As soon as I learned about Google Trends I was instantly fascinated. You could spy on the collective consciousness of the herd in both time and space, searching keywords by individual country or the world as a whole and over custom date ranges.

But like most things we encounter on the interwebs, it didn’t manage to achieve anything more than curiosity status with me, that is, until I actually found a use for it. So obviously this is going to be another Google-Trends-for-Bitcoin-trading post. Sure, we all know interest is down from 2017, but not everywhere. In fact in some parts of the world, interest in crypto never went away.

Bitcoin Interest in the Major Economies

- Bitcoin interest in selected strong economies as indicated by Google keyword searches for ‘bitcoin’.

Since the 2017 All-Time High, cryptocurrency-related interest in many countries has plummeted. The chart above makes this very clear.

Now immediately some very interesting things come to light. You’ll see that in two of the largest crypto-trading nations, the USA and China, interest has been hurtling down, inline with price action, since the end of last year. This really indicates that adoption in the USA was fueled overwhelmingly by price and, as such, the interest trend looks to be continuing down. The situation is similar in other similar nations such as the UK.

The same could also be said for China, except that this is not in keeping with other Asian countries. In fact few entities in the world have moved so aggressively against Bitcoin and permissionless blockchain technologies than the Communist Party of China. This might have something to do with the ever weakening Yuan, having lost 10% of its value since 2013, and China’s paranoid anal introspection when it comes to its own economic policy (please take that literally :P). China’s unceasing pressure on cryptocurrencies, which has now moved from a ban on exchange to a complete outlawing of even mentioning them in any kind of public forum (yes really, crypto now unword double plus bad brother) is mostly likely based on it’s gut wrenching fear of capital flight. In trying to keep its currency low in order to strengthen exports, China risks triggering an exodus of wealth. This eagerness of Chinese investors to park their money abroad is well known. The last thing Beijing needs is a cheap, peer-to-peer, sha-256-encrypted network which allows almost instantaneous monetary transactions anywhere in the world. As such domestic policy in China has driven down interest within the country.

Japan on the other hand is a completely different story! In contrast to China, Japan has adopted a pro-active approach to Bitcoin & Co. and it probably has the highest levels of consumer adoption than any other industrialised nation. This is also evidenced by the sudden upswing in interest in the Google Trends results since the end of Q2 2018, which was coupled with speculative optimism. However, in Japan too interest has waned with the price.

India is a mixture of the two. It is a country caught between two policy poles. It shares many of the concerns of China, but also looks to harness the potential benefits of the blockchain. As such it’s crypto policy has been up and down since forever. Recently though an alleged ban was ruled out and this was accompanied by a renewed uptrend in interest at the start of the second half of the year.

In contrast to many European countries, interest in Germany remains strong and contrary to the worldwide search trend and maybe linked to the countries tradition for research and innovation in enterprise technology solutions.

So we see how interest in the major economies is highly influenced by price (USA/Europe) or legislation (China/India) or innovation (Germany/Japan). Now let’s look at those countries which are deep in hyperinflation already or are teetering on the brink of a looming currency crisis.

Interest in the High-Inflation Economies

- Percentage change since April 2014 of selected world currencies.

Without getting into the whys and wherefores (yes, the USA and it’s evil European satraps probably have as much to answer for as Chavismo, but god poor, poor Venezuela…), there is a currency crisis brewing in many parts of the world. The decline of fiat money carries on apace and these market cycles become unavoidable on large enough time frames. Last time I looked, inflation on the Bolivar was running at 4,000,000% and as such there is a real, existential need for alternative currencies and stores of value in these countries… right… now. Looking at Google Trends, we see a completely different picture from the one presented by the rich countries.

- Bitcoin interest for selected weak economies based on Google keyword searches for ‘bitcoin’.

Looking at the chart above, we see immediately that interest has already bounced hard in 2018 and continued to rally after other markets continued to lose interest. Bitcoin was even trading for close to 900,000,000 Iranian Rials on localbitcoins.com at one stage in mid-2018, that’s over $23,000 using the official exchange rate.

- Averages of Google Trends using the keyword “bitcoin” for both selected strong and high-inflation (weak) economies. Includes worldwide filter (dashed line) for comparison.

Of course 2017's highs were overvalued given the level of adoption, the point is that whilst interest has waned in countries where the primary motivation for crypto was speculation, in countries where the people have a real need for it, interest is booming! Let’s compare the previous two charts. We can see that in the beginning, prior to 2014, interest in both categories was relatively similar. Hey, crypto was new, better check it out, looks fun, what’s it all about, oh look I can make a buck kind of stuff. But as the currency crisis started to take root around the world, people in affected regions started showing increasing interest in Bitcoin and their searches overtook the selected major economies. In fact, when interest starts to lag behind in the strong economies, it often begins to pick up in the weaker ones. Clearly the Google trend for high-inflation economies is up.

Yeah but… wen mewn, wen lambo?

The current market correction is overwhelming. The price suppression is massive. The whale manoeuvres unknowably deep and cryptic. Honestly, the manipulation is massive on both sides, but the trend remains down. Is that really a descending wedge in the price action and what will happen if it breaks down? Which exchanges will fold first and which will get hacked? Hmmm…

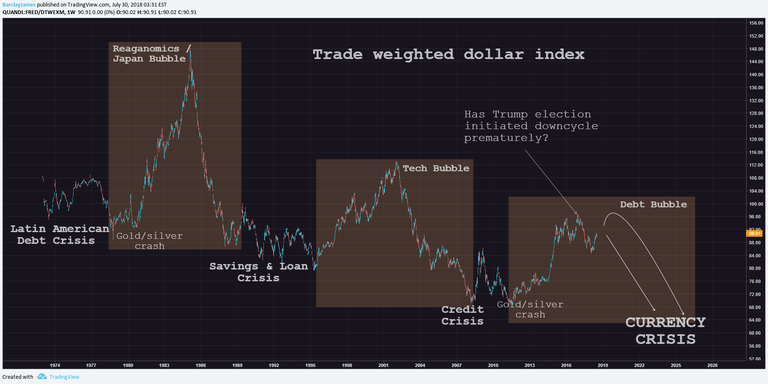

- The inevitability of boom and bust?

Whatever happens to the current market landscape, cryptocurrencies are going nowhere! Central bank fiat money is ailing, sure. But let’s avoid the armageddon scenarios. In the 1970s, during the last period of hyperinflation, the world population was half what it is now! Our food, water and fuel resources seemed limitless. This time there is the potential for things to be far worse for people in general and, while the elites who understand market cycles all too well have been preparing for decades, the rest of us have little to no idea what the coming decade has instore. Likely it will be harder than the 2008 crisis for many people. The countries in that first chart I gave will probably be less affected than those in the second chart.

One thing I am confident about is that deflationary cryptocurrencies will have already gained a permanent foothold in many regions around the world, both online and in the physical world as secondary means of payment to legal tender. Indeed in some countries it may even become legal tender. Japan for instance passed the Virtual Currency Act in 2017, which paves the way for such adoption in the future. Even if it is only an additional means of payment, it will be people’s silver, not the silver currently controlled by JP Morgan.

Going on the basis that human behaviour is essentially the same the world over, eventually a real adoption trend should overtake speculation on a global level. And the spark that lights the match may not come from the strong economies, which are often mired in complacency, but from those countries that have a real need for alternative currencies.

First there was the gold economy, then the oil economy, now we are entering the information economy. An Age where companies that essentially make next to no profit (Amazon loses around 95% of all its receivables in overheads) can be valued at 1 trillion dollars, because of their access to the goldmine that is personal information and the potential that it offers for manipulating both society and economy.

Cryptocurrencies have appeared at the right time in history. Was this really an accident?

Hello,

Welcome to Steemit.

In order to confirm your authorship of the content, please make a mention about Steemit or add a hyperlink to Steemit in your Medium blog:

https://medium.com/@sunnyday.james

You can remove this mention from your website, once we confirm the authorship.

Thank you.

More Info: Introducing Identity/Content Verification Reporting & Lookup

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@sunnyday.james/google-trends-is-your-friend-45ee3277fe20

!cheetah ban

Failed ID Verification.

Okay, I have banned @barclayjames.

Hello @barclayjames! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @barclayjames! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!