Money is anything that is commonly accepted by a group of people in exchange for goods or services. Money holds value because people believe it is valuable. If they accept it in exchange for a good or service, they are confident that they can later exchange the money for something they will want or need. For example, the value of the paper money known as Fiat that we use for our everyday transactions, is enforced by the faith of the government and sustained by the confidence of the general public who uses it to exchange goods and services.

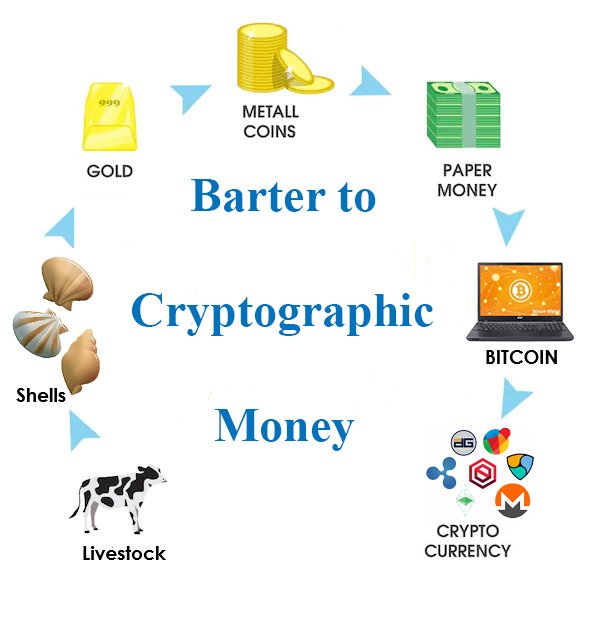

Eventually livestock such as cows and sheep became a standardized transfer of value from one person to another marking the first form money took. Since, the form of money has evolved from livestock to natural objects like shells and peppercorns to precious metals like silver and gold, to paper like cheques and bank notes. Each new form of money aims to solve the major problems of the last one. For instance; gold is a good store of wealth, but large amounts are bulky and difficult to transport while paper money is much lighter, smaller in size and thus easily transportable. Yet no new form of money is perfect and there are always problems that needs to be solved.

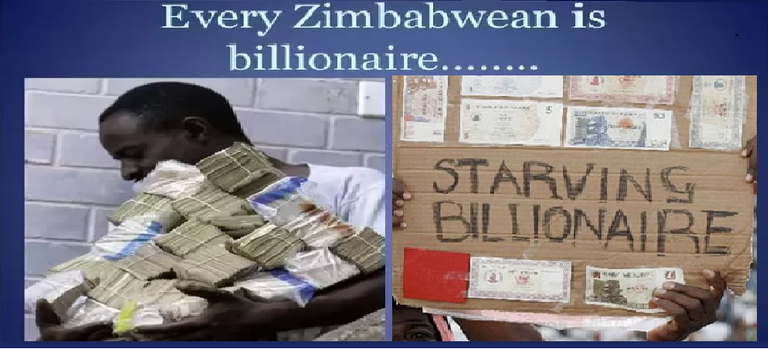

Our national currencies (known as Fiat) are controlled by a small group of politically motivated people and there is always a danger of over-printing which may result in its rapid devaluation and inevitably, the destruction of the country’s economy. In such a scenario people may witness their entire savings being wiped out as the value of the currency decreases to the point of becoming completely worthless.

In the early 2000s the central bank of Zimbabwe began to print money at an astonishing pace which accelerated the rapid devaluation of the Zimbabwean Dollar. The consequences were devastating: millions of people lost their jobs along with their entire life savings. For perspective, in 1983 one Zimbabwean dollars was equivalent in value to the US dollar and by 2008, one billion Zimbabwean dollars was worth a mere 0.0015 US dollars. So as a billionaire in 1983, if you kept all your savings in Zimbabwean dollars, you would have essentially been reduced to a poor of man.

Sending paper money from one country to the next is an expensive process involving the payment of multiple fees. Furthermore; paper money is prone to falsification or forgery which can also lead to the devaluation of the currency. According to the United States Department of Treasury, an estimated $70 million in counterfeit bills are in circulation.

But persistent problems will often push us to find innovative solutions and it was in the year 2008 that a detailed paper about an electronic cash system called Bitcoin was published online. One year later, the Bitcoin software known as the blockchain was made available to the public. Unlike Fiat currencies, Bitcoin is created by coded rules in the blockchain and is decentralized in the sense that it is not controlled by a central authority. In fact, this innovative piece of technology guarantees that Bitcoin cannot be forged and that only a fixed amount of 21 million Bitcoins will ever be created.

The blockchain is designed to distribute bitcoins by rewarding anyone who would connect their computer to its network to ensure its security. Like this, no one group of people control Bitcoin and everyone could be part of the new economy which would unravel as a result. Bitcoins made sending money to anywhere in the world simple and easy thus eliminating the need for banks or money transfer services. Suffice to say, Bitcoin solves all the basic problems of paper money. But new innovative ideas especially those with the potential to disrupt traditional systems or bring about impactful change will not be easily accepted. It takes countless attempts, repetitive demonstrations and endless rehearsals before it can be internalized and accepted by others.

During the time when we used grains as a medium of exchange, if someone were to offer you as a farmer, 100 US dollar saying, ‘‘Here you go Favor, I’ll be taking one of those fine goats!’’ , you would be utterly confused and probably think to yourself that this person was crazy. I mean why would you give your valuable livestock in exchange for a piece of material worth far less the value of your smallest goat? So, the dollar would be completely worthless here because no one recognizes or even understands its usefulness to accept it as a form of payment.

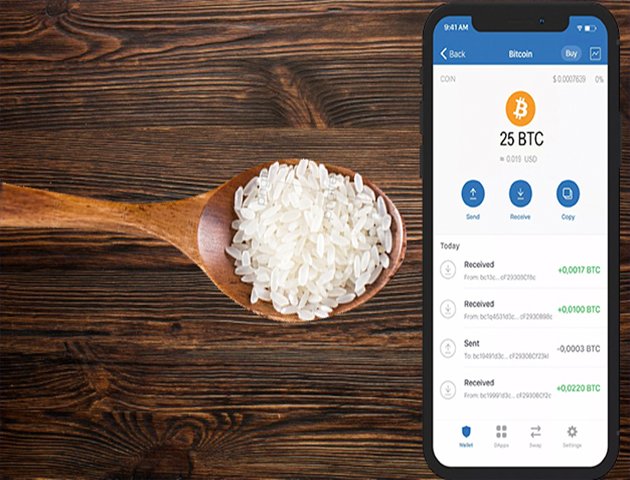

Bitcoin was not easily accepted after being introduced to the general public. Money had now taken a new form which people were finding difficult to grasp. The lack of understanding of the concept of money was one major barrier to the early adoption of a bitcoin which, in its early stages, had the potential to redistribute wealth and drastically improve the living standards of millions of people. Throughout 2009 and early 2010, as much as 25 bitcoins was worth just about a spoonful of rice.

Early supporters of bitcoin would help raise awareness about bitcoin via publications on news websites, educational videos and generous charity donations. Websites called bitcoin faucets were also built to freely distribute the digital currency as an incentive to encourage its use. By February 9th 2011, bitcoin was already equivalent in value to US dollar. Today 25 bitcoins can purchase about 160 thousand bags of rice, enough to feed at least 1 million children for a duration of one month.

Bitcoin is now gradually being used as a store of value rather than a medium of exchange or as some people call it, “Digital Gold”. It is no surprise that the ultra-rich are now transferring the value of their wealth into bitcoins since they have already realized that bitcoin will eventually serve as a more reliable store of value than gold due to its scarcity and ease of transfer.

Although Bitcoin was freely available to everyone when it was first launched, the sheer lack of understanding and awareness among the general population has ensured that the small number of people who used and accepted bitcoins much earlier than the rest, would go on to own most of the bitcoins so far created. The consequence is the further widening of the wealth gaps which exists today. Furthermore, the Bitcoin software or Blockchain is incapable of processing transactions fast enough to be a reliable means of exchange for the entire world.

As a result, many alternative currencies have been created in order to address the perceived limitations of Bitcoin. Today there are more than 5000 digital currencies created but so far only the Pi Network project has developed a unique approach to making digital currencies more easily accessible to everyday people. During development of the Pi Network software, the Pi currency is distributed to anyone with a mobile phone. This will not only help create a wider distribution of the currency but will also create a new source of wealth and business opportunities for many people from all over the world. You can learn more about the Pi Network by clicking Here.

Even so, not everyone will take the opportunity to be part of the new emerging economy powered by the latest form of money. Nevertheless, there is one very important lesson to learn here, which is: The people or group of people who are faster able adapt to an ever rapidly evolving and progressing world, will always have the advantage.

sources: Pi Network,Wikipedia,The economics of digital currencies, Investopedia, How to know more about cryptocurrency than others, Number of smartphone, What is Money?, Value of Money: Meaning, Measurement and Preparation of Index Numbers, Why Isn’t Money Just Paper?, What is Money, Bitcoin vs inflation,Inflation, How Paper Money Is Made, Paper Money, Money, Fiat Money, Fiat Money vs. Commodity Money, Bitcoin's Price History, The History of Money,Inflation, Credibility, and the Role of the International Monetary Fund, COMBATING HYPERINFLATION IN ZIMBABWE, Zimbabwean dollar, Cryptocurrency, Everything You Need To Know About Bitcoin, Currency Devaluation and Revaluation, A Short History Of Bitcoin And Crypto Currency Everyone Should Read, Bitcoin, What's the difference between a cryptocurrency like Bitcoin and fiat money?, Understanding Bitcoins: Facts and Questions, History of bitcoin, When did the U.S. start using paper money?, Altcoin, A history of money and how our use of it has changed down the centuries, Climbing prices put S-E Asian central banks on alert