Crypto Is Melting Down

The world is falling apart! The end is near! Yikes!!!

Why not capitalize on all the excitement of this great crypto crash of May 2018 I say, this is what news companies say “if it bleeds it leads!” Meaning if it is death and destruction then it will get views.

As we head into the Blockchain week and Consensus Conference in NYC mid May, everyone is calling for $15k or $25k bitcoin, it’s an easy call. It happened last year that everything rallied like mad around Consensus, so why wouldn’t it do the same this year? Maybe it will, maybe it won’t, but that’s not a way I like to trade. Instead I prefer to stick with a quantifiable strategy that I can measure, anticipate and predict but more importantly that I can replicate.

About half of my predictive systems are still safely in Long territory, and have been for a number of weeks, sitting on some pretty nice profits and giving us breathing room to withstand these dramatic sell offs...after dramatic rises. Understand that for short sellers this past few weeks have been painfully dramatic as well.

This week surprisingly brought in a number of short signals in crypto, XMRUSD, LTCUSD, ETHUSD and ETPUSD all went short this week. With thoughts of last years Consensus obviously still in the back of everyones mind, I was surprised to see such moves by these names. But like any long/short trader you don't argue, you just take the damn trade.

The Gap

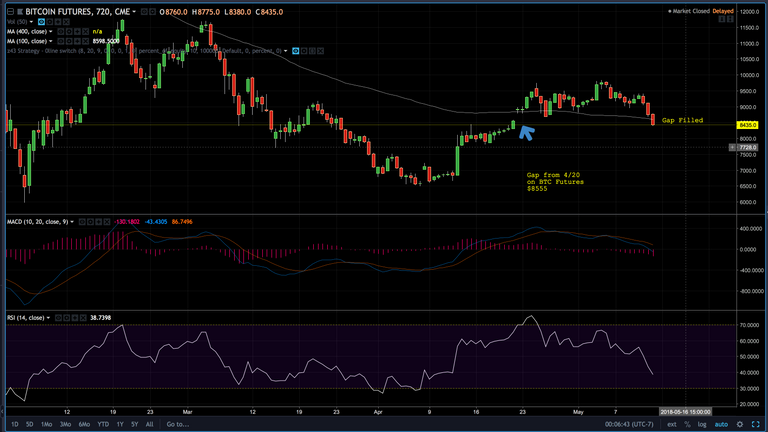

Since the introduction of Bitcoin Futures on the CME, BTC has been taking its cues from the futures market. This is a surprising development but to the day that CME launched their product btc has had (perhaps still having) a major distribution cycle. This to me means that we need to pay very close attention to the gap on BTC_F (bitcoin futures) at $8555.

Gaps are something new to crypto currencies as they trade 24/7/365 unlike the more traditional markets like currencies and equities. When gaps are made in equities, they become a magnet for prices to revert back to. The longer prices move away from these gap prices the more painful the eventual move back to the gap.

Today, in the Europe session, that is to say while everyone in the United States and Asia were asleep, crypto started to move down aggressively and quickly, within in striking distance of that $8555 gap price on the futures.

Breaking the Channel Trend

Additionally BTC has been moving up and down in a sideways trending channel, once the bottom of that channel was pierced it was as if all stops were ran. This channel also just happened to be sitting at this round number level of $9000. These round numbers tend to be places where people like to place stop losses at. After all the mantra on the interwebs is to tell everyone to “do their own research” and “always place your stops”. Now, what is interesting there is that less is put out there about stop losses than on the actual trade signal itself.

That is more importance is placed on the price of entry vs how to managed the trade after the trade has been put on. So rather than look critically at where prices are most likely to have the most stop losses and take that into consideration people just casually place a stop at 9k and wonder why they get taken out of trades, or why the markets dump so aggressively while they were asleep.

I wonder if anyone will be waking up this morning to see their stops hit, exited trades only to find themselves back to where they were shortly there after. Time will tell.

Bearish Divergence on MACD and RSI

For the past two weeks we’ve been putting in these slightly higher highs on BTC at the same time lower sloping lows on the MACD and RSI’s, otherwise known as a bearish divergence. MACD and RSI are very VERY good indicators that something isn’t quite right when you have a bearish divergence and at the other end, bullish divergences. They aren’t 100%, nothing is, but they do tend to be a good heads up that something interesting is about to happen.

As we move into the US trading hours, we are watching to see how BTC_F futures trade at the gap. Coincidentally we are heading into a weekend and the CME Futures stop trading Friday afternoon and don’t re-open again until Sunday. This leaves a lot of opportunity for another gap to be put in which we’ll have to deal with again.

A possible scenario is that we get a drop to 8550, fill the gap during US trading hours and then just sit idly by while Alt’s mount a massive rally off their lows and pump into Consensus while BTC lags behind a bit waiting for Futures to open on Sunday before BTC gets any funny ideas about rallying without the futures markets.

How I’m playing it

All crypto markets have moved into bullish yet cautious territory. Some have tactical short signals (potentially leading another leg down?). We are lightening some of our long in percentage of holding and short positions need to continue to prove their worth before we increase short position sizes, as such we are long 50% of our total long position size and shorts are 25% of 1/4 position size.

Longs

BTC - We are still 75% long from the April lows with all strategies sitting in long position until further notice.

EOS - Lightened to 25% position when we broke below $16 support

IOT- lightened 20 25% position after we failed to put in a higher high, potential failure to put in a bearish breakout and that will get us a lower entry price long.

Shorts

XMR - Short

ETH - Short

LTC - Short

ETP - Short

This analysis is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. The research utilizes data and information from public, private and internal sources, including data from actual trades. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. The views expressed herein are solely those of the author as of the date of this report and are subject to change without notice. The author may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed.

A bit about me and my trading Journey

How I became a professional trader

https://steemit.com/introduceyourself/@chris-d/how-i-became-a-professional-trader

Trading during 9/11 attacks

https://steemit.com/crypto/@chris-d/short-selling-when-the-world-is-falling-apart

A Day in the life of a professional trader

https://steemit.com/cryptocurrency/@chris-d/the-day-in-the-life-of-a-professional-trader