bitseven.com - EtherDelta Founder Charged by SEC For Operating Unregistered Securities Exchange. Bitcoin Cash Fork arriving on November 15 be ready as the BCH community drama continues. Vitalik Buterin Says Ethereum’s 1000x Capacity Upgrade “Not So Far Away”.Winklevoss Twins Sue Charlie Shrem Over 5,000 “Missing” Bitcoin. Google’s Sundar Pichai says his 11-Year-Old Son Is Ethereum Miner. Basic Attention Token Price Plummets as Coinbase Trading Triggers Massive Selloff

Among major news this week, the United States Security and Exchange Commission (SEC) announced formal charges against EtherDelta founder Zachary Coburn for operating an unregistered national securities exchange. The SEC order explains that EtherDelta facilitates the trading of ERC20 tokens, many of which they deem to be securities. The charge comes on the heels of the 2017 DAO Report. This report outlines certain types of digital assets that the SEC considers to be securities, including DAO tokens. It’s implied that at least some of the tokens being traded on EtherDelta fell into this category. Over the last 18 months, users on EtherDelta performed more than 3.6 million trades, with many involving security-classified tokens.

Well, the 15th is arriving and so is the Bitcoin Cash Fork. Bitcoin Cash hard fork will mean two separate and independent BCH blockchains and in result two coins. Bitcoin Cash was the result of a divided community on increasing the block size of the Bitcoin (BTC). And now, Bitcoin Cash is trading the same waters. Twice in a year, Bitcoin Cash undergoes a hard fork for protocol upgrades which goes unnoticed. However, this time the community has failed to come to a consensus and is divided over the future of Bitcoin Cash blockchain. Seems like Controversial and untrusted figure in the Bitcoin Cash (BCH) community Cobra Bitcoin may prove to be the saving grace for the network’s future, after a highly contentious dispute between Bitcoin ABC and nChain threatens to split BCH into competing chains ahead of a scheduled hard fork.

Ethereum co-founder Vitalik Buterin used his keynote speech at Devcon 4, Ethereum’s annual developer conference, to unveil a roadmap for the evolution of the platform to Ethereum 2.0, which, among other things, will see the protocol upgraded to the proof-of-stake model. While the Ethereum community has been delaying timelines of their critical launches, Vitalik assured that Ethereum 2.0, Ethereum’s 1000x Capacity Upgrade, was “not far away”

From the courtrooms this week, Winklevoss twins filed a lawsuit against Bitcoin pioneer Charlie Shrem, alleging that he stole 5,000 BTC that he was supposed to acquire and hold for them. According to the lawsuit, the twins gave Shrem $1 million to invest in Bitcoin in 2012, which would have been worth $5000 BTC then, and roughly $32 million now.

This week, Sundar Pichai in his interview with The New York Times, Pichai revealed, “My son is 11 years old, and he is mining Ethereum and earning money.”Since Sundar Pichai, an Indo-American businessman, became head of Google, the company has maintained a love-hate relationship with cryptocurrencies. Google had initially announced a ban on cryptocurrency ads in June 2018, however, very next month the company partially removed the ban.

Among Altcoins, After massive uptrends due to the Coinbase listing announcement, the actual trading of BAT has caused an adverse effect. After the coin went live on Coinbase, it plummeted by around 20 percent against the US dollar. What was important here is that the selloff of BAT on Coinbase demonstrated the typical buy the rumor and sell the news trend in the cryptocurrency market.

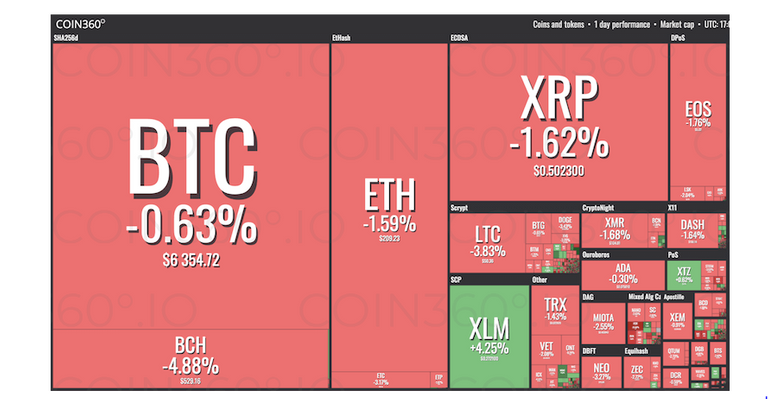

Bitcoin (BTC)

The stability of Bitcoin continues this week as well as it was up just around 0.34% this week. The reported strength was yet in the stable zone. The prices hit the high point of USD 6,552.16 and the lowest point of USD 6,363.62 during the week. The exchanges that were more active, in volumes, with BTC across various pairs this week were, Bithumb (10.51%), Coinbit (9.23%), CoinBene (3.74%)

Among prominent voices, Venture capital investor Tim Draper reaffirmed his prediction that the Bitcoin (BTC) price will reach $250,000 by 2022, during a panel discussion at the Web Summit summit conference

Ethereum (ETH)

Ether prices, on the top, this week were at USD 221.65 and were at lows of USD 206.57 staying not very far from the USD 200 support. The markets that were more active, in volumes, with ETH across various pairs this week were OEX (7.13%), BitForex (3.73%) and LBank (3.56%)

Among news surrounding Ethereum, Erik Voorhees, CEO of ShapeShift told in an interview with CNBC Crypto Trader, that Ethereum [ETH] is better because Vitalik is involved

Ripple (XRP)

On the top, this week the prices of XRP were at USD 0.560547 and towards the bottom, it quoted USD 0.460769. The exchanges that were more active, in volumes, with XRP across various pairs this week were ZB.COM (12.84%), Bitbank (11.07%), and ZBG (9.45%)

For XRP this week, Wietse Wind, the creator of the cryptocurrency micropayments service, XRP Tip Bot is in line to seek approval from Amazon to integrate the blockchain app with Alexa

bitseven.comBitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITCOIN LEVERAGE TRADING YOU CAN TRUST