Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator.

The network is peer-to-peer and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a block-chain.

Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto and released as open-source software in 2009.

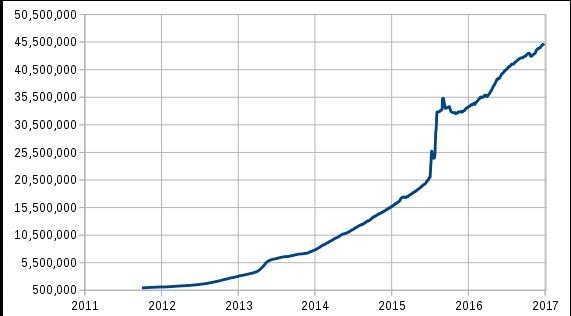

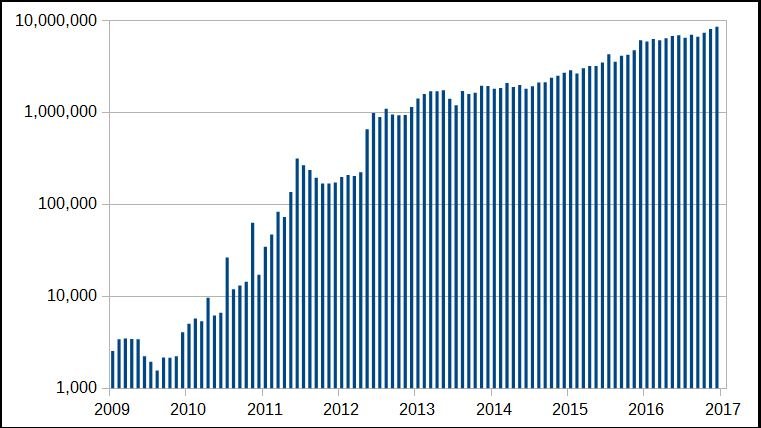

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies,products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment. Research produced by the University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.

The word bitcoin first occurred and was defined in the white paper that was published on 31 October 2008. It is a compound of the words bit and coin. The white paper frequently uses the shorter coin.

There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account. The Wall Street Journal, The Chronicle of Higher Education, and the Oxford English Dictionary advocate use of lowercase bitcoin in all cases, a convention followed throughout this article.

The unit of account of the bitcoin system is a bitcoin. A satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoins, one hundred millionth of a bitcoin. A bit equals 0.000001 bitcoins, one millionth of a bitcoin or 100 satoshis. A millibitcoin equals 0.001 bitcoins, one thousandth of a bitcoin or 100,000 satoshis.

BLOCK CHAIN

The block-chain is a public ledger that records bitcoin transactions. A novel solution accomplishes this without any trusted central authority: the maintenance of the block-chain is performed by a network of communicating nodes running bitcoin software. Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications. Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The block-chain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the block-chain. Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the block-chain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the block-chain

TRANSACTIONS

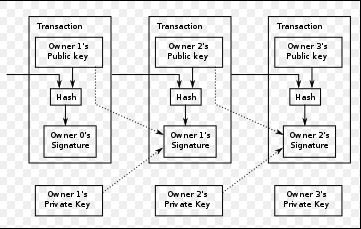

Transactions are defined using a Forth-like scripting language. Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Any input satoshis not accounted for in the transaction outputs become the transaction fee.

TRANSACTION FEES

Paying a transaction fee is optional. Miners can choose which transactions to process, and they are to prioritize those that pay higher fees.

Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. Thus, fees are generally measured in satoshis per byte, or sat/b. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs

OWNERSHIP

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse (computing the private key of a given bitcoin address) is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key. A backup of his key(s) would have prevented this

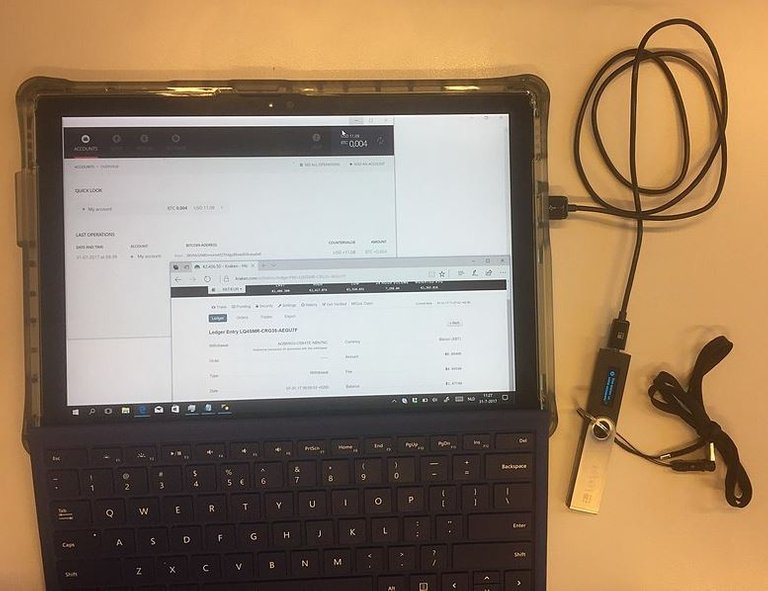

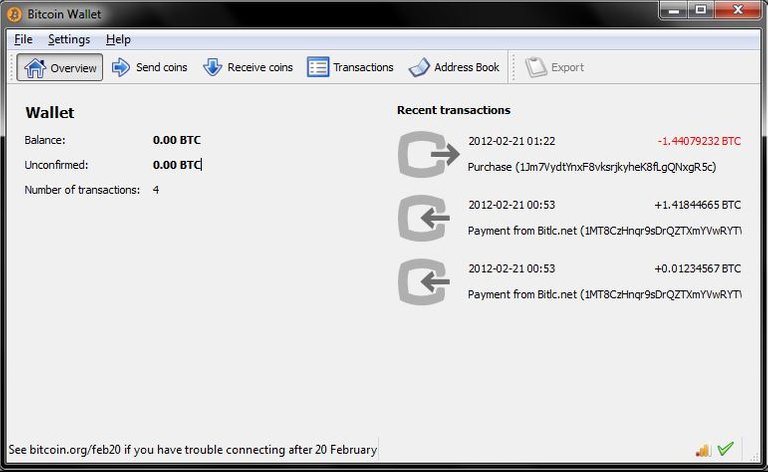

WALLETS

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins, due to the nature of the system, bitcoins are inseparable from the block-chain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated. At its most basic, a wallet is a collection of these keys.

There are three modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

Full clients verify transactions directly on a local copy of the block-chain (over 150 GB As of January 2018). They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules. Because of its size and complexity, storing the entire block-chain is not suitable for all computing devices.

Pruning clients store only the set of transactions that have not been spent (the "UTXO set"), thereby reducing the size of data they need to store, while simultaneously allowing them to validate new transactions. However, if miners alter the block-chain at a point suitably far back in time (a "reorg"), the pruning client must re-validate the entire blockchain from its genesis.

Lightweight clients consult full clients to send and receive transactions without requiring a local copy of the entire block-chain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest block-chain and do not ensure it is valid, requiring trust in miners.

Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware. As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011. This has led to the often-repeated meme "Not your keys, not your bitcoin".

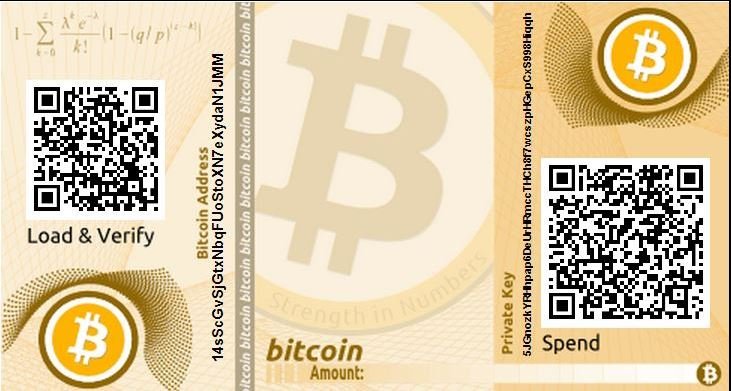

Bitcoin paper wallet

Trezor hardware wallet

Physical wallets store offline the credentials necessary to spend bitcoins. One notable example was a novelty coin with these credentials printed on the reverse side.Paper wallets are simply paper printouts.

Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions

REFERENCE IMPLEMENTATION

The first wallet program – simply named "Bitcoin" – was released in 2009 by Satoshi Nakamoto as open-source code. In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as "Bitcoin-Qt". After the release of version 0.9, the software bundle was renamed "Bitcoin Core" to distinguish itself from the underlying network. It is sometimes referred to as the "Satoshi client".

While a decentralized system cannot have an "official" implementation, Bitcoin Core is considered to be bitcoin's reference client. As such, it serves to define the bitcoin protocol and acts as a standard for other implementations. Today, other alternative clients (forks of Bitcoin Core) exist, such as Bitcoin XT, Bitcoin Unlimited, and Parity Bitcoin.

PRIVACY

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses. Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.

To heighten financial privacy, a new bitcoin address can be generated for each transaction. For example, hierarchical deterministic wallets generate pseudo-random "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys. Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs. "Bulletproofs," a version of Confidential Transactions proposed by Greg Maxwell, have been tested by Professor Dan Boneh of Stanford. Other solutions such Merkelized Abstract Syntax Trees (MAST), pay-to-script-hash (P2SH) with MERKLE-BRANCH-VERIFY, and "Tail Call Execution Semantics, have also been proposed to support private smart contracts.

CLASSIFICATION

Bitcoin is a digital asset designed by its inventor, Satoshi Nakamoto, to work as a currency. It is commonly referred to with terms like digital currency, digital cash, virtual currency, electronic currency, or cryptocurrency.

The question whether bitcoin is a currency or not is still disputed. Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify". Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria. It does best as a medium of exchange; as of February 2015 the number of merchants accepting bitcoin had passed 100,000. As of March 2014, the bitcoin market suffered from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account.

FINANCIAL INSTITUTIONS

Bitcoins can be bought on digital currency exchanges. According to Tony Gallippi, a co-founder of Bit-pay, "banks are scared to deal with bitcoin companies, even if they really want to". In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin, and HSBC refused to serve a hedge fund with links to bitcoin. Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency; this has become the subject of an investigation by the Australian Competition and Consumer Commission. Nonetheless, Australian banks have trialled trading between each other using the block-chain technology on which bitcoin is based.

In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers." In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees was opened in Boston.

Plans were announced to include a bitcoin futures option on the Chicago Mercantile Exchange in 2017. Trading in bitcoin futures was announced to begin on 10 December 2017.

AS AN INVESTMENT

Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts. During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.

The Winklevoss twins have invested into bitcoins. In 2013 The Washington Post claimed that they owned 1% of all the bitcoins in existence at the time.

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission. Forbes started publishing arguments in favor of investing in December 2015.

In 2013 and 2014, the European Banking Authority and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization, warned that investing in bitcoins carries significant risks. Forbes named bitcoin the best investment of 2013. In 2014, Bloomberg named bitcoin one of its worst investments of the year. In 2015, bitcoin topped Bloomberg's currency tables.

According to bitinfocharts.com, in 2017 there are 9,272 bitcoin wallets with more than $1 million worth of bitcoins. The exact number of bitcoin millionaires is uncertain as a single person can have more than one bitcoin wallet.

Congratulations @cornelkingsley! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP