Finally, the time has come to tell more about Bitcoin seasons (see previous articles here: The Newest Bitcoin User Manual), the essence of Bitcoin investment. First of all, you have to be aware of the difference between the price chart and market capitalization chart. There are separate charts for Bitcoin price only, Bitcoin market capitalization, crypto market capitalization (for all cryptos including Bitcoin) and altcoin market capitalization (for all cryptos excluding Bitcoin). They all have a similar shape (If you want to see a long-term market capitalization, go to www.coinmarketcap.com ), but one day the charts may split and then saying “crypto seasons” may not be the same as “altcoin seasons” or “Bitcoin seasons”. For now, saying so regarding the whole cryptosphere is more or less valid, no mater if we mean the price of Bitcoin or total crypto market capitalization, but anyway it is safer to precise which cryptocurrency we are exactly talking about. BTC (or crypto, altcoin) seasons don't have to mean the same as e.g. “TRX seasons” because, although Bitcoin movements have impact on the whole cryptosphere, every altcoin may have its own price seasons (like Tron has), regardless what BTC is doing. So phrases like “crypto winter”, in itself, is not precise (in the sense of “crypto market capitalization winter” as there is no “crypto market price winter”) because it matches the total capitalization of existing cryptocurrencies but not each of them separately. So let's stick to “Bitcoin seasons” (not “crypto seasons”) here as we consider only Bitcoin price (not market capitalization) charts in this article.

Bitcoin seasons are a bit similar to 4 phases on the picture showing typical market bubble chart (Pic.1) but more detailed. You can find there Stealth Phase, Awareness Phase, Mania Phase and Blow off Phase. In our case we are searching for some specific points on the chart where we can identify the beginning and the end of some logical periods, which one can call the seasons. They are marked with colors on the next picture (Pic.6).

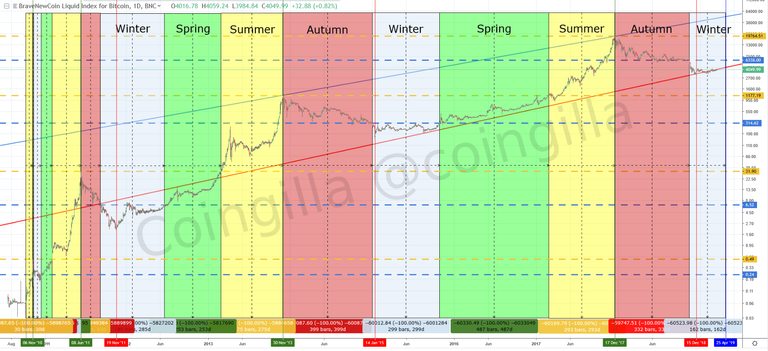

Pic.6 Bitcoin seasons

Spring area is green like grass, summer is yellow like sun, autumn is red like falling leafs, and winter is light blue like snow (a shade white would be less visible on the white background). The best way is to talk through the autumn first, as it begins at a very characteristic point, All Time High (ATH). This is also when Blow off Phase begins.

Autumn. It comes when last ATH is formed and the price starts dropping sharply away from the yellow dash line. This line indicates the end of summer (at last, we can call it a summer line, now) and the beginning of autumn. Lower highs and lower lows are being generated. Price falls like colorful leaves of the trees. Bull run is over now and new downtrend unfolds. It stops for a while to take a breath at level indicated by the blue dash line on our picture (let it be our winter line). From ATH to this “floor” is about 67% - 73% (average 70%) of loss.

Winter. Finally under selling pressure the price capitulates also here and supported by volume spike suddenly goes underwater below this fragile “ice level”. It stops up to 84%-87% lower than the ATH. After this last plummet the price movements are small and in most cases the chart goes sideways in the narrow range of variation (compared what was during autumn). Bitcoin reaches its lowest local dip at an early stage of the winter (red vertical markers on Pic.6). Now, the market is cold or it looks dead. The situation changes, when the price breaks through the winter line again but this time in the upward direction.

Spring. When the winter line is defeated, it is confirmed that new uptrend just began and the new season with it. The price line will never touch this ice level again except one situation: “ground frosts”. It may happen couple of days/weeks later, when the price comes back for a while to kiss this line goodbye before it goes north forever. Hell Line becomes a bumpy road now till the end of spring during which the price jumps on the bumps from time to time and then comes back to the ground, but the main direction is always up. When the previous ATH point is reached (last summer line is kissed for good morning), the spring ends.

Summer. Next period coincides more or less with the Mania Phase described on Pic.1. Price breaks out the yellow line and slowly accelerates towards next “golden roof”. Some time after a cooling process occurs while price drops a bit but it is just temporary. In summer trajectory changes its shape into well visible parabola when every next top is being formed faster and faster. The price chart changes exponentially even on the logarithmic representation, and the market is getting very hot. When the level of Heaven Line is reached at the end of the day it means that the market is overheated. Sooner or later huge crash comes, which announces the coming of next autumn, and the whole process repeats from the beginning.

If you take a closer look at Pic.6, you will see that from last ATH to previous ATH (that is from last summer to previous summer) is around 4 years long. It means that a full year in Bitcoin world lasts 4 years in our reality. Will it be the same next time? This is a theme for another article.

What interesting dependencies can we find on the picture above? It is clear that all seasons become longer comparing to the “squeeze” period in Dark Age. Every next spring and summer is longer, but last autumn was shorter than the previous one. Every next winter was a bit longer then one Bitcoin-year earlier. Anyway, don't treat it as a prognostic model, it doesn't mean that shortening or lengthening one or the other season each subsequent time is a rule. Maybe yes but it's too early to tell. Remember that if Bitcoin-year has 4 real years, lengthening of one season means shortening of the other.

Now, when it is defined what the crypto winter is you can compare BTC/USD with e.g. LTC/USD or TRX/USD price chart. You can see there that both altcoins got out of their winters while Bitcoin and the whole cryptosphere (based on the crypto market cap chart) are still in. It clearly shows that "altcoin winter" or "crypto summer" are very general terms and should only be used in this sense.

Next chapter:

<< Bitcoin turning points

| Home |

Bitcoin behaviors in a nutshell >>