✊ Thank You Very Much For Reading!

😎 Please Remember To Like & Follow!

Bitcoin cash's surge above USD $600-700 has raised a few questions to why and what may be the potential fallout for Bitcoin....

Bitcoin Cash's rising price may be down to a number of key factors;

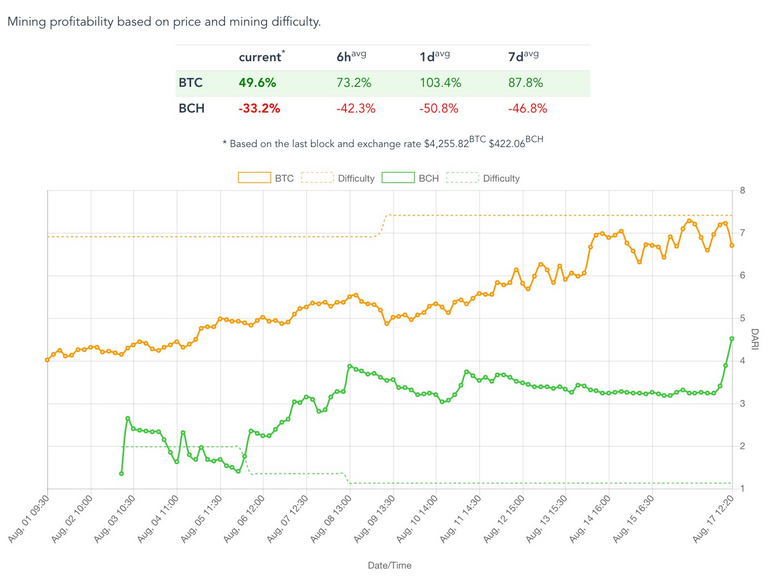

#1 Reduced mining difficulty ;

Block 479,808 (set for this weekend) will likely trigger a difficulty adjustment downwards 50% and this could trigger a exodus from Bitcoin in the wake for higher mining returns.

#2 Rising value/profitibility of Bitcoin Cash ;

The rising price is also creating the incentive for miners to dedicate computing power to the bitcoin cash blockchain, one that could find them moving away from bitcoin. With the new push, bitcoin cash miners are making around 2% more mining on Bitcoin Cash.

#3 High fees on the Bitcoin Network ;

The clunky bitcoin blockchain charges higher fees on transactions, so miners must take into account the extra 1.5 BTC per block on bitcoin (about $5000-6,000 USD). By comparison, bitcoin cash has very low fees (on average under $50 USD).

#4 Bitcoin Cash has a working product

August 1st prompted a lot of question marks around what could go down. Despite all this fear Bitcoin Cash has emerged unscathed & The Bitcoin Cash network is moving along with no hitches on its 18th day running as miners have processed 1062 blocks since its inception on August the first, further adding to investors confidence & will only be sure to grow as long as everything goes to plan. Again Bitcoin cash is the clear winner for practicability at this stage;

#5 Future scalability and speed

I won't go into the drama with this occuring but it would be naive to think that Bitcoin Cash will stop at 8MB per block size, they have shown they can easily move in unison and as soon as any turmoil occured re: Transaction times or cost, they would scale accordingly and 32MB blocks aren't so distant.

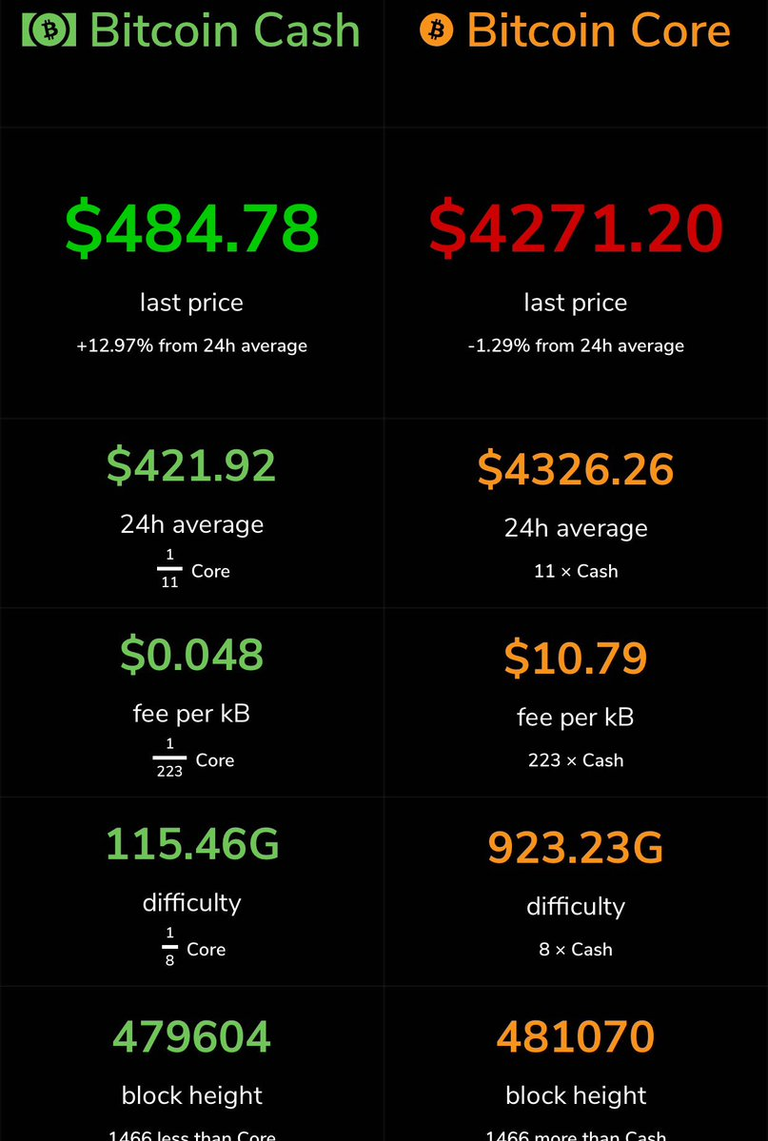

Bitcoin Cash (BCH) markets on August 18, 2017.

However, some drawbacks;

#1 Confirmation times

Bitcoin's 100 confirmations are typically taking around 17 hours compared to 34 hours on Bitcoin Cash

#2 Liquidity

Bitcoin still has much higher liquidity so miners may choose to run with Bitcoin.

#3 Segwit2x

Segwit 2x is coming and if all goes well (the hot topic right now) this will scale Bitcoin and remove the window for a micro-payment replacement .... but for how long?

#4 Bitcoin Cash's Mystery Miner

There is strong talk in the market of the mystery miner who is crunching a large amount of the blocks on the Bitcoin Cash network. There has been speculation that this is anyone from the Russian, Chinese government to even North Korea who have expressed their direct interests in Bitcoin and cryptocurrencies.

Keep informed!

Follow me: @Crypto-kiwi

Sources:

https://coinmarketcap.com/currencies/bitcoin-cash/

https://www.coindesk.com/bitcoin-cash-closes-profitability-parity-original-blockchain/

Yh the fake conspiracy theory by the trolls is up. Both currencies will survive the upcoming dollar collapse. Mark my words. LOL. Thanks for making this post.

:)