The crypto bubble will burst in July.

I am an early Bitcoin investor. I have full trust in the disruption of the cryptocurrency market which will tumble down the financial sector as we see it today. Even if we are all sure about this, the market will fall in July.

The question now is, how to make money out of this future crash?

WHY WILL THE MARKET CRASH IN JULY

Uncertainty and miner's own private interests.

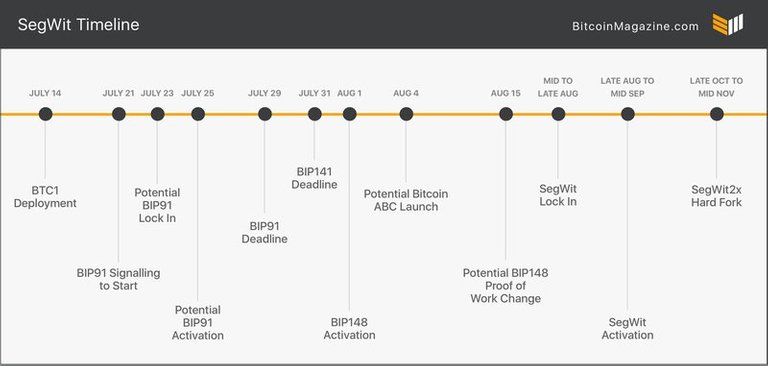

On the 1st of August, we will see the BIP 148 with a majority of support. It's already with more than 80% support from miners. The chances of a chain split on BTC are extremely low. And even if this happens, game theory indicates that the smallest chain will probably perish (there's not the same stagnation or conservatism for a "Bitcoin Classic" as there was for Ethereum Classic. But uncertainty is anyhow present, as there's multiple scenarios like hacking, useless generated blocks, small chances of a chain split, etc.

- Uncertainty: If you are an investor which is not a miner and lacks the power and influence within the community, you will not risk to a third party's decision making your portfolio's value.

- Organized Whales and Miners make money from dips and pumps: They will want to move the market in their advantage when there's opportunities to do so. If you create the dip, you control the dip.

- Controlled Chaos: The big players in the market want to control where the market is heading. The higher the degree of uncertainty, the higher the need of the whales to control market movements.

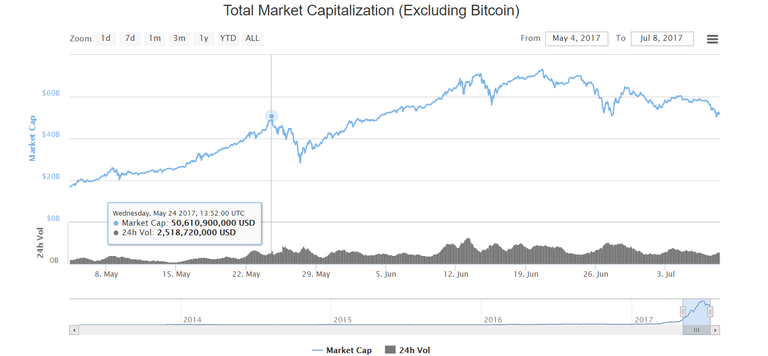

- The alt-coin market is highly inflated: We have seen huge ICO fails such as Bancor, Dao, etc. But we are also seeing other many coins with a huge potential, but completely overpriced as per today's fundamentals, such as Siacoin or Golem. Uncertainty will hit them stronger. Some of these coins are already falling highly. there is a clear movement back from Alt to BTC.

- BTC is getting capital back from alt-coins due to the higher volatility. That's why it has fallen so little this weeks compared to some analysts predictions. Dominance is back at 45%. But btc will suffer on the upcoming weeks.

- Alt-coins have huge Betas on BTC: Falls on BTC on July will drop even higher the crypto market.

WHAT TO DO:

Clearly the best way is to invest in inversely correlated assets to BTC, depending on how much you belive segwit2x and BIP 148 will affect the BTC price.

- If you expect major drops: USD Tether: It will give you liquidity for when the market hits minimums to be able to buy again.

- If you expect moderate drops: LTC: If you think the drop will not be so high, you should go to LTC. Strong community with strong support and always beating BTC on their drops.

- If you expect testing 2100 level: ETC: Similar to LTC. It's not inversely correlated, but it will remain strong due to its community and the new updates on Emerald Wallet.

Sorry I might have missed it but how do you intend to make money out of this scenario? From what I can see, BTC and Litecoin seem to be the most resilient so I'm considering keeping my funds mostly in those, although am still deciding whether I move a chunk into fiat as well.

Unfortunately I have a large amount of ether locked up in ENS contracts so I'll need to short ethereum on poloniex as a hedge against a fallout there.

What do you think?

You can definetely hedge yourself going short, but this is quite risky, as volatility even with a negative trend can result in positive spikes which will close automatically your position on a loss.

I suggest changing funds to USDT and wait until the 4th of August to rebuy BTC and alt coins with big betas, which will suffer the biggest corrections. Examples such as SC, BCN, REP, BTS, STRAT

Usdt? I dont agree that is a safe place to hold it :) Personally I will use them and put the rest into SP. Seems to me to be a small error but it might pay itself off later on.

Reason I dont agree with usdt is that it does not have a unified value between exchanges and due to this the market prices gets skewed.

No crypto has the same value throughout exchanges, and there's always chances of arbitraging during volatile periods. Having said this, 1 USDT is backed by 1 USD, therefore the price always ranges between 0.95-1.05 depending on liquidity of the market

I think thats a good advice, Earlier today I converted quite substantial amount to FIAT, I think I will be able to buy BTC back at 2200 or similar. For average non technical person / investor, all the commotions around the bitcoin protocol is just bad news.

Well, as per today if you did so, you can buy at 2100. I still anyhow expect the drop to the 1600-1800 level.

I actually didn't buy back yet. I think the same, maybe a bit more optimistic 1700-1800 level. I hope everything will be fine on August with SEGWIT and good news should bring back a positive trend.

wait did you just recommend BCN as a SAFE place to hold cash? Are you kidding? have you seen the chart? that coin is going closer and closer to 0 every day, I'm kinda amazed it hasn't been straight up removed from Polo.

I did not. I mentioned that after the 4th of August, it is interesting consider currencies with high betas that have suffered from the BTC uncertainty, and BCN is an example.

BCN is definetely not a safe currency, but rather completely the opposite (precisely that's the definition of a high beta).

Your daily dose of Crypto News

https://steemit.com/cryptocurrency/@beyondthecrypto/crypto-news-top-10-daily-market-statistics

always useful to reed your news ;)

Thanks for sharing this information. Which is your expected BTC price after 1st august? Might be ETH rise due to the Segwit? thanks!

Support levels of 1600 would be a possible scenario.

BTC is still the overall dominant in the market. ETH is still correlated to BTC. The uncertainty on BTC affects the whole market to certain extent. This means people will pull out money to the safest alternatives, and maybe we end up seeing the correlation between ETH and BTC breaking during this period.

I think the ETH/BTC correlation will be broken. ETH really is completely independent and looks like a safe heaven compared to BTC for the time being. So, the ETH/BTC correlation is quite accidental, IMO, without any fundamental reasons.

I absolutely agree with you.

Miss leading Title!

I explain briefly the actual situation with Segwit2x and BIP148, the risks and what to do to make money out of it. I would appreciate to know what has not been clarified.

Thanks!

USD Tether give no guarantee of liquidity, since it's not real USD it could just be blocked on all exchange (for some reason) and you will be stuck with worthless tokens

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

USDT is tradable in the major platforms, with a huge volume output and backed by real USD (which gives a basis of price). Therefore it's one of the most liquid cryptocurrencies.

Can you briefly explain why you think Siacoin is overpriced? I too believe it is a revolutionary idea but all the recent dumping of the coin makes me start to believe maybe it was overpriced. I bought my majority of my holdings of Sia at around 500 sat and held and saw it rise to 880 sat, but now it is below 400 :(

I exited SC already some weeks ago before the spike at around the 350-360 level, which I already considered quite high. I never entered again.

The idea is incredible. The system works, but it's not user friendly, it's not even close to jumping the chasm, and it has an extremely small user base. The potential? Huge. But on reality there's nothing right now.

INHALES

WRONG.

I am a silly robot!

!cheetah bad robot