It's down to the hawala system.

Hat-tip to redditors for figuring it out. The long and short of it is that India operates capital controls, so you can send bitcoin to an address owned by an Indian exchange, and sell the coins for rupees, at a price of 68,000 rupees (roughly $1000), but you can't get that money back out to the western exchanges to rebuy your bitcoin at $735 and profit.

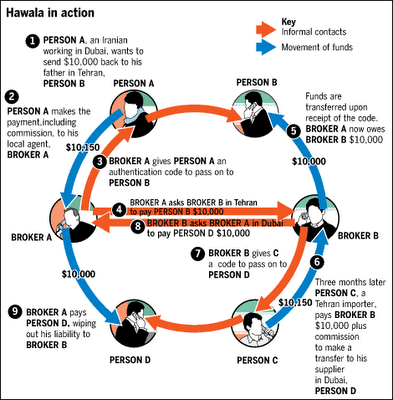

Because of the capital controls, the only way to move money in India is the hawala system where you give money to a hawala agent, shake hands on it (nothing written down for safety) and the money materialises in a bank account in London or New York (or is delivered by hand in pounds or dollars in those places). The normal hawala fee is about 15-20%, but since India's draconian withdrawal of 85% of notes in circulation, the fees are now 30% - 40%.

The new rules in India allow you to deposit your old obsolete notes at a bank and get new notes which are legal tender. But those who deposit more than 250,000 rupees are alerted to the tax authorities who check whether tax has been paid on the money. Needless to say, the wealthy and middle classes are only depositing small amounts and resorting to unorthodox methods to get their old notes either exchanged for new, or out of the country without alerting the tax authorities.

$730 * 140% = $1022. Which is the bitcoin price on Indian exchanges, and indicates that the hawala people are now using bitcoin to move money and the bitcoin price on Indian exchanges includes the hawala fee. How long have they been using bitcoin? No-one knows, but it is an interesting development.

What a great finding for so many... Thanks for sharing and solving the so-called mystery. Namaste :)

40% is a massive premium! Though I suppose if the rupee sinks further against the dollar, those who have exchanged will be in profit as their money won't have devalued further.

Great piece and thanks for sharing. Upvoted and shared on Twitter✔ for my followers to read. Now following and looking forward to reading more of your blogs. Cheers. Stephen

great analysis. after reading your post I got my answer. upvoted :D

Very logical analysis. Dont think any revenue authorities have thought of this angle while catching the culprits in demonetization

Good points in this article. Good to see I'm not the only one that is thinking about this. The cryptospace definitely feels a bit inflated. However we also said that about the S&P 500 40 years ago Besides coinmarketcap.com there is: https://www.coincheckup.com They give great insights in the team, the product, advisors, community, the business and the business model and other techincal insights. Check: https://www.coincheckup.com/coins/Bitcoin#analysis For a complete Bitcoin Investment and research analysis.

friends this telegram pump group is very successful. I would recommend https://t.me/rocketpumptrader

The same thing has been happening with Gold. Arbitrages generally only exist because the market can't exploit it.