Poloniex is a popular exchange where a lot of altcoins are traded.

https://poloniex.com/lending#BTC

There is usually a fair bit of demand from margin traders for Bitcoin.

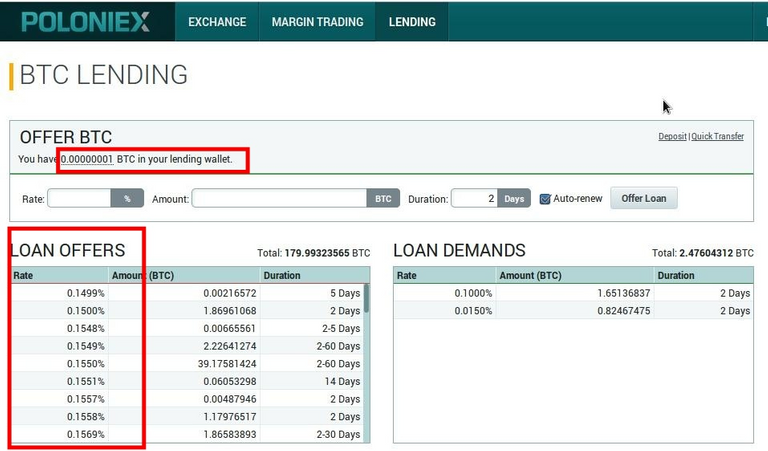

Through the lending tab pictured below:

Source: https://bestbitcoinexchange.co/btc-lending/

You can lend out your Bitcoin to traders who are trading on margin.

The traders offer interest rates and the lenders offer lending rates. If and when they agree on a rate, loans become active.

As a lender you control a limited number of things and your results will be better if you think about them and do them the right way. Here are my 5 best tips:

1. Don't lend out at rock bottom rates

Don't lend out your Bitcoin at rock bottom rates. It's ok to have your Bitcoin sitting there and waiting for some time to secure better rates. The longer duration contracts you are trying to secure the more important it is to have some patience.

Traders have their funding contracts run out constantly and they need to roll-over their contracts in order to maintain their positions. Once that happens to a big trader he will be forced to take whatever is on the board. That's why it's bad to always try to undercut other lenders.

You can undercut very big lenders. Sometimes you'll see blocks of 70 or 100 Bitcoins being offered at a certain interest rate. It may be good to undercut these as it cuts back on your waiting time. However, they could also be margin traders trying to get lenders to lower their rates.

2. Lend out for minimum periods only

You can chose for how long you want to lend out your Bitcoin. The way it works is that the margin trader can return your loan before it expires but you can't call it in. When rates spike that really sucks if you have funded long term contracts. If you are giving this advantage to a trader you have to demand a premium. Make sure you are capturing above market rates to compensate for the times where you will be missing out. If there are problems with Bitcoin you also want to be able to cut your funding. So keep it short.

3. Spread your loans

When you throw all your Bitcoin out there at one rate you find acceptable you may end up having just one counterparty. That's inherently more risky. If you chop up your loans into blocks and lend them out at different times or set higher rates on some blocks as an opportunistic trade. You are much more likely to have multiple counterparties.

4. Don't underestimate risk

Funding isn't as risky as trading on margin but it is definitely not without risk. You are harvesting these crazy high interest rates because others find it extremely risky or the supply demand mechanic would push interest rates down. You can easily get fooled by trying it out for some time with a small amount of Bitcoin and not experiencing any defaults. Default rates tend to cluster. At some point there is going to be an event; hack, price move or other adverse event that will have default rates spiking. You may do very well for a long time and suddenly BOOM all your loans are gone. Or maybe that doesn't happen. For now the jury is out whether the insane interest rates offered are justified.

5. Pay Attention To The Clock

In my limited experience there are times when it's much easier to get good rates compared to other times. You want to try and get your loans in around those times. For me it has been evenings on GMT+1. However, I didn't make a scientific study out of it so it could just have been a coincidence.

Good post, I recommend Lending on Poloniex - has worked really well for me! Do you know of any other cryptocurrency Lending programs?

Kucoin may counts similar offer. They share 50% of the daily profit until March 2018 who has Kucoin Shares (KCS) on portfolio, after that it will be 15%.