The Future is (Bitcoin) Futures

Introduction

The Commodity Futures Trading Commission (CFTC) just gave the green light to allow for the trading of Bitcoin futures. This marks a watershed moment for Bitcoin, as many Wall Street investors can now get in on the Bitcoin action. So, what exactly are futures, and how will they affect Bitcoin?

Futures

Speculation

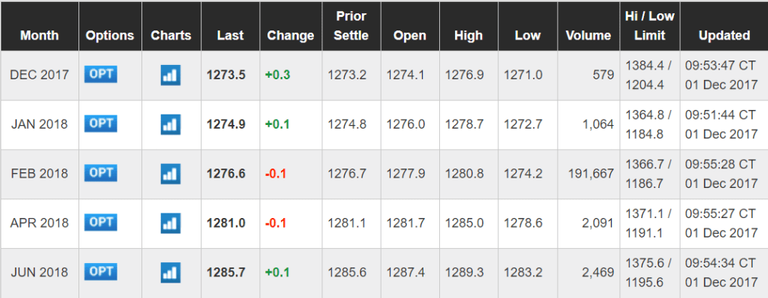

A futures contract is a legal agreement to buy or sell a commodity at a predetermined price at a specified time in the future. Futures can be used to bet (speculate) that the price of a commodity will be higher in the future than it is today. Let’s take gold for example. Do you think gold is going to be worth more in 3 months than it is worth today? You may want to consider buying gold futures. To do so, you’d go to an exchange like the CME Group and buy a futures contract. Below are the current gold futures contracts trading today.

Current futures pricing for Gold on CME

The “Last” column represents the last traded price for a particular gold futures contract. The last price is quoted in U.S. Dollars per Ounce. It can be seen that the price of gold futures currently increases over time, from $1273.5 in December to $1285.7 in June. This indicates that the market believes that the price of gold will rise steadily in the near future. So, if you buy a June 2018 futures contract, you would not only need the price of gold to go up, you would need it to go up even more than the market prediction of $1285.7/ounce in order to profit.

You may be familiar with options, which are another financial instrument for speculating on price movement during a specified time period. The main difference between futures and options is that options give the buyer the “option” to buy or sell the underlying asset at expiration whereas the holder of a futures contract is obligated to fulfil the terms of the contract. In some instances, the futures contract holder actually takes physical delivery of the underlying asset. Imagine that you bet that the price of cattle will go up in the future. You’ve effectively signed up to buy a certain amount of cattle at a certain price in the future. If you forget to close the contract you’ll end up taking delivery of the actual cattle! That would literally stink. Most futures take place on cash-settled exchanges, so the effective price difference is paid in cash and you don’t have to worry about a truckload of heifers showing up at your apartment.

Cows are cute

Hedging

Futures allow for more than simply betting on the price movement of commodities. Many companies rely on futures in order to maintain steady cash flows. Let’s take Kevin’s Ice Cream Factory for example. Kevin sells premium Ice Cream by the Gallon for $12. At this price, Kevin has a net profit of $3 per gallon after paying for ingredients ($6), labor ($2), and amortized equipment costs ($1) for a total cost of $9. Milk is the primary ingredient in Kevin’s Ice Cream, and he is currently paying $5 a gallon for it. Let’s say that Mad Cow Disease hits the United States and decimates the dairy cow populations. The price of milk skyrockets to $10 a gallon. These damn cows again!

No one wants a sick cow

Kevin has a choice to make. With milk at $10 a gallon, the ingredients now cost $11 and Kevin’s net profit is in jeopardy. Kevin’s total cost has risen from $9 to $14. If he continues to sell ice cream at $12 a gallon, Kevin will now have a net loss of $2. Alternatively, Kevin could raise the price of ice cream to $17 and maintain his normal $3 profit. The ice cream industry is very competitive however, and his sales will likely suffer if the price per gallon is increased. What should Kevin do?

How can Kevin guarantee a profit?

Luckily, Kevin had to foresight to purchase milk futures. Last month, Kevin bought a contract to purchase milk one month into the future for $5. At the time, the Mad Cow outbreak had not yet occurred, and the price of Milk was expected to stay steady. Kevin paid a small premium for this contract and a few dollars in exchange fees. With all futures costs added up, Kevin effectively paid $5.10 for the milk and was able to turn a profit of $2.90 for his ice cream! Kevin also decided to take physical delivery of the milk, so he doesn’t have to worry about finding a supplier.

Bitcoin Futures

Futures are a big deal for Bitcoin. Not only do institutional investors now have a way to bet on the price of Bitcoin, but companies who transact in Bitcoin or hold a lot of Bitcoin in reserve now have access to hedging tools.

Hedging

Let’s say you’re a computer company that imports electronic equipment from Taiwan. You find it very convenient to pay your supplier in Bitcoin as international wire transfers are slow and pricey. It’s easiest to keep Bitcoin on your balance sheet so that you can instantly pay your supplier. However, you know that Bitcoin is a volatile asset. Although Bitcoin has an upward price bias, it frequently pulls back in price as much as 40%. Your supplier is happy to accept Bitcoin as payment, but he instantly converts the funds upon receipt, and all contracts are drawn up on a USD settlement price.

I AM THE CAPTAIN NOW

Your next order is for 10,000 microprocessors to be delivered in 2 months for $1 million USD. With Bitcoin currently trading at $10,000 per coin, you first ensure that you have the 100 BTC on hand to pay the supplier upon receipt of the goods. No one knows what price BTC will be in 2 months, however and you need to provide however much BTC is required for a $1million USD equivalent value. In order to minimize risk, you decide to sell 100 BTC futures for $11,000 that execute in two months. If BTC goes up past $11,000 in this timeframe, you’ll lose some potential profits. If BTC drops, however, the buyer of your contract has an obligation to purchase your 100 BTC for $11,000 each, and you’ll have enough money to pay the supplier.

The availability of Bitcoin futures will also enable retailers to reduce balance sheet volatility when they accept Bitcoin as payment. Many retailers who accept Bitcoin instantly convert to USD to avoid any volatility. Companies like Overstock, however, hold any Bitcoin received on their balance sheets in hopes that BTC will rise in value vs the USD over time. Either way, the availability of futures adds flexibility to businesses.

Mining companies will also see a huge benefit with the availability of futures hedging. Companies shell out major bucks to purchase in Bitcoin Application Specific Integrated Circuits (ASIC’s) in order to mine Bitcoin. Mining rewards themselves can be spotty, which encourages many miners to join pools in order to receive steadier cash flows over time. The availability of futures will also allow mining companies to operate with steadier profits as the price of Bitcoin rises and dips. This should bring increased competition to the mining industry. More miners = more hashpower = a more secure and useful Bitcoin network!

Exchange Traded Funds

Will ETF’s send Bitcoin to the moon?

Most retail investors don’t trade futures. However, futures are considered a stepping stone to ETF’s. ETF’s are marketable securities that track the price of underlying assets. ETF’s allow investors to put their money behind commodities or groups of stocks more easily. Do you want to invest in the largest companies in America, but don’t have enough cash to buy every single stock? Just buy the “SPY” ETF, which tracks the price of the S+P 500. ETF’s trade throughout the day when the stock market is open, and have very small management fees.

Many investors are hesitant to invest in Bitcoin because they don’t want to create an account on a Bitcoin exchange. In addition, IRA’s and other tax-advantaged accounts only allow investors to purchase certain assets. Bitcoin is not an asset that can currently be purchased directly through an IRA. For this reason, a company called Grayscale started the Bitcoin Investment Trust (GBTC) was created. This trust is a closed end fund that holds Bitcoin as an underlying asset. The fund is so popular that it trades at a 50-100% premium to the value of the underlying Bitcoin. This shows how anxious retail and institutional investors are to buy Bitcoin through traditional means!

A handful of companies have tried to get SEC approval for Bitcoin ETF’s. The SEC has yet to grant approval, citing that Bitcoin is illiquid and does not have sophisticated trading instruments like futures and options. It is anticipated that options will be built on top of futures by exchanges like CME and CBOE, which will pave the way to ETF approval. Once ETF’s are approved, Bitcoin will be much more accessible to the average investor.

Currency or Commodity?

Is Bitcoin more like gold or the USD?

Investors and Regulators are constantly arguing whether Bitcoin is a currency, like the USD, or a commodity, like gold. With today’s ruling, it seems that Bitcoin is being defined as a commodity. However, since futures will allow for hedging, Bitcoin will also see increased use for payments, making it similar to a currency! Regardless of how Bitcoin is classified, a healthy futures market helps legitimize Bitcoin as a financial tool.

Conclusion

Today’s futures approval is a huge announcement. Bitcoin is gaining acceptance as both a commodity and currency. The availability of futures will make Bitcoin speculation more accessible for retail and institution investors, while also helping to steady cash flows of Bitcoin related businesses. The future is bright for Bitcoin!

Thanks very good post !!!!

Awesome Work!

Keep it up!!!

@cryptoinvestinfo

your CryptoInvestmentExpert

A word of warning, futures is a very high risc very high reward investment tool. If you dont know what youre doing, stay as far away as you can from this as it can ruin you in hours/days. Thanks for the article, learned a thing or two! Best regards!

please reply in this comment

thank you

Top 10 Crypto Currency to invest in 2018

Bitcoin,Ethereum,Bitcoin Cash.Ripple,Litecoin,Dash, Monero,IOTA & Ethereum Classic

Joined www.t.me/btctradingclub for more news

Very informative! Thanks

Although I wont be using futures I think it is going to see a huge rise in the price of bitcoin.

The natural value of bitcoin is very high due to its cap of 21million, the more it is used and traded the closer it will reach to its natural value.

With futures I can only see the extent of its trading increasing , thus its value too.