What is Liquidation?

Trading cryptocurrency Derivatives with high Leverage can be very profitable. On BTCMEX you can trade BTC/USD Perpetual Contracts with up to 100x Leverage. It allows traders to open positions and place orders that are significantly larger than their Initial Margin. Learn more about Bitcoin Perpetual Contract on BTCMEX.com.

But what happens if the trader experiences loss? When the trader loses nearly all of his Initial Margin (the percentage of the open position value held by the trader at the beginning) his position is automatically closed. This process is called Liquidation. The trader whose position is liquidated loses his entire Margin.

Liquidation: explained by BTCMEX

Liquidation is an automatic closing of the position due to a significant Margin loss.

For Long positions, the Liquidation Price is always lower than the Entry Price, for Short positions, the Liquidation Price is always higher than the position’s Entry Price.

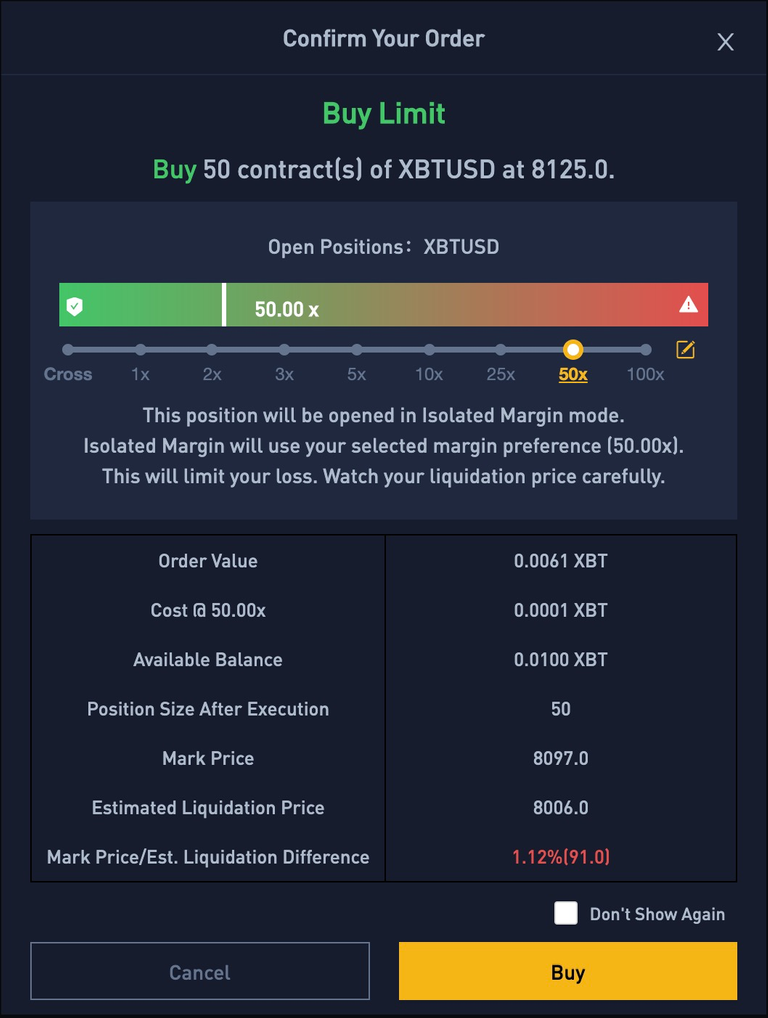

Liquidation of a Long position: Example

For example, if a trader opens a Long position buying 50 BTC/USD contracts with 50x Leverage, and the Entry Price of the position is USD 8,125, the estimated Liquidation Price is USD 8,006. Once the Mark Price touches UDS 8,006, this position will be automatically Liquidated and closed by the Last Traded Price.

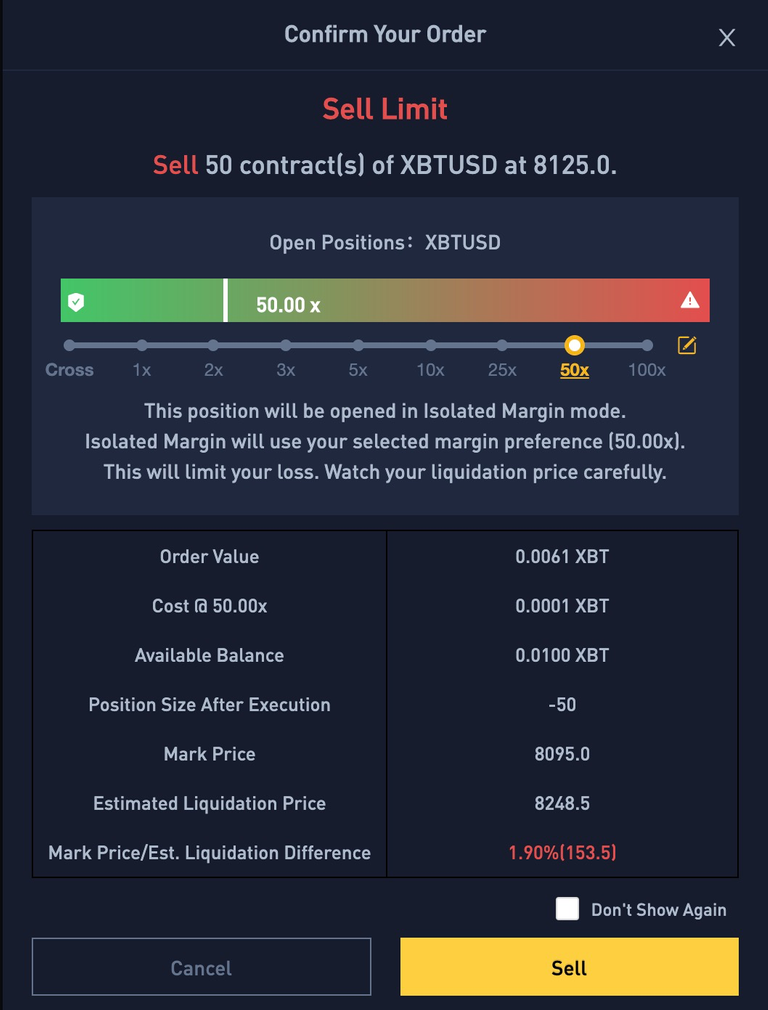

Liquidation of a Short position: Example

If a trader opens a Short position buying 50 BTC/USD contracts with 50x Leverage, and the Entry Price of the position is USD 8,125, the estimated Liquidation Price is USD 8,248.5. Once the Mark Price touches UDS 8,248.5 this position will be automatically Liquidated and closed by the Last Traded Price.

Maintenance Margin: Explained

In crypto Margin trading, Leverage is an important feature of the Perpetual Contract. On BTCMEX you can trade BTC/USD Perpetual Contracts with up to 100x Leverage. It allows traders to open positions and place orders that are significantly larger than their Initial Margin. Initial Margin is the percentage of the open position value held by a user at the beginning.

For example, if you are buying 100 Perpetual Contracts with 20x Leverage, it means, 5 contracts are your Initial Margin, and 95 are borrowed from the exchange.

Maintenance Margin is a minimum amount of a trader’s money he needs to keep his position open. Used with the Mark Price.

Since users are trading with the exchange’s money, if the price drops (for long positions) or goes up (for short positions) too much, the exchange can potentially lose money. To guard against loss the platform sets a typical margin requirement, which is calculated on the BTC price — Maintenance Margin.

To keep the position open a trader needs to fulfill the maintenance requirement — hold a minimum percentage of the value of the position. When a trader is about to lose all of his Margin, his position is automatically liquidated.

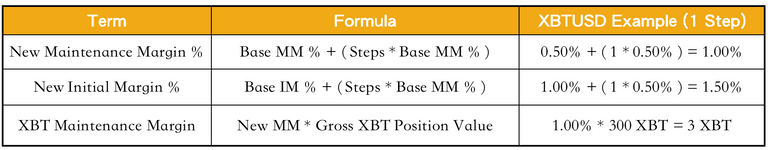

Maintenance Margin on BTCMEX is 0,5% of the position value. BTCMEX Risk Limit policy applies for positions which value is BTC 200 or more. For each BTC 100 in the position size, the Maintenance and Initial Margin requirements are increased by 0.5%.

Risk Limit Calculations

Process of Liquidation on BTCMEX

Liquidation is an automatic closing of a position because the Mark Margin (the Margin you would have based on the Mark Price) reaches the level of the Maintenance Margin. When Liquidation occurs, the trader loses all his Margin. Liquidation is triggered by the Mark Price (average BTC market price), while the liquidated position will be automatically closed at the Last Traded Price (BTC price on the Exchange).

BTCMEX provides Bitcoin Perpetual Contracts trading with high Leverage. The value of your position is your Margin + Exchange Margin. Initial Margin is the percentage of the open position value held by you at the beginning. Maintenance Margin — a safety amount, calculated with the Mark Price, which is set by the exchange for Risk-Management purposes. It is the minimum value of the Margin a trader needs to have not to be liquidated. It’s calculated according to the Mark Price, which serves as a trigger for Liquidation.

The price at which Liquidation occurs always depends on the Leverage chosen, the Initial Margin value, and the Maintenance Margin value. The Liquidation Price will always be at a price better than the Bankruptcy Price, the price at which a trader would have lost all his Initial Margin.

BTCMEX uses a Dual-Price Mechanism, a condition when Liquidation is triggered by an average market price — Mark Price, and not the Last Traded Price of the exchange. Meanwhile, the position will be closed at the Last Traded Price.

What is Dual-Price Mechanism?

Dual-Price Mechanism is a condition when Liquidation is triggered by an average market price and not the Last Traded Price of the exchange. The Dual-Price Mechanism is one of the reasons to trust innovations in crypto trading.

Inflated trading volume and pump-and-dump schemes are the market manipulations that are illegal in traditional finance, but common in crypto industry due to lack of regulations and untraceability. As a result of market manipulations on several famous crypto exchanges, the Last Traded Price (spot price) deviated significantly from the Index Price (market price), which caused many unreasonable Liquidations.

Standing at the forefront of innovations, BTCMEX uses the Dual-Price Mechanism during Liquidation to overcome possible problems and provide a fair and transparent Bitcoin Perpetual Contracts trading environment.

A Dual-Price Mechanism is a measure used by cryptocurrencies exchanges to avoid wrongful Liquidations due to price movements caused by actions of whales — holders of big assets on the exchanges.

The Dual-Price Mechanism kicks in during Liquidation — an automatic closing of the position due to a significant Margin loss. On BTCMEX Liquidation is triggered by the Mark Price, which means the exchange simply doesn’t have the power to manipulate the market! Meanwhile, the liquidated position will be closed at the Last Traded Price.

Dual-Price Mechanism: Explained

The Dual-Price Mechanism on BTCMEX is based on:

Mark Price — the average market price (Index Price) + a decaying Funding Basis.

Last Traded Price — the internal price on the exchange.

The Index Price is derived from the average BTC/USD price index of major exchanges. On BTCMEX it is calculated equally from three exchanges Kraken, Coinbase, and Bitstamp (33.33% each).

Dual-Price Mechanism: Calculation

Mark Price = Index Price x (1 + Funding Basis)

Funding here refers to the periodic interest payments between traders which aim to keep the Last Traded Price on BTCMEX as close to the global Bitcoin price index as possible.

The Last Traded Price is the current Perpetual Contracts’ underlying price on the exchange.

If there’s a price difference between the Bankruptcy Price and the price at which your position is closed during the Liquidation, if the value is positive, it will be added to the Insurance Fund, if the value is negative, it will be taken from the Insurance Fund to cover loss or trigger an ADL — Auto-Deleveraging.

BTCMEX uses the Dual-Price Mechanism to protect the users from market manipulations and avoid the risk of traders’ positions being liquidated due to actions of the heavyweight players who can move the market. At the same time, Funding is used to make sure the Last Traded Price doesn’t deviate significantly from the BTC/USD Index Price.

When trading cryptocurrency Perpetual Contracts, every user needs to be aware of several market features. Every BTCMEX trader should consider the following key components:

- Mark Price: An average market price on major crypto exchanges. The Mark Price determines Unrealised Profit and Loss (PNL) and Liquidation prices.

- Initial and Maintenance Margin: These key Margin levels, that determine how much Leverage one can trade with and at what point Liquidation occurs.

- Funding: Periodic interest payments that are exchanged between the Long and Short positions every 8 hours. If the price rate is positive, then longs will pay and shorts will receive the funding, and in the opposite way if the price rate is negative. Only traders who have open positions at the Funding Timestamp pay or receive Funding.

- Funding Timestamps: UTC 04:00 (Beijing 12:00), UTC 12:00 (Beijing 20:00), and UTC 20:00 (Beijing 04:00).

What is Funding?

The Funding Rate is comprised of two main parts: the Interest Rate and the Premium/Discount. This rate aims to keep the Last Traded Price of the Perpetual Contract in line with the underlying market price of Bitcoin. This way, the contract mimics the margin trade market, as buyers and sellers exchange interest payments periodically.

Every Perpetual Contract traded on BTCMEX consists of Base currency (BTC) and Quote currency (USD). The Interest Rate is calculated as following:

Interest Rate (I) = (Interest Quote Index — Interest Base Index) / Funding Interval, where Interest Base Index = The Interest Rate for borrowing the Base currency;

Interest Quote Index = The Interest Rate for borrowing the Quote currency;

Funding Interval = 3 (Funding occurs every 8 hours).

Perpetual Contract may trade on BTCMEX.com at a significant premium or discount to the Mark Price. In both cases, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading.

Each contract’s Premium Index is calculated as following:

Premium Index (P) = (Max (0, Impact Bid Price — Mark Price) — Max (0, Mark Price — Impact Ask Price)) / Index Price + Fair Basis used in Mark Price

Final Funding Rate Calculation

BTCMEX calculates the Premium Index (P) and Interest Rate (I) every minute and then performs an 8-Hour Time-Weighted-Average-Price (TWAP) over the series of minute rates.

The Funding Rate is next calculated with the 8-Hour Interest Rate Component and the 8-Hour Premium/Discount Component. A +/-0.05% dampener is added.

Funding Rate (F) = Premium Index (P) + clamp (Interest Rate (I) — Premium Index (P), 0.05%, — 0.05%)

Hence, if (I — P) is within +/-0.05% then F = P + (I — P) = I.

In other words, the Funding Rate will equal the Interest Rate.

This calculated Funding Rate is then applied to a trader’s BTC Position Value to determine the Funding Amount to be paid or received at the Funding Timestamp.

Funding Rate Caps

BTCMEX imposes caps on the Funding Rate to ensure the maximum leverage can still be utilized. To do this, two caps are imposed:

The absolute Funding Rate is capped at 75% of the Initial Margin Rate — Maintenance Margin Rate.

If the Initial Margin Rate is 1% and the Maintenance Margin Rate is 0.5%, the maximum Funding Rate will be 75% * (1% — 0.5%) = 0.375%.

The Funding Rate may not change by more than 75% of the Maintenance Margin Rate between Funding Intervals.

Funding Fees

BTCMEX does not charge any fees on Funding. It is a direct peer-to-peer interest payment.

The information about Funding is available in the Contract Details in the left bottom corner on BTCMEX.

How to adjust Liquidation Price on BTCMEX?

There are advanced trading tools to keep your position open and push the Liquidation Price down (for Long positions) or up (for Short positions).

Add/Remove Margin

You can add or remove Margin in the open position settings, but it won’t change the position value. Adding Margin will reduce the Leverage and push away the Liquidation Price. Removing Margin will increase the Leverage and move the Liquidation Price closer to the Mark Price — the trigger for Liquidation.

That is to say, the higher Leverage a trader is using, the higher chance there is for his position to be liquidated.

Isolated Margin VS Cross-Margin

On BTCMEX there is a Cross-Margin — a function to use the entire available Margin to open a position. Selecting Isolated Margin a trader can choose the Initial Margin he would use with which Leverage and the position value.

A trader can select Isolated or Cross-Margin while placing an order.

By default, all positions are initially set to Cross Margin. Users enable the Isolated Margin on the order the control panel at the left side of the Trading Dashboard using the leverage slider. The further to the right you move the slider, the higher the leverage and the less margin is used for the position.

To sum up, in Derivatives trading, Liquidation is a condition when a position is closed automatically once the Mark Price hits the Liquidation Price, and the trader loses his entire Margin. The position is closed at the Last Traded Price, but Liquidation is triggered by the Mark Price — a part of the Dual-Price Mechanism used on BTCMEX, which makes the exchange transparent and fair cryptocurrency derivatives trading platform.

www.btcmex.com

Liquidation: An automatic closing of the position due to a significant Margin loss.

Leverage: A part of the total position value that is borrowed from the exchange.

Margin: A part of the total position value that belongs to the trader.

Maintenance Margin: A minimum amount of a trader’s money he needs to keep his position open. Used with the Mark Price.

Initial Margin: The amount of money a trader uses to open up a position.

Bankruptcy Price: The price at which a trader would have lost all his Initial Margin.

Liquidation Price: The price at which a Mark Margin (based on the Mark Price) level reaches the Maintenance Margin level.

Dual-Price Mechanism: A condition when Liquidation is triggered by an average market price and not the Last Traded Price of the exchange.

Mark Price: The average market price (Index Price) + a decaying Funding Basis.

Last Traded Price: The price index of a cryptocurrency on the exchange.

Index Price: The average price index of a cryptocurrency on major exchanges.

Funding: The periodic interest payments between traders which aim to keep the Last Traded Price as close to the Index Price as possible.

Congratulations @btcmex! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!