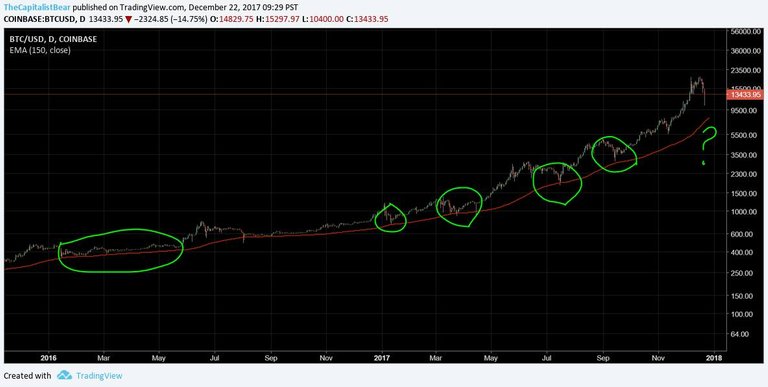

For the past week or two I've been warning that BTC needs to hit the daily 150EMA to complete its correction. We just hit that bottoming around $9,200.

Article proof here: https://steemit.com/bitcoin/@bodaggin/i-warned-btc-correction-wasn-t-over-did-btc-trick-you

Posted on Dec 22:

Today's market:

So where does BTC go next?

Satisfying the 150EMA could mean the correction is complete. The Elliott Wave models show the possibility for a minor corrective bounce, and a final wave 5 down. Maybe to 8,000? I don't know.

What becomes complex is a "C" wave correction is usually similar in time and duration as the "A" wave correction before it. In fact, "C" must be a minimum of Fibonacci 100% of distance traveled in "A". The "A" wave in this case is very messy, which could mean "C" will also be messy. So if we allow for messy counting (something I'm hesitant to do), it could mean "C" is similar to "A" and showing basically complete. I don't know.

Primary forecasts for the past week have been between 8-10k, and unfortunately even currently between 8-10k we still don't know. All we know is we're close to the POTENTIAL beginning of the next larger wave up. There's an outside chance that we're already in the bubble bursting phase of crypto as well. (Yes crypto is a bubble).

Let's watch and see.

DISCLAIMER: This is not a trading recommendation. Crypto markets are fast moving, highly volatile, and high risk. Do NOT make trades based on this analysis and do not risk more than you're willing to lose entirely, 100%, all of, in trading. This is simply one opinion, not advice in any way.

Interesting, I like your perspectives.

I'm really just learning and getting a feel for this stuff but a couple of things don't quite sit right for me at this moment.

The 150 EMA really was just wicked leaving the candle body ( at present) a good margin away from the EMA line @ 9700

We are really close to a long term trend support @8k under today's candle - possible wave 5 target is on that line in my mind.

That bounce from 9260 had me thinking IMPULSIVE MOVE AFTER EMA HIT while all the time pondering the notion that If wave one was long, wave 5 is going to be short and the 3-4 correction still needed to be significant to make some space and time for that to look right on a chart.

Anyway just some thoughts from an amateur enjoying watching it all play out.

Thanks for your posts

Thanks @Flungspun. If I understand your first point right, you're leaning towards another wave down (5) to the $8k area. I very much agree with that possibility and give it a 50/50 chance. The only reason I may lean more towards bottom being in is because "A" down in Dec was a very messy subwave count.

One rule of Elliott is wave "C" is similar in time and duration (but also shape in a way), to "A", which could justify a messy "C" count.

Really tough to know, but I have high conviction one or the other is true. Studying the sub-wave makeup of this bounce (3 wave vs 5 wave move up) should gives us more context. Great points.

Not sure I understand the second part of your post (not your fault, describing Elliott in text format is tough to convey/pick up). Typically wave 5 is of equal length to wave 1 except in the case of an ending diagonal (very bearish to the trend).

In an ending diagonal each motive wave (1, 3, 5) gets progressively shorter. Wave 1 is longest, 3 is shorter, and 5 is shorter than 3. This usually signifies a reversal to the corresponding trend on that timeframe.

Feel free to clear me up on anything I'm not understanding. Your Elliott outlook seems good. Much better than Haejin's :)

Ah yes Elliot and text ... tricky. I'm going to attempt to put up a chart but I'm currently looking at spaghetti and no option to fix it right now.

I should have been more specific in that looking o for the bottom of wave C correction there is a possibility to fit to the preexisting channel support (but no space to fit the final 5 wave impulse.

If that was to work the ABC of wave 4 must aggressively extend up to allow for that space.

The result is not as I implied a "short 5" but a wave 5 that starts higher(close to crossing 1) and results in a lesser extension below the 3

Thus fitting nicely into my preconceived idea that BTC should do what I tell it and never the reverse. :)

Maybe we are just going to make that channel a bit wider.

The problem there is that for wave 4 to be that aggressive it will look bullish and impulsive, the ABC will look like 123-4- oh where did 5 ... down we go?

I'd guess the giveaway would be

A&C of ABC should be equal ?

but 3 of an impulse is longer than 1.

So even now I'm still expecting that EMA150 to have a candle end planted quite a bit closer than it is now. RSI on the daily bottom and a big old 5 waves down as I resume hitting the buy button. I just really didn't like the look of it as it left the gates @9200 .. short term ... oops

OR quite the epic triangle is forming into February ............

@Flungspun I very much agree with those possibilities. The 4 fakeout is very possible (markets LOVE fakeouts). Very very good comments. Thumbs up!

fakeout,

I see what you did there.

Used a whole word to describe my paragraphs accurately .... haha

Appreciate the feedback, thanks.

lest see how it plays.

Strong article. How do you relate this crash to the one from 2013? Referring to the fact that it took years to recover from that one. Resteemed

@steemitromney Admittedly I've only been around the crypto space just under 1yr. Been a stock/commodity trader for close to 10yrs.

As for the 2013 crash, it was the wave 1 top. I'm hearing from experts I follow that we're in macro wave 3, and we just completed the 3rd wave of that 3, meaning next wave up is wave 5 of 3.

After that this would point to a wave 4 correction similar in time an duration to the wave 2 correction beginning 2013 you talk about. A correction very deep and long in time.

However, it's possible we've already topped that leg, very tough to know.

Regardless a "time correction" such as beginning 2013 like you refer to is needed in crypto. What it will do is weed out some of the hot activity as traders shift to another macro market to participate in (US stocks, commodities, etc). Big action coming in those markets.

Also, crypto is complicated. So if it really is here to stay, the general public will need to learn it and that takes a lot of time for the masses. Hope that helped and answered your question.

Awesome reply indeed. Why is the peak of 2010 not included in that count? I'd say went price went from 5 to 100, that might have been wave 1. This would make it more crucial for the previous peak to be the top of a wave 3 I guess :p

It's a great point @steemitromney. I honestly haven't looked that far back into the macro count and haven't found reliable data going back that far. Do you have a good link to a chart with price data going back to BTC inception? That's one tough thing about unregulated grey markets, tough to get accurate data. Let me know, would be something interesting to look into. You may be on to something.

Here's a good site. You can set a custom time frame to zoom in on a specific period.

Its funny really how perspective has changed :p

when it comes to EW, the actionary waves are rather easy to forecast.

The corrections on the other hand are really difficult to predict since the bullmarket will do what it can to fight it and resist any change of trend heavily. This results more often then not in a sitaution that only after the correction you discover the true nature of it, especially when it is a correction of a higher degree of trend.

Just my two cents from learning about EW, I would not recommend to try daytrading at this point but rather to simply buy the dips