Shortly after hitting the $19,800-mark last week, bitcoin price came tumbling down reaching as low as $10,400. Other cryptocurrencies followed suit with Ethereum falling from $863 to $492, Litecoin falling from $370 to $150, IOTA falling from $5.8 to $1.1, Ripple falling from $1.25 to $0.42 and so on. Then the markets recovered shortly, but seem to be developing a downward trend again. This development looks very similar to the bubble model created by Dr. Rodrigue in 2008.

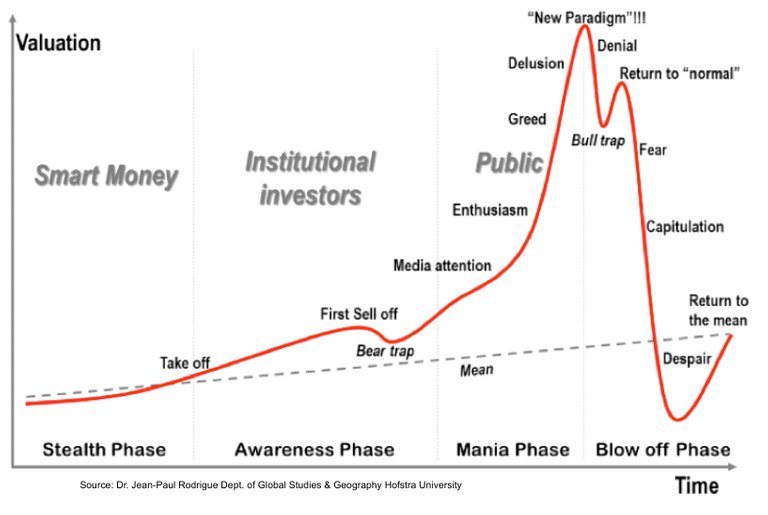

Dr. Rodrigue is a professor at the Department of Global Studies and Geography at Hofstra University in New York, who became well known for his bubble model in 2008. His model and chart are often cited and used to predict bubbles in many investment types, including stock markets, bond markets, housing markets, and now, cryptocurrencies.

Dr. Rodrigue's bubble model

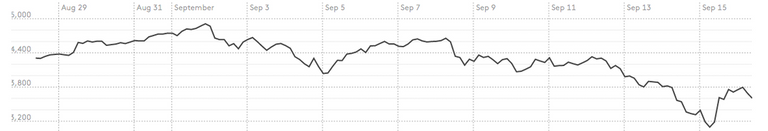

Bitcoin Line Chart - 30th December, 2017; 12:15 GMT (Source: Tradingview.com)

Bitcoin Candles Chart - 30th December, 2017; 12:15 GMT (Source: Tradingview.com)

Looking at the close resemblance between the bitcoin daily chart and the bubble model you can see that we are now at the “FEAR” stage.

I don’t hold Bitcoin, should I be concerned?

On the 22nd of December, when bitcoin price dropped, you’d notice that other cryptocurrencies experienced similar price drops, and if you look at other cryptocurrencies now you’d notice that most of their charts are at the Fear stage as well just like Bitcoin. Also, I don’t think it’s just a coincidence that Charlie Lee, the inventor of Litecoin sold out all his Litecoins just 48 hours before the 22nd December market crash (read here).

I'm blocking anyone that complains that I've quit Litecoin because I sold my LTC and that I no longer have any skin in the game. If you really believe that, you don't really need to see my tweets anymore. Cheers! 😀 pic.twitter.com/IsjdM22e7i

— Charlie Lee [LTC] (@SatoshiLite) December 27, 2017

Has the Cryptocurrency Market crashed before?

Yes, several times;The 2013 Bubble:

Bitcoin had never crossed $30 until 2013, however a surge of media scope helped drive it well above $200. In the spring of 2013, a horrible crumple saw the cost of bitcoin tumble from $233 to $67—overnight! That is a 71% drop. It took seven months to recuperate.

Bitcoin spent the vast majority of the remains of 2013 around $120. Then prices bounced ten times in the fall, hitting a high of $1,150 in late November, and suddenly prices tumbled, going below $500 by mid-December. It took more than four years for bitcoin to reach $1,000 once more.

Prices would have likely recovered more quickly after the bubble popped, but for what happened next.

The 2014 Mt. Gox Calamity:

The price of bitcoin had been making huge increases after the bubble pop of 2013 when, in February, the cost tumbled from $867 to $439 (a 49% drop).

The February crash came after the administrator of Mt. Gox—The largest bitcoin exchange at the time— announced the exchange had been hacked. On February 7, the exchange stopped withdrawals, and later revealed that the hackers stole 850,000 bitcoins (which would be worth around $12 billion today). The episode, which created serious doubts about the security of bitcoin and undercut its liquidity, setting off a doldrums period for bitcoin that kept going until late 2016.

The 2017 Summer Selloff:

In the beginning of January, bitcoin broke $1,000 for the first time in years and began climbing like there's no tomorrow. By June, the cryptocurrency hit $3,000—but suddenly staggered back, falling 36% to $1,869 by mid-July.

Just as bitcoin started to boom afresh, many stressed something wasn't right with its code. In particular, bitcoin suffered from slow transaction speeds and high fees compared to other cryptocurrencies like Litecoin and Ethereum, and its core developers couldn’t arrive at a concession on how to update the bitcoin code. This raised the possibility of a "fork" (which would deliver two forms of bitcoin's authoritative blockchain) and future breaks, which thus seemed to give rise to market jitters and the consequent fall in price. Incidentally, such a fork materialized in August as opponent Bitcoin Cash—yet this appears to have done no long-term damage to bitcoin.

The China Chill

After apprehensions over the fork died down, bitcoin went on another insane tear: It climbed near $5,000 toward the beginning of September before diving 37% by September 15, losing over $30 billion from bitcoin's total market cap. The Chinese Government was responsible for this price swoon.

When China cracked down on Initial Coin Offerings in September, there were boundless bits of gossip the Communist government will ban exchanging cryptocurrencies altogether. Accordingly, BTCChina-the a very prominent exchange announced it would end trading. This crackdown, combined with questions about China’s de facto monopoly on bitcoin mining led to the bitcoin price tumble.

Lessons Learned from Previous Bitcoin Crashes

A glance back at bitcoin value swings over the most recent five years, which include a few stomach-beating tumbles of 40% and even half, buttresses the highly volatile nature of bitcoin and cryptocurrencies in general.

It's additionally obvious that the majority of the bitcoin crashes are coincident with speculative run-ups combined with exogenous stuns, for example, a noteworthy hack or a government crackdown. Likewise, much of the time, bitcoin has recovered from the crashes in months or even weeks—proposing anxious bitcoin purchasers will be alright in the event that they are holding for the long run. Then again, the crashes of 2013 and mid 2014 are a call for caution—recall it took a very long time for the individuals who initially purchased bitcoin at $1,000 to recoup their investment.

Conclusion

If you have been following my posts and cryptocurrency investment tips, I’m sure you should have made an excellent return on your investments by now as most of the cryptocurrencies I advised to invest in have gone up over 4000% this year and over 400% since November, so at this point I think it would be wise for you to take your profits, step back for a while to observe the market and wait for a good time to buy the dip.

Disclaimer: This is just my point of view and not trading advise. Cryptocurrency investing is quite risky, so always carry out your own due research before making any cryptocurrency investment decisions.

Cover Image Credit: Hacked.com