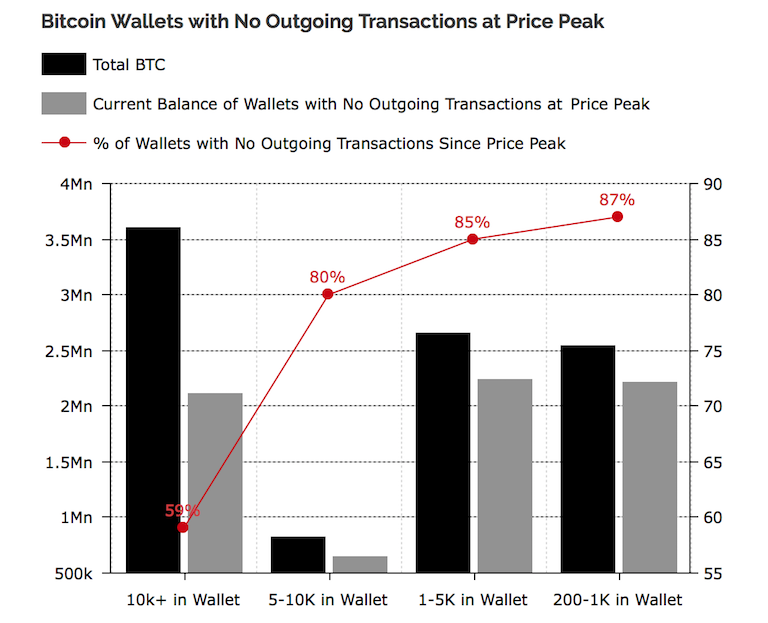

According to the journal Diar on September 17, there are more than 55% of the bitcoin in circulation is stored in wallets. In the past 11 months, the value of bitcoin in these wallets has exceeded $1 million (as the Bitcoin price reached up remarkably $5,000). Impressively, one-third of the bitcoins in these wallets have never been traded. This possibly means that either the owner has lost the wallet key, or hodlers believes Bitcoin’s future use (although the bitcoin market underwent bear in 2018, long-term investors are confident in Bitcoin).

The figure from Diar shows more than 87% of Bitcoins are stored in wallets with least 10 bitcoins (more than $60,000 based on the bitcoin history value) of each — the total value is slightly less than the $100 billion of the total market cap. However, these wallet addresses only accounted for 0.7% of all bitcoin addresses.

Meanwhile, wallets with the balance (at least) 100 bitcoins ($640,000) is less than 0.1% of total Bitcoin addresses, whereas they account for 62% of total Bitcoin circulation.

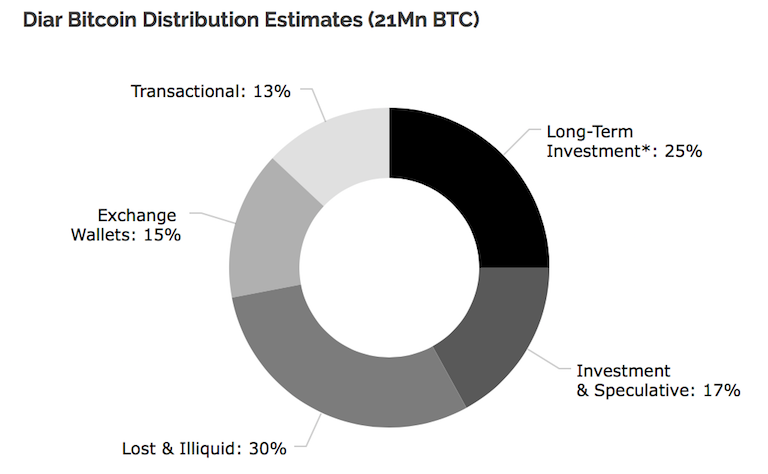

Briefly, the person who has the most bitcoins is not the wealthiest investor but exchanges who hold most bitcoin on behalf of the customers. In fact, the wallets owned and managed by the five major exchanges currently have 3.8% of the total bitcoin supply stored, valued approximately at $4.2 billion.

When Bitcoin price reached highest peak on December 2017, 42% of Bitcoins have never been transferred from the wallets what are with at least 200 Bitcoins in balance. Since then, the bitcoins contained in approximately 27% of wallets has continued to increase. (The effect was also led to the Ethereum market — The adoption rate of Ethereum has noticeably increased in the past a few months. The secondary reason to store ETHs is that the Ethereum community has deployed numbers of dApps specified in games, gambling and high-risk funding what actually attract a lot attentions, though the ETH price falls rapid in recent).

However, an analysis conducted earlier this year by the firm Chainalysis showed that between December 2017 and April 2018, the total selling of Bitcoin was as high as $30 billion. The report also mentioned nearly one-third of the bitcoin supply was concentrated in the hands of 1,600 people, as early as April this year. However, for long-term investors, this is a good thing. Chainanalyze indicates that up to 30% of the bitcoin supply is in status of loss or untapped. And a recent analysis by Diar is also consistent with Chainanalyze’s estimating.

All data used for price & market analysis collected from citicoins.com

DISCLAIMER: this work is a duplication since licensed under CC-BY-SA 3.0. (https://medium.com/@scryptoxic/tons-of-bitcoins-are-stuck-in-wallets-5aaa172a4d45)