So you're in business now (and treat it like a business). Time to begin your journey in trading. Before you put your money in, it's advised to watch the markets first. There are tons of options, so choose your pick and study them.

In Bittrex you'll see a button that says 'Studies' above each graph. Click on it to get the various indicators out.

Remember guys, always buy low then sell high.

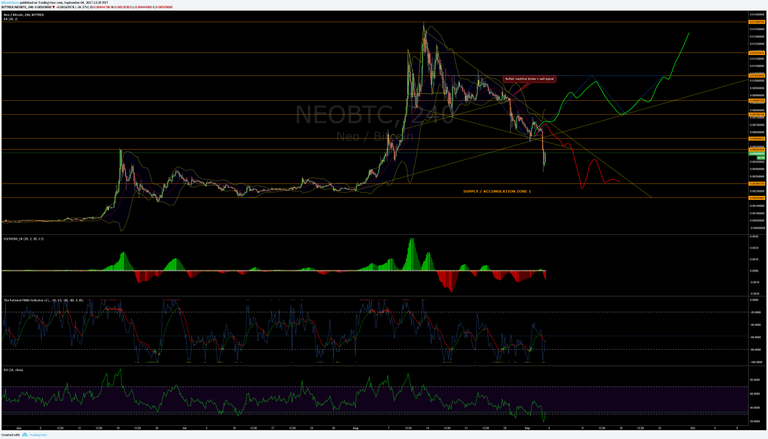

To get you going on using indicators to support your buy/sell decisions,

here's how to use 3 of the most popular technical indicators:

Bollinger Bands:

Basically traders look to sell when the graph heads near the top of the band and buy near the bottom.

Bollinger is named after the guy that made this indicator.

MACD:

The Moving Average Convergence Divergence indicator is a tool many traders use. It shows the relationship between two moving price averages. Traders buy when the two lines crossover at the top, and sell when they crossover at the bottom.

In case you care, convergence divergence means the relationship between two factors, and in this case it's referring to the two moving price averages, each over different periods of time (actually whatever, this is getting too complicated).

Relative Strength Index (RSI):

The higher the RSI, the more interested traders are in buying rather than selling.

It has a 0 - 100 range, so when its line is above 50 the other traders are feeling confident in the coin, when it's below 50 they're feeling sceptical. Again, in case you care, the RSI is the average of the number of upward price movements in a period divided by the average of the number of downward price movements.

So there are 3 popular indicators to get your going...

Remember that these are just tools to help you, not an exact science, so never depend on them too heavily.