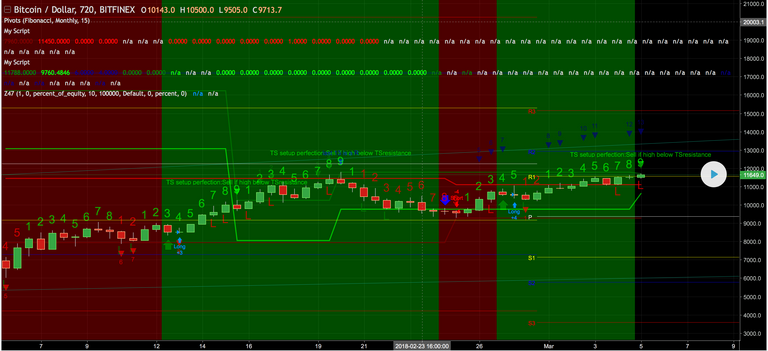

The 12 hour chart on BTCUSD 0.68% is showing a 9 count with reversal today as these factors come into play:

-Just closed above overhead trend line resistance yesterday

-The Twitter Famous (fwiw) "Inverted Head and Shoulders" pattern has played out signaling moves to the 17k levels

-Bullish territory above the pivot , thought admittedly this is a weak bullish indicator

-Bottoming price action on high volume from the 6k lows

-All 5 of my algo's have BTC 0.68% in a long

-BTC 0.68% stayed above the 200 day moving average

-BTC 0.68% closed above the 50 day moving average last week

This is where moves get exciting, we hit these inflection points and more people come out of the woodwork to either take profits or make buys, the volume increases, and people get hurt...or wealthy!

Currently 50% of full long exposure.

Next levels that I'm looking for is a close above the midpoint of R1 and R2 at about the $12,200 levels. From here I'd look to buy the first pullback and up my BTC 0.68% long exposure.

If that happens, it would signal a bullish breakout and open the door to confirming the bullish breakout by holding above the 12,900 level for over 6 hours. Again from here I'd look to buy the first pullback and that would again increase my BTC 0.68% long exposure.

Finally from there the 17k level would be in sight.

I'm coming at this from a traders perspective, more of a swing trader than day trader. Moves to 23/26k, 50k, 64k, 100k are on the table but they aren't near enough to be within the analysis...and to be fair a sub $2,000 price is also on the table in some of the analysis.