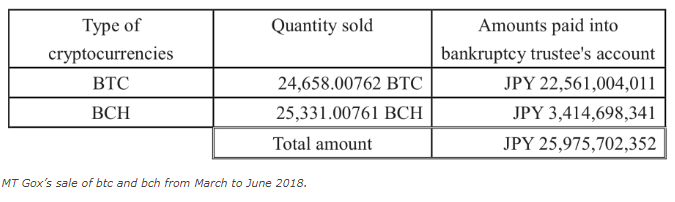

Nobuaki Kobayashi, the trustee of the long defunct Mt Gox exchange, revealed today that $250 million worth of bitcoin and bitcoin cash was sold between March and June.

That’s in addition to half a billion dollars worth of bitcoin and bitcoin cash sold up to March 2018 which seemingly affected bitcoin’s price. Kobayashi said:

“As a measure to secure interests expected to have already been obtained by all bankruptcy creditors who filed proofs of bankruptcy claims in the Bankruptcy Proceedings, the bankruptcy trustee sold a certain amount of bitcoin and bitcoin cash that belonged to the bankruptcy estate, during the period from the 10th creditors’ meeting in the Bankruptcy Proceedings (i.e., from March 7, 2018) to the commencement of Civil Rehabilitation Proceedings, and secured a certain amount of money for the bankruptcy estate.”

It appears the first sale of cryptos was to secure the fiat equivalent of creditors claims for their holdings of both cryptos and fiat money which amounted to a total of half a billion at a set price of $400 per btc.

This latest sale appears to be to secure the fiat equivalent for any disputed court claim, with Mt Gox mired in a number of legal cases that arose prior to the bankruptcy and since.

The remaining circa 140,000 btc and bch will now be distributed to creditors through civil rehabilitation proceedings, which means they will receive cryptos in cryptos, rather than in their fiat equivalent.

Ciivil rehabilitation claims are on-going with a deadline of October 22nd. Afterwards, it may be that early next year the cryptos are distributed to creditors.

That would mean some five years since MT Gox declared bankruptcy, the case may finally be closed, with the once biggest crypto exchange so closing a now old bitcoin chapter, although some are suggesting Mt Gox may be reinstated.