"Banks as we know them are dead, Bitcoin and the Blockchain fundamentally kill how current banks operate with fiat money and fractional reserve lending. However, banking itself is not dead it just needs to be re-invented. Btcpop.co has done just that.”

In light of JP Morgan’s CEO Jamie Dimon recent statement that “Bitcoin is a fraud” I think it is important to remind people that banking is a legitimate service that is here to stay. Notice I said banking and not banks, as anyone who understands cryptocurrency knows the current fiat banking system is a pack mule competing against a modern car. But, in fairness it is the fiat system that has destroyed banking of today. If the money was sound banks still provide a needed valuable service to its depositors. That service is still valuable with Bitcoin...it's just completely different.

Free market solutions such as Btcpop.co will eventually fill that need even better than traditional banks today. But what is that need exactly? What value do banks provide?

Understanding Money

Bitcoin has brought the understanding of money, value, and economics out of the shadows and into the limelight. People, now more than ever in the history of the world understand what money is and how it works. This is great news, as the more someone knows about money the better they are able to take control of their own finances. This is not to say that everyone will dig in and deeply research bitcoin and money and establish a fundamental understanding of money and economics like myself, but they will at least think about it. And it really isn’t that complex to understand that money is the medium of exchange between value and has certain qualities of money.

I usually share in simple terms that money possess the following qualities:

- General Acceptability: People accept it as payment

- Portability: It can be moved

- Indestructibility or Durability: It last over time and isn’t easily destroyed

- Homogeneity: One unit is the same as another unit.

- Divisibility: It can be divided into small units of account for accurate pricing.

- Cognizability: It can be understood as a money

- Stability of Value: It stores value over time

I have shared Bitcoin with dozens of people and the thing I always start with is explaining what money actually is. And how fiat money is not good money. I genuinely don’t believe people are foolish or negligent of their understanding of money, but not that many people understand it. Literally 80% or more of the people I have talked to think that the USD is backed by something. And 100% of them think they can go to their bank and get their physical money anytime they want. And if you know anything about fiat money, you understand its baseless currency at the whim of those in power (and essentially a ponzi scheme).

The list of things that modern finance truths that have been masked from the general public is hideously long. And I won’t attempt to share how bad the system is in this writing. But the truth is that when the general public doesn’t understand even its own money, it's easy to hide some pretty nasty actions behind fancy words and rose tinted keynesian economics. With Bitcoin this is not possible. Everything is out in the open, and a couple quick youtube videos give a Bitcoin user a better understanding of money and economics than previous generations ever acquired.

Bitcoin will kill fiat and traditional Banking

So my argument is that with just a tiny bit of understanding, fiat and traditional banking is doomed.

I can go into detail on this but it really isn’t the point I am trying to make. Bitcoin and/or cryptocurrencies in general will beat the current system simply because they are better.

Bitcoin is a better money, and once digital, online banking with a superior currency becomes better than current banking very fast. Feel free to argue any point you want defending fiat or defaming cryptocurrency. At the end of the day the market decides, and even though people and markets are not always rational in the short term, the free market is always right and always picks the best service.

What is the Banking Service?

This can be an ambiguous question, but in simplified form a bank provides the following services:

Bank

- Holds and lends out deposits to make loans and generate interest

- Provide High Security at a Low Cost

- Make Money Digital and Easier to use

- Provides Credit to Borrowers

- Interest Bearing Savings Accounts

Right on cue way back in 2011 the free market started working to create this service for the brand new Bitcoin economy. Through adapting the P2P model, innovative thinking, and of course trial and error the market has come up with a usable solution. As a fast follower to the first movers in P2P lending Btcjam and Bitcoinledingclub, Btcpop has battled through the hard lessons and emerged as a viable service that meets all a Bitcoin user’s banking needs.

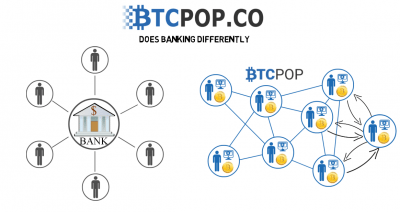

P2P Banking

With any understanding of Bitcoin, one can very quickly figure out that a centralized banking model is non starter. P2P free money doesn’t just wander aimlessly into a centralized bankers vaults for him to decide what to do. The main reasons people deposit money in the banks are for security and digital money (2 things Bitcoin is the best at). So a Bitcoin user is simply not going to give up control of their Bitcoin, because what incentive do they have to?

P2P Banking solves this problem. Users still have to deposit into the platform, but once there they are free to invest, hold, speculate, or do whatever they want with their money at any time. And that is the important part, users remain in control of their funds following the decentralized model.

How Btcpop fulfills Banking Service in P2P fashion:

Holds deposits and lends out money to generate interest

This is arguable the most important, profitable, and difficult things banks do. Making the decision on how much credit should be granted to someone and at what interest rate is no easy task. In normal banks, professional bankers take on this tasks and a vast amount of historical data is there to assist them in accurately determining credit. Bankers are then rewarded for providing a good service in the form of profit from interest.

At Btcpop this profitable, yet difficult task is accomplished with the best tool in the world for solving difficult complex problems…...THE FREE MARKET. Btcpop as a P2P lending platform provides tools for borrowers to create loan offers that other users will invest in and fund to capture that profit (Btcpop only receives platform fees not interest). Borrowers make their loan more appealing by verifying, building reputation, increasing interest APR, and even adding digital collateral in the form of Altcoins or P2P Shares. Then the market (other P2P lenders) will determine if the loan is a good risk or not by funding the loan. Many investors can invest a little, 1 investor can invest the whole amount, the free loan market decides.

Provide Security

Many depositors in traditional banks only deposit their funds for the security and actually receive little to no interest on their holdings. This is a viable service with fiat money as it is not efficient for everyone to have a large vault and security system in their homes. So banks can install good security and serve many people a high level of security at just a fraction of the price.

While it may not seem like it, Bitcoin is applicable to this model. See Bitcoin as a protocol provides the tools for Bitcoin to be stored more securely than any asset ever has before. BUT, and this is a big BUT for a reason, Bitcoin’s security is only as good as the security of the user. Handling private keys and keeping them secure takes some know how and not everyone wants to learn this. Also keeping your Bitcoin really safe usually makes it harder to easily use. So Btcpop provides the service of very high security and easy usability leveraging the expertise of Btcpop’s owner who is an expert user of Bitcoin. All the user needs to know how to do is keep a secure password and 2fa and they effectively tap into this security with no extra learning about offline cold storage or private key management. Btcpop's owner personally oversees any large or strange withdrawals to help protect user funds.

Btcpop is also very transparent about the whole platform and how it works. Here is a link to one of Btcpop's transparent cold storage wallets

Act as Payment Agents

Traditional banks digitize your money and make it easier to use. This isn’t needed with digital currency such as Bitcoin because it is already digital and highly usable. As mentioned before Btcpop just makes this process more secure and easy to use for the average Bitcoin user.

Provide Lines of Credit

This is in fact just another form of loan that banks pre-offer users. But, lines of credit are very valuable as its not efficient to go apply for a new loan every time you need to borrow a little money. So banks offer credit to borrowers in the form of credit cards, or overdraft protection/line of credit they can withdraw at anytime they want.

Btcpop offers as similar service in the form of instant loans to verified borrowers. The loan has set terms, and the line of credit starts out quite small and at high interest.

However, as your reputation and payment history increases so does your line of credit. Due to the nature of the industry and the low level of initial trust a user gets “Instant Collateral Loans” are the most effective form of instant credit Btcpop offers. Users can simply borrow against their other altcoin or P2P share holdings at a set 5% and a 15% APR Rate.

Interest Bearing Savings Account

Today at most banks you are encouraged to open a savings account to earn interest on your funds. But this risk free interest rate is far lower than inflation and last time I checked it was .1%.

While nothing is ever completely risk-free due to platform risk. Btcpop also offers customers risk free interest bearing wallets. These accounts can be withdrawn anytime, and they receive interest on profits from btcpop’s instant loans (or lines of credit above). The Instants Pool return rate varies depending on deposits and loans, but it has historically returned anywhere from 4%-15% risk free returns on deposits.

Btcpop goes on to provide Financial Services above and Beyond

So as impressive as Btcpop’s free market P2P banking solutions are it doesn’t stop there. Btcpop offers P2P Shares, P2P Bonds, an Altcoin Exchange, and eventually more related services.

One may wonder what the regulatory status of these P2P services is. Btcpop is very predictable and will always remain firm in its commitment to the free market. As a result the platform is based in the Marshall Islands and is regulated by the free market instead of some psychopaths who make laws and force people to do things at the point of a gun. But at the same time Btcpop makes efforts to ensure there are not malicious actors or actions happening within the platform.

Btcpop has been growing at a strong steady rate and continues to improve its services in a safe and secure matter. So if you want to be an early innovator and ahead of the crowd head on over to Btcpop.co today and begin banking with Bitcoin!

I second that! Been on btcpop for a year now I love it. Happy to see btcpop on steemit.

Yep! Definitely worth a follow, people. :)

Btcpop rocks.

We hope this :D

Proud user of Btcpop.co!

Fiat money is made up money. Its the cause or one of the causes of so many economic troubles around the world. Fiat money are made by the governments with the blessing of the banks. Bitcoins are a direct treat to them. Lets hope they dont outlaw it.

Bitcoin and other alt coins will provide another option for online transactions.

Hi! I represent the official ICO bounty program https://crypto.tickets.

We really like your activity on Steemit and I want to invite you to our automated Steemit bounty program.

You can get Stakes easily for every repost or post.

About project: https://steemit.com/@crypto.tickets /@crypto.tickets

Official bounty page https://crypto.tickets/bounty.program.en.html and bounty thread – https://bitcointalk.org/index.php?topic=2164768.0

Please, let me now about your decision in return message 😉