Over the years, there are allways busybodies who claim that bitcoin is a bubble. I will show you why this statements themselves are a bubble. So....it´s a double-trouble-bubble...

From the beginning of Bitcoin, there were allways trolls who try to discredit cryptocurrencies. Near to every few month, some economy scientists or financial leaders will come out of somewhere (only a few poeple knewed them before) and try to tell the poeple that cryptocurrencies are dangerous and investors will loose their money.

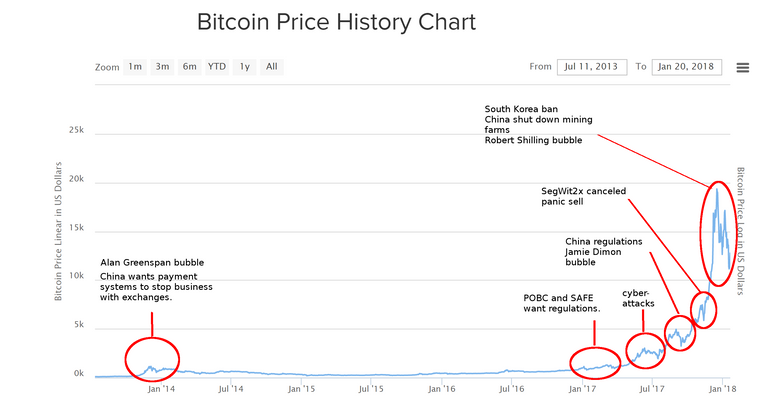

Let´s look based on Bitcoin´s history chart, what happened in the last few years.

December 2013

The first bigger correction was in december 2013, the price increased to about 1050 USD and decreases fast to 660 USD in only three weeks.

What happened here?

Allen Greenspan claimed at the beginning of december that cryptocurrencies are a bubble

What a fail, he was wrong. Cryptos are big now and Ripple is on it´s best way to be supported by banks and governments.

China wants payment systems to stop doing business with cryptocurrency exchanges.

After this correction, bitcoin traveled along 150 - 250 USD until november 2015. Since this time, Bitcoin increased steady until it became again a value of about 1030 USD on January 2017.

January 2017

After a new increase to about 1030 USD in the first quarter of january 2017, the Poeple´s Bank of china (PBOC) stated that it would have a self proof of the big exchange BTCChina. Also, The State Administration of Foreign Exchange (SAFE) has taken an eye on one of the biggest trading platforms for cryptocurrenices. China stated that cryptocurrencies must be regulated.

What now happened was that the price of Bitcoin decreased to about 770 USD....a small correction.

It began to increase again, just a few days after until June 2017.

June 2017

Bitcoin increased to about 2940 USD after the last correction in January. But now there were several reports about cyber attacks on multiple platforms. Bitcoin decreased again to 1990 USD until middle of July 2017 but did perform well very fast and increased to 4630 USD at beginning of September 2017.

September 2017

Now sitting on an unbelievable price of 4630 USD, the next correction comes again. China again, want to regulate and forbid cryptocurrencies. Jamie Dimon talks about a bubble. Bitcoin decreased to about 3500 USD for a short time, but recovers to 7480 USD on beginning of november.

Later, there were some assumptions that JP Morgan bought bitcoins after the correction...very suspicious.

The next short correction comes...

November 2017

The Hardfork to Segwit2x is canceled which causes investors to sell their coins. Bitcoin decreased to about 5850 USD, but again recovers just in a few days and increased to amazing 20000 USD in the middle of december.

December 2017

After the insane "all time high" of about 20000 USD, Bitcoin has a huge correction. It falls to near 13000 USD, came back to about 17000 USD and again decreased to about 10000 USD. This was caused by multiple statements from South Korea to ban cryptocurrencies and some news from china that they want to shut down mining farms in cause of too high energy wasting.

On 19th of january, Robert Shilling, a big financial noble price holder, talks about a bubble.

It turns out that some members of the financial agency of korean governement, made some tradings with Bitcoin before or after the statement that the cryptos could be banned. This is under investigation now, but it has a bitter taste of price manipulations. A few days later, the korean government has softend the statement and some government members stated that it is near to impossible to ban cryptocurrencies.

At the time of writing (21st of january 2018) the cryptocurrencies are in a slow recover. Bitcoin sits at about 12200 USD.

In the past four weeks, there were several attacks from governments and financial agencies.That lead into multiple crashs, but the crypto market recovered again and again.

Conclusion

Price corrections will always happen and my opinion is, that it won´t work without. It´s a normal behaviour of trading and it happens also at the stock trading platforms. Corrections are just new entry points for new investors. It is absolutely normal that if a price increases very fast and high, the correction comes because the poeple want to take the profit.

In the basics, there is no difference between trading a stock or trading a cryptocurrency. The crash can happen on both and we all should be clear about that we can loose our money. Nobody should invest all, everybody should just invest as much as he can loose and live without that.

The only thing that makes cryptocurrencies to a bubble is the fear of investors caused by bad press and FUD spreading news from big financial poeple and governments.

Imagine no government or busybodies had said anything about it...how would the price and the chart be today?

We as investors should learn to deal with that FUD, the bubble talk itself is a bubble which leads into trouble. There will be the time where all this wouldn´t fear investors anymore. The statements about a bubble are the same speculations as the tradings. If I say today, the Bitcoin is a bubble and will burst and then in some month it happens, I can say: I told ya, but you won´t listen. This is a nostradamus like behaviour without a base. If there weren´t all these talkings, cryptocurrencies could be already a stable currency at the market and many shops would accept it.

There is no realistic base for that bubble theory. It is just a FUD spreading talk, maybe some of the FUD talking guys have made a good investment as the price was at the ground.

The bubble talk itself is a bubble and will burst in the future, it wouldn´t be heard by anybody then and no one will be feared of such statements anymore. As we learned from the past, there could be big corrections, but the market recovers soon.

In this spirit, I want to you show a nice song from Götz Widmann, a german songwriter. It´s not about cryptos...it´s about a bubble :). Have a nice day.

I do think that it is true that the amount of Bitcoin ‘bubbles’ is growing, and that a lot of the bubble theory is FUD. Though this thinking is based in reality, when a FOMO rush overextends an investment to its limit, and then it crashes down as people sell on a correction. But unlike the .com boom and the tulip bubble, Bitcoin isn’t based on a physical entity. This means that Bitcoin has nothing to overextend above, because it isn’t grounded by something that has an actual value, such as tulips or .com companies. This means that it cannot be so highly overpriced as tulips and .com companies were.

And one tip, you can style your posts so that “Conclusion” is a header, like this:

This is a header.

You can find a styling guide here.

Note that I am an investor in Bitcoin, though, so this is a biased response. I recently posted about my prediction for Bitcoin to go to $50,000 here.

@shredz7

Thanks for reply, I agree with you. The style option wasn't available...I wonder why. I faced sometimes a problem with writing articles...maybe it's upon my browser settings.

Congratulations @colddays! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @colddays! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP