The price fluctuations of Ethereum in the past year have found that the price trend of Ethereum is significantly positively correlated with the activity on the chain. Most of the time, it follows Metcalfe's law (the network value is squared by the number of users). The speed is growing, but this has changed recently.

For example, in April, the Ethereum price was around $400-500, the price has fallen to around $200 at this moment. However, the Ethereum network’s daily trading volume has decreased slightly in contrast to the price, this number has been stable at around 600,000 transactions, and basically no less than 500,000.

In other words, although the price of Ethereum has been falling for several months, the use of the Ethereum network has remained stable. (except for the abnormal situation of short-term network peak congestion in July, check the Ethereum price history, the falling started since the Ethereum network experienced the congestion on July).

Another indicator that shows situation Ethereum has at this moment is the DAA (daily active address). Despite on the slight decline in recent, the number of DAA remained stable mostly between 300,000 and 400,000, whereas the price trended to completely different direction.

(As the Ethereum market trend figure shows, the Ethereum price curve was always higher than the DAA before mid-July. After the time, the number of DAA has been significantly higher than the price curve)

Logically, the high correlation between price and activity is easier to understand as when more people use Ethereum, the more demand for Ethereum.

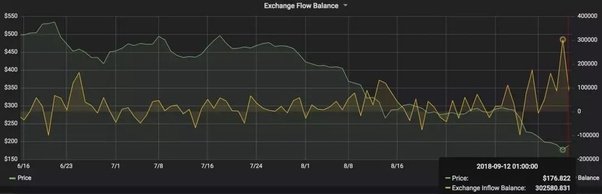

However, market sentiment has changed a bit recently. The net inflow data of various transactions over the time. Since September 6, the number of Ethereum coins inflows to exchanges has exceeded 93,000. September 8 was the only negative net inflow(to exchange) volume which was only 6,400 more outflows than the inflow. (Unlike Ethereum, Bitcoin price is much less likely affected by market sentiment eventually it dominates and leads over rest of cryptocurrencies)

And this phenomenon may also coincide with the reason why the Ethereum price falls during this time - there are more Ethereums flowing into exchanges rather than wallets or other addresses, but the amount of outflow is little indicating that Ethereum undergoes the pressure of abandoning.

This explains that Ethereum's price volatility is not positively correlated with its network activity during this time. An abnormal, excessive bearish sentiment puts the entire Ethereum community undergoing a highly pressured state. It may also indicate that the current bearishness is irrational, as Ethereum has fallen by 90% from the highest peak over time. Perhaps this is a good moment to buy in Ethereum.

All data for market analysis was obtained from Citicoins.com