will also prompt tax preparers to be required to ask the question to EVERY client.

That will be an interesting one to answer!

Posted using Partiko iOS

This post has been promoted with @minnowbooster.

5% of the purchase will be burned and 5% sent to the @steem.dao fund as part of our ethical promotion initiative.

For further information please check this post.