As you found out in previous articles (see them here: The Newest Bitcoin User Manual), Bitcoin shows the signs typical for a market bubble. It didn't do it once but few times already and every single “micro-bubble” was located on the chart higher then previous one. If we can see the price is still growing and the repeating bubble pattern is being formed, can we actually call this pattern a bubble? Maybe better name for it would be a “correction”? If so, can Bitcoin be a bubble? Time will show, but I doubt it is. For this to happen, Bitcoin price has to break Hell Line down significantly and go almost to zero. Adoption of every new groundbreaking technology is turbulent and growths exponentially. It stabilizes only after some time.

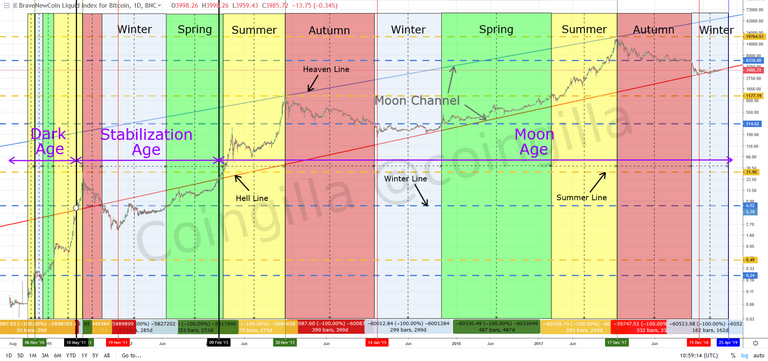

As we know from the observation of various markets, trends can last for many years. Why wouldn't it be the same for Bitcoin? The main upward trend (Hell Line) and main channel (Moon Channel) were identified here as an important signpost for Bitcoin investors. Of course it may change anytime and then you will know that some other signpost has to be found. But till that day you can follow this path and be aware of possible change in the future (maybe tomorrow, in a month or in many years).

To help identify the levels where price may bounce off, main support and resistance lines were indicated here (summer lines and winter lines). Depending on the direction of the market the same line can be a resistance one day and a support the other. Each investor can use them to take a market position accordingly.

It is amazing that in real life we have 4 seasons and BTC tends to have them, too. The phrases comparing the price behavior to the seasons (e.g. “crypto winter”, “crypto spring”) were a bit “fuzzy” so the main periods were specified here to sort out the topic. Now, if someone says that we are in “crypto summer” (should be in "Bitcoin-summer", actually), it may mean that we are above the previous ATH on BTC chart, the price goes exponentially up very fast (almost vertically) and... the party may be over soon. It is wise to start unloading your stuff into fiat or stablecoins before the masses start blocking the exit. Simply your sales orders may not go through the panicking crowd (there could be much more sales then buy orders, that is no one would like to buy at current price). “Crypto autumn” may mean that the party is already over and now it's time to short your positions. The price is constantly falling like a ball from the hill, sometimes bouncing off the slope. In “crypto winter” it's time to go shopping because the price already found its rock bottom and now goes mostly sideways as not many sellers left. “Crypto spring” is characterized by stable growth between winter line and summer line. It's a time when you can buy Bitcoin and don't have to worry to much about the price drop because even if it happens, it will go up at the end.

Another important Bitcoin feature every crypto investor should take into consideration is that December and January are the most important months in Bitcoin life. It may be a situation (but not always), when in these months Bitcoin summer ends and autumn begins or, in other words, the highest or the lowest local price point is achieved.

Everything written here can be summarize on the picture that “knows it all” (Pic.7). Notice the black vertical markers with dates showing the borders between Dark Age, Stabilization Age and Moon Age.

Pic.7 Bitcoin ages, seasons, main levels and Moon Channel

At the end here is my final thought for Bitcoin long-term investors (not short-term traders). If you want to be a prominent crypto farmer, you need to remember about one crucial thing: In the crypto world you sow Bitcoin during its crypto winter and harvest during its crypto summer. If you do it opposite, you will be starving.

I also wanted to point at one thing, too. You may have noticed that on pictures I was using BLX index instead of BTC/USD quotation. It is a BraveNewCoin Liquid Index for Bitcoin run by www.tradingview.com. I chose it to show the Bitcoin price from its earliest stages, which is not possible at current exchanges because they didn't exist those days. But there is one disparity that is worth knowing. If you compare the BLX price with the price of BTC on Bitstamp, one of the oldest exchange, you will see that the position of the price line in relation to Hell Line is a bit different. The BTC price dived here only a little bit below the red line on 06th of February 2019 and then surfaced above it 3 days later (Pic.8).

Pic.8 Bitcoin price and Hell Line intersection on Bitstamp

It looks like the hell gates opened for “Bitstampers” only for a very short period of time to suck in last condemned souls of all selling nonbelievers and then were closed forever or at least until the next winter. The Bitstamp Hell Line above looks more credible as a support compared to the line from BLX chart below (Pic.9).

Pic.9 BLX and Hell Line intersection on www.tradingview.com

Conclusion

Have you guessed yet, where can you find the best user manual for Bitcoin? You had it in front of your own eyes for all the time! Yes, it has been drawn on the price chart by the market itself. The chart and the ability of reading it properly is the key to efficient Bitcoin investing and trading. And now you know how to do it.

I am aware there are more interesting things to be discovered in BTC chart but it goes beyond the scope of this article. That's why I just focused on the price actions and didn't go deeply into explaining what was the reason of some specific behaviors.

We will see in 2, maybe 5 years how the Moon Channel worked out, or was the Hell Line strong enough to maintain the weight of the whole price above. Of course everything may change but then every good investor adjusts his or her strategy to variable market situation. No one is infallible and the most important thing is not to be always right (what is impossible) but to quickly adapt a new strategy to changed conditions. So don't treat this article like an oracle. Be smart and adapt.

Next chapter:

<< Bitcoin seasons

| Home

NAFA, DYOR, FYI.

Everything in this article is not a financial advice (NAFA) and is just my opinion given only for your information (FYI). I am not a financial advisor. Always do your own research (DYOR) before making any transaction.

Congratulations @coingilla! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Hello @coingilla! This is a friendly reminder that you can download Partiko today and start earning Steem easier than ever before!

Partiko is a fast and beautiful mobile app for Steem. You can login using your Steem account, browse, post, comment and upvote easily on your phone!

You can even earn up to 3,000 Partiko Points per day, and easily convert them into Steem token!

Download Partiko now using the link below to receive 1000 Points as bonus right away!

https://partiko.app/referral/partiko

Congratulations @coingilla! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!