Bitcoin price has been the center of attraction for almost a decade now. Since the launch of Bitcoin, people are going crazy about Bitcoin & Bitcoin Price. From the time when the Bitcoin price almost touched $20k mark in December last year.

People anticipated that the price would not just touch $20k mark, but also jump over it. Unfortunately, bitcoin slowly started falling since the new year and as we got along with 2018, the bitcoin price was on a free fall. But something peculiar has been happening lately. Bitcoin price has been hovering around $6500. In other words, the bitcoin price is most stable at around $6500.

In this post, we will see how is this happening, why is this happening & all the stories around this. Without further ado, let’s dive in.

Bitcoin Price Analysis

While Bitcoin has been doing great in the month of August this year, but something went wrong since mid-august. As per studies, Bitcoin was doing great until August. In the month of August, the price hit the fourteen-month record low at $6,430.

However, the prices were seen to be dead flat around this price segment and to this there are many opinions around the globe.

The bitcoin price didn’t just affect bitcoin investors, but the other altcoins also fell in the price table. Ethereum was worst hit, with over 4% fall within 24 hours. 4 percent is too much for top performers like Ethereum.

Some experts believe that higher the bitcoin dominance in the market, that is higher the bitcoin price, higher will be the chances of altcoins being trapped in fluctuations.

Here’ what president of Xapo, Ted Rogers has to say in this regards.

“We could be in the midst of the extinction-level event for “cryptoassets” that many maximalists have predicted. 90%+ of the CoinMarketCap list will disappear eventually — might as well happen now. Meantime, lower BTC price means incredible opportunity to buy more bitcoin_”_

In the huge diversity of bitcoin investors, there are many theories & speculations on this. While there are many bullish predictions on bitcoin price & on the other hand there are rumors that influential investors are manipulating, or in other words, controlling the bitcoin price. According to the rumors, influential investors are not willing to pay more than $6500 and this is why the bitcoin prices are hovering around this price segment.

Another aspect of this scenario is that bitcoin will rise faster since the altcoins are trapped in fluctuations. Furthermore, the altcoins are trapped in fluctuations because of the possibility of bitcoin price rising higher & higher.

So this itself is a loop of a loop, a nested loop to be exact.

Does this mean, this is an infinite loop? Will bitcoin ever get stable?

Let’s see in the subsequent section

Stability in Bitcoin Price

If you’ve been following Bitcoin price for past 14 to 16 months, you’d know how volatile it has been. Since Aug’17 the price has been pushing the bar and every day was a new record high for Bitcoin. As aforementioned, since Jan’18 the prices were on a free fall & to date, the price hasn’t gone past $6500 too many times.

However, where bitcoin has gone past $6500, it has dropped down below this line. Sure, this is peculiar for many but there are people who think bitcoin is here for a long run and those who were into this for quick money have left with losses.

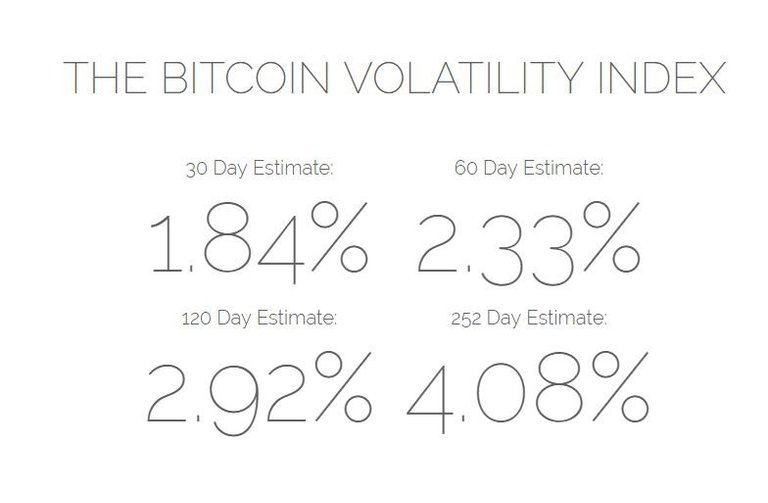

To back this with data, here’s a bitcoin volatility website called Bivtol Index. This website shows surprising data about how stable bitcoin has been in the past 30 days. There has been just 1.84% fluctuation which steady as a rock. At least considering what Bitcoin price has seen in past 14 months.

Even as of today(14 Oct 2018), the bitcoin price is hovering around $6500. Compared to the previous fluctuation rate same time last year which was 3 to 7 percent.

On the other hand, the 120-day & 252-day percent metrics are more on a consistent side. One thing to note here is that when the Bitcoin went for a bull run since Mar’17, after which the price ran towards $20,000 but fell short by a few hundred dollars.

Bloomberg this June reported that Bitcoin is having a great stability around the price segment $6400-$6800. Not only this, Bitcoin even managed to fly around $8200 mark.

Bitcoin is seeing 17-month record high stability. Has been in $6,400~$6,800 range since August 9, apart from 1 day in September when it broke out of $7k.

Historically, Bitcoin recorded long periods of stability before initiating a new rally. https://t.co/Jic0J51RMq

— Joseph Young (@iamjosephyoung) October 7, 2018

Check out the CoinDesk’s graph of Bitcoin price from Jan’17 to Jul’18. You can see the price falling down since Jan’18 and then steady since Mar’18.

Furthermore, longer Bitcoin will be hovering around $6.5K or so, its price charts will start getting flat and all those who’ve been opposing the cryptocurrencies will be raging out with valid arguments that Bitcoin was a bubble and will be dropping further to its ultimate price tag, which is zero.

However, it’s a hypothetical situation. For the Bitcoin price to reach zero, no one in the cryptoverse would be using Bitcoin, which is not going to happen. At least not in the next couple of years. Not being over-optimistic, but Bitcoin is on an edge of the unknown where further price drop will be a disaster for the industry.

Next couple of months will be very crucial for Bitcoin. Even if the price falls to $3k, it’s gonna be good news for the believers of Bitcoin & cryptoverse.

Worst case would be, bitcoin price reaching around $1k or below. This would create some serious problems & all the rumors about Bitcoin being a bubble. Once Bitcoin is gone, the cryptoverse would collapse at once. Bitcoin needs support from the investors now. The ‘strong hands’ needs to come together and invest more to life the price up & eventually reap the benefits.

One common problem that is kind of keeping the price away from the bull run, is investors are not keeping the cash flow. Bitcoin worth $10 billion, or 7% of Bitcoins is in cold storage of One Company, which is a bit of concern bitcoin price.

That was on why Bitcoin price is hovering around specific price segment. Let us talk about the factors affecting the Bitcoin price.

Factors affecting bitcoin price

The fluctuations happen for a reason. The rumors that run around the cryptospace are simply vague, at least for now. The cryptoverse is a community of investors and no individual can control the price of it, and to do that, the individual would need to own the who bitcoin market, which is too expensive for an individual.

Bottom line is, that the bitcoin price is not being manipulated. With that said, let us take a look at the factors affecting the price. Following this will be the answer to the golden question of this post.

Factor affecting bitcoin price #1: Bitcoin supply & increasing/decreasing demand

Just like any other equity, bitcoin is also an asset that fluctuated based on the demand of it. Furthermore, the price of bitcoin is determined by the cryptocurrency algorithm solving complex equations, which is done by volunteers called miners.

The other side of this coin is the demand which directs by the awareness, usability and profit margin of Bitcoin. Bitcoin is like the internet, everyone knows about it but not everyone has access to it. Considering the price, there is a little bit of a boost to its demand. Whatever’s expensive, is in demand by default.

Thanks to the enthusiastic community members, they haven’t lost hope in bitcoin though there the demand isto supply ratio is too low. There are a few technical aspects that create a problem in the supply but that’s out of scope for this post.

The system is scheduled to create 21 million bitcoin over the course of 100 years. 13 million have already been mined and the remaining will be mined in the years to come. The system is programmed in such a way that as the bitcoin mined the difficulty level to mine the remaining will keep increasing. This way, the price will also keep increasing.

Factor affecting bitcoin price #2: Regulatory authorities

Since the launch of Bitcoin, the traditional banking systems and government bodies have been against it for obvious reasons. Apart from the cryptocurrency hacks, there are chances of illegal trading being carried out with cryptocurrencies as payment. Thanks to the complete anonymity, the illegal trading becomes easier. But the private keys that relate to the transfer is enough to catch hold of the culprit.

Countries like India is very particular about the norms. In fact, India has banned cryptocurrency until there’s a way to keep track of the transactions happening. The crime rates in India have grown, giving a valid reason for the government to ban cryptocurrency.

In April’17, Japan legalized bitcoin for good & since then the price shot up, so high that every day was a record high for bitcoin. Bitcoin price is directly affected whenever there is a statement from a regulatory authority of any country. Be it a good or bad news, the price fluctuates. Recent happenings with Japan & China regulating cryptocurrencies, the price has shown good colors.

Factor affecting bitcoin price #3: Bitcoin in news & social media.

The internet has shrunk the world. It doesn’t take long to make things go viral and to make something go viral, social media is the place. All the ICOs, hacking news, cyber attacks make it to the social media and thus the price is affected.

Considering the fact that cryptocurrency market capitalization is lower than the global economy, even the slightest rumor can drastically affect the price. Furthermore, news about cyber attacks or hacks further pulls down the price. Even rumors affect in a bad way.

Factor affecting bitcoin price #4: Developers & Investors

The most influential group of people in the cryptoverse are the developers & investors. Their words are rock solid for the whole community, they are blindly followed. People trust these two group of people as they are aware inside out of bitcoin price.

Bitcoin is more than just a cryptocurrency. People have sentiments attached to the digital coin which is a huge factor for the price to be so high. Optionally, you can keep in touch with the industry leaders and developers to stay on the track. This will help you learn about the current market trends, the direction of currency’s price trend.

To be frank, Bitcoin has recently started gaining the actual momentum. Or in other words, Bitcoin has started flying towards its actual potential this year. So it’s evident why the prices are so stagnant. So far it has been risky to put in money, but now the prices are stable enough to invest. The actual game has just begun.

These factors are minimal unless the users, developers & investors don’t react to it. It takes a lot of time & money for a product to reach the market, but it takes just one loyal user to market the product without expecting anything in return.

So, the rumors that bitcoin is going to die, or the prices are being manupulated are a hoax. Good projects are like dust, it takes time to settle. As said earlier, bitcoin has started inching towards its true potential so this price is actual cut of it.

$20k/BTC were all speculations and ICO hype. Crypto adoption takes time and weak hands were not ready for it. They came for quick money and left after quick losses.#bitcoinprice#cryptocurrency#bitfolio

— bitfolio.org (@BitfolioO) October 13, 2018

If you are a user, investor or enthusiast, we want to tell you bitcoin is safe. People who were looking for quick money have lost money which is why the community says the bitcoin is a bubble.

This brings us to the end of the article. If you find this any helpful, feel free to share the article on your social profile.

Originally published at https://bitfolio.org/bitcoin-price-detailed-analysis-bitcoin-price-hovering-around-65k.