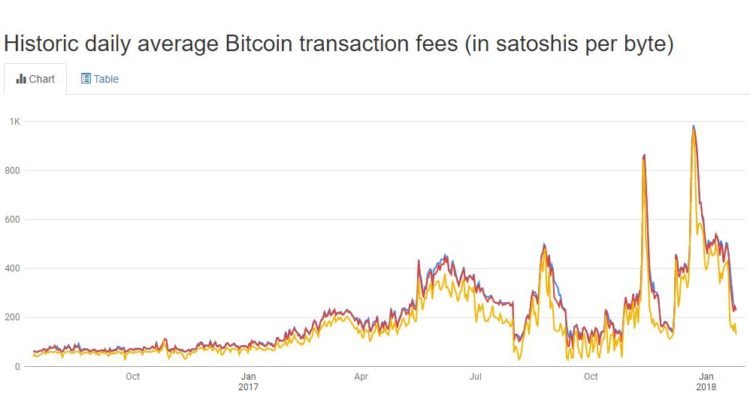

While Bitcoin’s massive fees (topping out at $65 per transaction) were the main headlines at the end of 2017, the new year has already brought with it a massive turnaround, taking them down to around $1 of the time of writing. It is still a great deal more than most altcoins, but it is showing that the community is moving in the right direction in lowering them. Do note that the “average” has been artificially inflated because there are many services that are paying well above what is actually needed.

Batch Transactions and SegWit Start Taking Hold

The main things that appear to have lowered fees are SegWit (which allows for more data per block, meaning more transactions are confirmed in each one) and batch transacting (which allows for more transactions since it lowers overhead). With companies like Coinbase jumping on board, it’s caused many others to follow suit, which benefits everyone from the companies to their users, and it even indirectly affects outside parties.

It was originally believed that these would have some impact, but it wasn’t clear just how much. After evaluations have been done, it’s been shown that some transactions can save as much as 90-95% of their space (meaning their fees are a fraction of what they would normally be and they are saving blockchain bloat).

Bitcoin’s Hash Rate Jumps Up

Another influencer in Bitcoin’s fee reduction is a massive jump in hash rate, which has pushed the block time down to around 8 minutes on average. It’s hard to tell how much of a role this is playing, but it’s clear that it does affect things – it’s essentially letting through 20% more transactions. We should see it normalize once the difficulty is rebalanced, but for the time being, enjoy the faster blocks (and transactions)!

Smaller Quantity of Transactions

If you look at a chart of the number of daily transactions in the Bitcoin network, it’s clear that we’re at least 25-30% lower than when fees were peaking. While the number of actual transactions itself is telling, it’s important to note that batching has a strong impact on those numbers. For example, if I wanted to send a coin to three separate people, I could batch the transaction and make it go through as one. Because of this, it is in no way a sign that the Bitcoin network is being used less. It’s also worth noting that the number of transactions does not give information as to how large they were (a normal one of 226 bytes is vastly different than a 1 MB one, for example). But because of the path the community is taking, we should be seeing this number lower some more, as there is going to be far less bloating and spam.

What to Expect Near-Term

It’s hard to tell exactly what will happen when the next difficulty adjustment kicks in, but the current fees have been low enough that we’re back where they were when Bitcoin was far cheaper (in BTC, not USD). Once they are normalized around the bottom (think 10-20 satoshi per byte), the question then becomes how to make them even smaller. Bitcoin has gone through minimum fee changes in the past as the price grew, and it’s entirely possible that we’ll see this again, moving from 0.0001 BTC to, say, 0.00001 BTC per transaction. Until then, we are already seeing it bounce back and get more utility, but it’s not quite good enough for micro-transactions yet.

I was hoping it would stay that high so the other cryptos that will be running away with the momentum within the next few years could grow quicker, like Steem. Oh well, they wised up, sort of. I love the Steemit trade that can be done with virtually pocket change at once. Do not underestimate the value of the steem ability to handle the biggest transaction load. Thanks for the post @crushthestreet! UPVOTE

That is great news!

Would think it is about time, because paying $5 + for a single transaction is a bit rediculous...

With future contracts ending today, I am hoping bitcoin price will surge. Hope to see some great price spike.

Transaction fees reduction has not impacted the prices yet.

A nice detailed and informative update. Thank you.