Unpopular opinion - Bitcoin Halving won't do shit

If you frequent the cryptocurrency places on the internet – crypto twitter, crypto reddit, crypto blogs, etc – you’ll see many people claiming that the metric rises in Bitcoin’s price is due to the “halving.” The Halving, for the uninitiated is just the amount of new Bitcoin’s entering the market, decreasing. It will be cut in half from 12.5 to 6.25 new Bitcoins every block. Since there are only 21 million Bitcoins ever to exist the decrease of new Bitcoins entering the market is certainly a good thing for the price, one might think.

The opposition to my case often points to the following graphic:

Now this graphic is very exciting. It shows you the past two halving and the metric-fuck-ton rise in price. It certainly looks convincing, right?

It’s basic economics:

However, that might not be the case this next time around. It’s a simple case of supply and demand really. Even with the inflation rate decreasing you need an equal or greater amount of new demand entering the market to maintain the same price level.

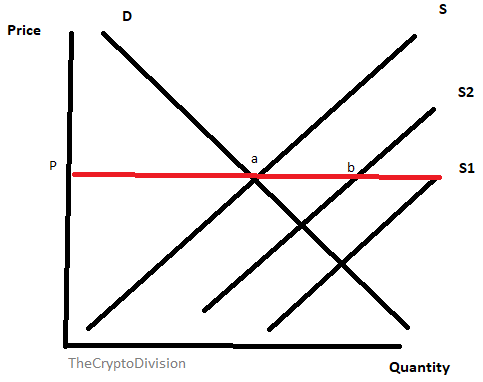

So in other words, lets look at a chart to demonstrate what I am talking about. If the inflation continued at it’s current inflation rate we might see the supply grow to S1 for Bitcoin supply on the market. However, after the halving we’d something closer to S2 for Bitcoin’s supply. So we’d see a higher price than if Bitcoin continued with the current block reward forever. But if no new demand enters the crypto markets, we still won’t see a higher price. We’d still see a price decrease.

We’d need at more new demand to enter the market to cover the area between A and B. We’d need our Demand curve (D) to shift right to meet at area b.

So the most common argument (and hope) for new money to enter the market is institutional investors. Which is rather funny given the hate most of the cryptocurrency community has for banks, yet they want banks buying our Bitcoins?... Anyways, lets take a look at this hope.

Bitcoin Funds Doomed to Failure?

The biggest Bitcoin ETF or trust for larger players on the street is GrayScale Bitcoin Trust (if you watch any of the financial news networks, you’ll see their ads). GrayScale currently has about 2.16 Billion under management and 2.4 million shares outstanding (numbers from September of this year - https://www.investopedia.com/news/why-buy-expensive-bitcoin-etf-instead-actual-bitcoin/). This sounds like a lot given the tiny marketcap cryptocurrency. However, it’s actually nothing. Why?

This is because each share of GBTC represents less than 0.0001 Bitcoins, meaning you’d need more than 1,000 shares to own one Bitcoin with GBTC. Even with all of their outstanding shares 2.4 million, they own 240 Bitcoins or less. Compare that to Satoshi Nakamoto’s estimated Bitcoin count, which is 1 million… institutional demand is far far less than most are wanting.

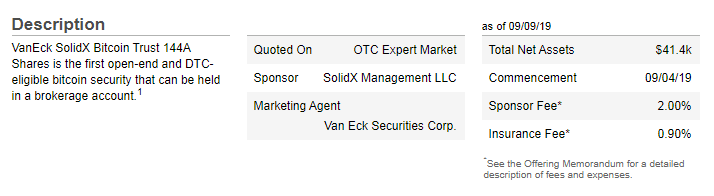

And as evidenced by this lets take a look at another ETF that was recently released. VanEck Bitcoin Trust which was started specifically for institutional investors. Three days into launch they had a holding of 41k…

At this point they were making about 69 dollars a month…

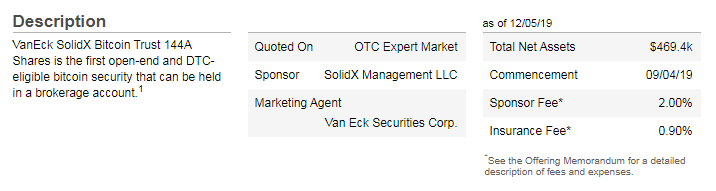

Fortunately for this fund they have seen a increase in the amount of money they manage:

Up to 469.4k around half a million dollars, or in otherwords, they are now making 782.22 dollars a month. Now, I don’t think I need to tell you how doomed to failure that fund is… I make more than they do in one week of work. For their sake I hope they begin to pull in more money quickly or else it’s doomed. There’s some more examples like this too so this isn’t just a one off cherry picked example.

However, there might be one hope for Bitcoin’s price and that is miners… Or so the theory is that as the halving approaches the big industrial miners are betting that the price will increase too and cut back on selling. And with a reduction of selling pressure from miners, and the hype around the halving, the price naturally increases. The one problem with that is miners have fixed costs and variable costs every month just like any other business. You have to pay your electric bill, you have pay your employees, you have to pay rent (assuming you aren’t just in your parents basement), etc. These costs don’t just magically go away with the halving or before the halving – and if other sources are right – retail and even smaller scale industrial miners are operating on razor thin margins, that selling pressure isn’t going away. And really, even for the big industrial mining operations out there, their costs aren’t going away either.

So what?

The issue with all of this is that even with a decrease in Bitcoin’s inflation rate or the third halving, there’s just no demand for it. The only demand that Bitcoin gets is from random internet druggies and trader wanna-bes. Sure, the infrastructure for institutional money is growing and it’s far better than it was at the last halving. But institutional investments would have to grow A LOT over the next few months for me to be convinced it’s going to really change up the market this coming year or even two-three years. Currently, it seems that banks and customers are very interested in entering the market. And with that, smaller/little price increases.

As for me:

As for me, I’m a betting man. I’m still adding to my collection of Bitcoin/crypto but only using 1% of my paycheck and saving/investing the other 14% like a responsible person. Ultimately, anyone who says they know exactly what’s going to happen after the halving is lying. There’s literally two data points that show after the halving price increased… that’s not a very good sample size. But like always, be safe and responsible and only invest funds you can afford to lose.

Disclaimer and Author's Bio:

Kendon started TheCryptoDivision in 2017 in order to help people understand cryptocurrency and learn about the unique opportunities in the space. Kendon is an economics graduate from BYU. He is working for an investment bank in the foreign exchange department.

If you haven't invested in cryptocurrency yet, Kendon recommends using Coinbase as a good jump start. Invest $100 dollars into Bitcoin and you'll get another $10 dollars’ worth of Bitcoin for free using the coinbase link.

If you have liked my content and feel like supporting my page anonymously feel free to donate:

Bitcoin Wallet: 31xJ7rmDTD5TSS62wg5ipg2Nv6RvMPoXmN

Eth Wallet: 0x641a67147FE99E438F74cD868a4C8D97adFf51b2

Monero Wallet: 4262AwLVeLwVem8JNzLuQ73kjdjRJEpSygyGncSwnWZsCXC7v4a9WtvhTZopoJBeF8f5Z3SMyHUArHrpssobJbJU972137B

Kendon recommends trying to fight the fed's devaluation of your dollars by using SoFi's free banking and getting around 2% on your checking accounts. You'll also get a free 25 dollars.

The author gets support/income for this website by donations, using affiliate marketing, and google ads. But he has never taken any financial compensation for any research or post. This is not meant as financial advice. If you want to get into contact with me DM me on Twitter or email me at TheCryptoDivision@protonmail.com

Learn more about cryptocurrency

**Suggested reading:** https://www.thecryptodivision.com/do-you-really-need-a-blockchain/ https://www.thecryptodivision.com/best-cryptocurrency-referral-programs/ https://www.thecryptodivision.com/235-2/ https://www.thecryptodivision.com/eos-a-look-into-a-budding-platform-coin/ https://www.thecryptodivision.com/the-undervalued-powerhouse-in-crypto/ https://www.thecryptodivision.com/bmining-coins-work/Follow me on:

Website: http://www.thecryptodivision.com/

Twitter: https://twitter.com/CryptoDivision

Facebook: https://www.facebook.com/TheCryptoDivision/notifications/

Steemit: https://steemit.com/@cryptodivision

I still don't know how this is supposed to continue, surley halving would make mining harder and people will stop using it. There is the question of storage and when will it be enough.

At the time the bitcoin blockchain is > 240GB would this not be costly to store?