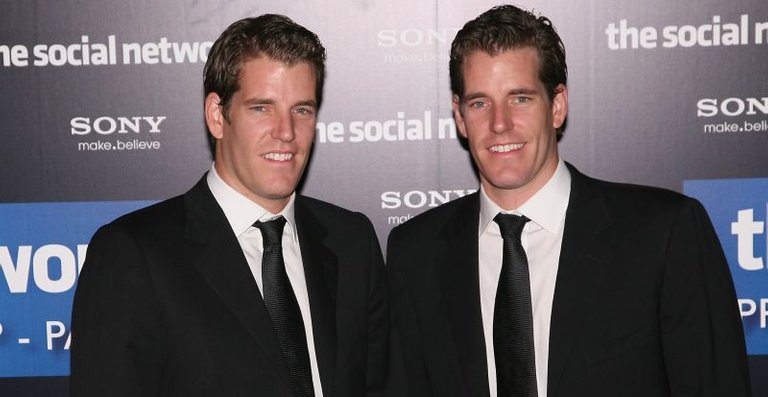

A Simple All You Need To Know Guide About The Winklevoss COIN ETF

I see many people are interested, but unfamiliar with rules surrounding the Winklevoss Coin, bitcoin ETF so I wanted to clear up some confusion people might have by breaking down the ETF, how it will end up being approved or denied and the steps needed to actually make it become tradable on the stock market. However, before we start, what is an ETF and what are the benefits of a bitcoin ETF? An ETF stands for an exchange traded fund which the exact definition according to investopedia.com is

a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange

This means that anyone can buy and trade an ETF without having to have thousands of dollars like you would need to participate in a mutual fund, the costs are usually lower than in a mutual fund and the market you are speculating on is usually more defined.

For bitcoin, the benefit comes with the ability to institutional investors who have large amounts of money and capital, who want to invest in bitcoin, but don’t want to deal with the technical hassle of storing coins on their own, the opportunity to speculate on bitcoin. This is something that not only large institutional investors want, but common people as well who want to buy bitcoin but not worry about storing it or losing it. The Winklevoss COIN ETF would also allow people to exchange their bitcoin into shares or remove them as well, but in baskets of 1000 which is 640k at the moment, so an option that is not available unless you have that much. This would be considered much more mainstream speculation than what is currently going on in the bitcoin market, which is why many think it will raise the price substantially.

So why is the COIN ETF taking so long to be approved?

The coin ETF has been seeking approval for a little over 3 years at this point in time. While originally applying to be listed for the NASDAQ exchange, they moved over to the BATS exchange because of a rule that says the BATS exchange only has a limited amount of time before they are forced to make a final decision on an application.

For the BATS exchange the rule says that after the application there can be two 45 day delays another 60 day delay, then a final 90 day delay but after that, there would need to be a decision made. We were just delayed the second time for 45 days, so in 45 days they will either have to delay it 60 days or make a decision.

Why does the ETF keep getting extended?

The first gold ETF took over 2 years to get approved because the bureaucracy of the SEC is very hesitant to allow new financial products because of consumer protection laws. When it comes to bitcoin and crypto currencies in general, the SEC is pretty unaware of the space and the concept is still alien to many of them. Something to note is the SEC cant actually stop someone from continually applying for an ETF, even after they disapprove it, they can really only give insight on why they are not allowing it. Which would mean that if the COIN ETF was “rejected” the Winklevoss twins could always make revisions and start the application process again.

The biggest criticism of bitcoin by the ETF is clear in the most recent announcement where they extended the period by another 45 days to allow people in various industries to comment on the comments that were made by various people about the ETF. The Sec raised concerns about bitcoin that likened it to a Ponzi scheme or penny stock speculation with no base inherent value. There is also the concern that the Winklevoss twins do not have insurance on the underlying assets within the ETF and despite having a revolutionary cold storage method, it does not seem like enough to persuade the SEC otherwise. There is going to be a 21 day comment period and then another period of review of the comments and although they didn’t specifically give a date of when they are going to address more concerns, extend the date again or make their decision, it should be around the 45 day mark. IMO The Winklevoss twins need to search for insurers who would be willing the insure the underlying assets in either USD or even better, bitcoin at this point to ease any concerns. Note there is another bitcoin etf looking for approval that does have insurance in bitcoin.

What would happen if BATS approved COIN?

If bats approved the COIN ETF, it would mean that they would be able to issue the shares and create all the backend stuff needed for the ETF, but it would not make it tradable. This is debated, but according to several people, the SEC would still need to directly allow the trading of the ETF, but if the exchange is going to let them list it there, there is most likely going to be little push back from the SEC. Hypothetically it could trade in a few weeks after BATS accepts it, but more likely it would be a few months.

So right now we are waiting for the comment period on the 5 comments made in the last few months to start. I fully expect that many anti bitcoin and pro bitcoin people will be fighting it out on the comments, which should be interesting. After that comment period though, there is just going to be more waiting. If the Winklevoss COIN ETF is denied, I don’t know if they will continue to try and have an ETF, heavily change the details of their ETF or seek out insurance. Only time will tell.

If you have any other questions about the ETF leave them below and I will do my best to answer them.

-Calaber24p

Is bitcoin honestly that volatile? I guess I'm too used to smaller, more illiquid crypto's and I consider bitcoin quite stable. Sure, it has its swings, but that's true for any stock when there's negative news.

Are there any notable parties who are adamantly against the ETF?

It can easily become volatile if more coins entered the market, such a small amount of coins can sway the price pretty heavily. There are a few people who are adamantly against the ETF for example this person J Stolfi who is a professor and big anti-bitcoin advocate who thinks its a ponzi, but also thinks gold is a ponzi. I think they are worried about introducing anything new because of potential risks being larger than the rewards.

Crazy, I didn't even know this was happening. What do you think it would do to the price of BTC if the ETF was denied? Seems like that would be a fairly strong blow to it's mainstream legitimacy.

I think it might lower the price a little bit, but ultimately there are other ETFs that are going to try to fill the hole. The more time that bitcoin continues to succeed the chances of a new ETF being approved gets larger.

dosent an etf allow people to basically bet on the price of btc that dont even exist like gold fututres all those paper ounces controling the price of real gold .. wont thaat alloe btc prices to be manipulated parton my ignorance

Thanks for writing this article.

I think that the ETF will get approved it's just a matter of time.

I think an ETF will get approved eventually even if its not the Winklevoss'

I really hope it will get approved, probably it will cause a huge surge in price if BTC is easily available on wallstreet.

Great conversation and a big thank you for the information as well. Namaste :)

nice post. interesting. upvoted

wow interesante

awesome

Thanks for the update. I speculate the decision will get pushed back as far as possible. However, as investors withdraw from Equities next year due to rate hikes and slow growth, the Exchange will want some new action. When a BTC ETF does get approved, it will probably spike then settle in price

Whether it's the Winklevoss or some other bitcoin ETF, it would be great mainstream exposure for crypto currency on a whole. When the masses see its trading on an exchange than it becomes legit and safe in many minds.

Thanks for the info, I've been wondering what the latest news was on the ETF. I really hope this succeeds as it will be a great step toward pushing Bitcoin into the mainstream. I hope the twins don't get discouraged by the lengthy process. It sounds complicated and the SEC is quite conservative, so I'm not at all surprised by the delay.

In the meantime, there is something similar to this moving forward full steam, beyond the SEC's jurisdiction: the ICONOMI.INDEX fund, which will be made up of a basket of the most popular cryptocurrencies. I think it will have a similar effect to the Winklevoss ETF for mainstream adoption, and ICONOMI recently completed a very successful crowdfunding round to raise the seed capital for setting up the fund and infrastructure needed for it. Should be quite exciting when the project launches later this year!

Nice thanks friend

@calaber24p

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.4. Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise.

Built by @ontofractal