Bitcoin is a great technology, right? It is decentralized, it’s cheap to transact, and no government or central bank has control over it. And one other thing, its value seems to be skyrocketing, which means it might be a good time to jump on the bandwagon and use it both as an investment and as a means to transact.

However, don’t convert your entire life savings to crypto just yet. While Bitcoin and other cryptocurrencies have already become mainstream, there are still some challenges ahead. And even with blockchain-powered technologies making life simpler and easier for users, it pays to have a better understanding of what makes cryptocurrencies and blockchains tick, and how we users can actually take advantage.

For one, there is no doubt that cryptocurrencies like Bitcoin and Ethereum are seeing mainstream use through apps and mobile solutions. But it is not always a rosy picture in terms of using this digital money.

In my earlier articles, I took a look at the potentials of blockchain for businesses, in making investments, and even addressing global poverty by giving financial access to the unbanked. But there is a simpler question for us users of cryptocurrencies.

Why can’t I just spend my coins?

The biggest benefit of Bitcoin, Ethereum, and other cryptocurrencies is also its biggest challenge: the fact that it is a purely digital currency. This means the amount in circulation is as digital as the cryptography that has created it — there are no paper bills or coins in circulation. While a unit of BTC or ETH may have its equivalent exchange in fiat currencies like the US dollar, there are no physical reserves of the currency.

The need to spend and exchange coins (for simplicity, we will refer to units of cryptocurrencies simply as coins) has spawned an entire industry of exchanges, where individuals, companies and platforms exchange coins with fiat money (like the US dollar, British pound, Euro, etc.).

Activity on exchanges like Coinbase also influence the value of coins. More transaction (velocity) influences the price upwards. In many cases, when exchanges are compromised by hacks and traffic attacks, cryptocurrency values also take a downward hit.

In the early days, this has mostly been peer-to-peer, with users exchanging their coins to dollars and vice versa through methods like bank transfers and sometimes even through in-game currency. Now, apps are letting us do all sorts of things, from paying bills to sending money to friends, and even shopping using funds from our Bitcoin wallet. Here’s how.

Bitcoin for debit card payments

The biggest benefit of Bitcoin should be how you can spend it, right? While some online stores and sellers already accept Bitcoin as a means of payment, how about the millions of stores and merchants out there that do not? You can’t just show the cashier the transaction confirmation from your Bitcoin wallet — most people do not even know what Bitcoin is.

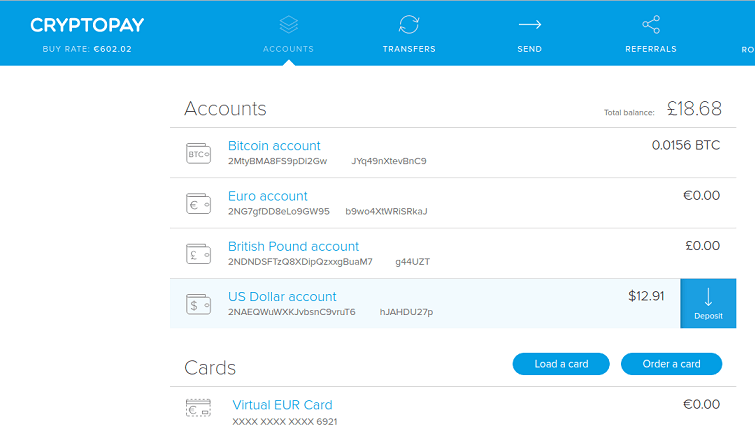

One startup currently making its mark is CryptoPay, which is making it easy to spend all that cryptocurrency at just about any store with a credit card terminal. CryptoPay is essentially a Bitcoin wallet platform, but it does more than hold your coins for you. One of its main features is the CryptoPay debit card, which is a Visa card that you can use to pay for purchases.

The company has two versions — a physical card that you can swipe (or insert into EMV terminals) and a virtual card you can use for transactions. Either way, both of these are a convenient way to spend your coins on any store without thinking about manually converting these or looking for someone who can buy your Bitcoins.

Bitcoin for your salary

Still working the daily 9-5 grind? Or maybe you are working as a freelancer or remote professional. You might be happy to learn that there are platforms that cater to your crowd. A company called BitWage offers a solution that lets employers pay wages directly to the employees’ cryptocurrency wallets.

SECTIONS

Apps

Gear

Tech

Creative

Contributors

Insights

Launch

World

Distract

Offers

ABOUT TNW

About

Team

Advertise

Jobs

Contact

TNW SITES

News

Conference

TNW NYC

Index

TQ

Deals

Answers

Cyberspace Culture

Ask Ethereum ETH founder Vitalik Buterin whatever you want on TNW Answers now! →

Going beyond Bitcoin wallets: These apps give you better control over your cryptocurrency-based finances

by DAAN PEPIJN — 8 days ago in CONTRIBUTORS

Going beyond Bitcoin wallets: These apps give you better control over your cryptocurrency-based finances ...

0

Bitcoin is a great technology, right? It is decentralized, it’s cheap to transact, and no government or central bank has control over it. And one other thing, its value seems to be skyrocketing, which means it might be a good time to jump on the bandwagon and use it both as an investment and as a means to transact.

However, don’t convert your entire life savings to crypto just yet. While Bitcoin and other cryptocurrencies have already become mainstream, there are still some challenges ahead. And even with blockchain-powered technologies making life simpler and easier for users, it pays to have a better understanding of what makes cryptocurrencies and blockchains tick, and how we users can actually take advantage.

For one, there is no doubt that cryptocurrencies like Bitcoin and Ethereum are seeing mainstream use through apps and mobile solutions. But it is not always a rosy picture in terms of using this digital money.

In my earlier articles, I took a look at the potentials of blockchain for businesses, in making investments, and even addressing global poverty by giving financial access to the unbanked. But there is a simpler question for us users of cryptocurrencies.

Why can’t I just spend my coins?

The biggest benefit of Bitcoin, Ethereum, and other cryptocurrencies is also its biggest challenge: the fact that it is a purely digital currency. This means the amount in circulation is as digital as the cryptography that has created it — there are no paper bills or coins in circulation. While a unit of BTC or ETH may have its equivalent exchange in fiat currencies like the US dollar, there are no physical reserves of the currency.

The need to spend and exchange coins (for simplicity, we will refer to units of cryptocurrencies simply as coins) has spawned an entire industry of exchanges, where individuals, companies and platforms exchange coins with fiat money (like the US dollar, British pound, Euro, etc.).

Activity on exchanges like Coinbase also influence the value of coins. More transaction (velocity) influences the price upwards. In many cases, when exchanges are compromised by hacks and traffic attacks, cryptocurrency values also take a downward hit.

In the early days, this has mostly been peer-to-peer, with users exchanging their coins to dollars and vice versa through methods like bank transfers and sometimes even through in-game currency. Now, apps are letting us do all sorts of things, from paying bills to sending money to friends, and even shopping using funds from our Bitcoin wallet. Here’s how.

Bitcoin for debit card payments

The biggest benefit of Bitcoin should be how you can spend it, right? While some online stores and sellers already accept Bitcoin as a means of payment, how about the millions of stores and merchants out there that do not? You can’t just show the cashier the transaction confirmation from your Bitcoin wallet — most people do not even know what Bitcoin is.

One startup currently making its mark is CryptoPay, which is making it easy to spend all that cryptocurrency at just about any store with a credit card terminal. CryptoPay is essentially a Bitcoin wallet platform, but it does more than hold your coins for you. One of its main features is the CryptoPay debit card, which is a Visa card that you can use to pay for purchases.

The company has two versions — a physical card that you can swipe (or insert into EMV terminals) and a virtual card you can use for transactions. Either way, both of these are a convenient way to spend your coins on any store without thinking about manually converting these or looking for someone who can buy your Bitcoins.

Bitcoin for your salary

Still working the daily 9-5 grind? Or maybe you are working as a freelancer or remote professional. You might be happy to learn that there are platforms that cater to your crowd. A company called BitWage offers a solution that lets employers pay wages directly to the employees’ cryptocurrency wallets.

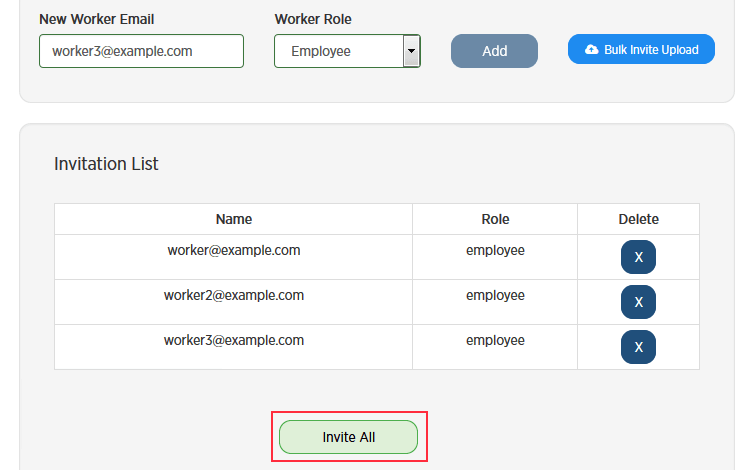

These services make it faster to settle wages, compared to legacy systems that require lengthy bank transfers. For freelancers with international clients, this solution offers a cheaper and faster means to receive salaries, compared with traditional bank transfers. The platform even provides tools for employers to manage their remote workforce.

“Workforces are increasingly becoming decentralized,” says Jonathan Chester, founder and CEO at BitWage. “Payments and trust are areas where Bitcoin and the blockchain offer an advantage.”

Accept Bitcoin from customers

Now the other side of the coin (see what I did there?) is accepting cryptocurrencies as a means of payment if you are running a business. Understandably, setting up yet another payment method might be taxing in terms of cost and onboarding involved. The above-mentioned CryptoPay actually offers this service, offering API access so that you can incorporate Bitcoin payments into your business website or platform.

k Ethereum ETH founder Vitalik Buterin whatever you want on TNW Answers now! →

Going beyond Bitcoin wallets: These apps give you better control over your cryptocurrency-based finances

by DAAN PEPIJN — 8 days ago in CONTRIBUTORS

Going beyond Bitcoin wallets: These apps give you better control over your cryptocurrency-based finances ...

0

Bitcoin is a great technology, right? It is decentralized, it’s cheap to transact, and no government or central bank has control over it. And one other thing, its value seems to be skyrocketing, which means it might be a good time to jump on the bandwagon and use it both as an investment and as a means to transact.

However, don’t convert your entire life savings to crypto just yet. While Bitcoin and other cryptocurrencies have already become mainstream, there are still some challenges ahead. And even with blockchain-powered technologies making life simpler and easier for users, it pays to have a better understanding of what makes cryptocurrencies and blockchains tick, and how we users can actually take advantage.

For one, there is no doubt that cryptocurrencies like Bitcoin and Ethereum are seeing mainstream use through apps and mobile solutions. But it is not always a rosy picture in terms of using this digital money.

In my earlier articles, I took a look at the potentials of blockchain for businesses, in making investments, and even addressing global poverty by giving financial access to the unbanked. But there is a simpler question for us users of cryptocurrencies.

Why can’t I just spend my coins?

The biggest benefit of Bitcoin, Ethereum, and other cryptocurrencies is also its biggest challenge: the fact that it is a purely digital currency. This means the amount in circulation is as digital as the cryptography that has created it — there are no paper bills or coins in circulation. While a unit of BTC or ETH may have its equivalent exchange in fiat currencies like the US dollar, there are no physical reserves of the currency.

The need to spend and exchange coins (for simplicity, we will refer to units of cryptocurrencies simply as coins) has spawned an entire industry of exchanges, where individuals, companies and platforms exchange coins with fiat money (like the US dollar, British pound, Euro, etc.).

Activity on exchanges like Coinbase also influence the value of coins. More transaction (velocity) influences the price upwards. In many cases, when exchanges are compromised by hacks and traffic attacks, cryptocurrency values also take a downward hit.

In the early days, this has mostly been peer-to-peer, with users exchanging their coins to dollars and vice versa through methods like bank transfers and sometimes even through in-game currency. Now, apps are letting us do all sorts of things, from paying bills to sending money to friends, and even shopping using funds from our Bitcoin wallet. Here’s how.

Bitcoin for debit card payments

The biggest benefit of Bitcoin should be how you can spend it, right? While some online stores and sellers already accept Bitcoin as a means of payment, how about the millions of stores and merchants out there that do not? You can’t just show the cashier the transaction confirmation from your Bitcoin wallet — most people do not even know what Bitcoin is.

One startup currently making its mark is CryptoPay, which is making it easy to spend all that cryptocurrency at just about any store with a credit card terminal. CryptoPay is essentially a Bitcoin wallet platform, but it does more than hold your coins for you. One of its main features is the CryptoPay debit card, which is a Visa card that you can use to pay for purchases.

The company has two versions — a physical card that you can swipe (or insert into EMV terminals) and a virtual card you can use for transactions. Either way, both of these are a convenient way to spend your coins on any store without thinking about manually converting these or looking for someone who can buy your Bitcoins.

Bitcoin for your salary

Still working the daily 9-5 grind? Or maybe you are working as a freelancer or remote professional. You might be happy to learn that there are platforms that cater to your crowd. A company called BitWage offers a solution that lets employers pay wages directly to the employees’ cryptocurrency wallets.

These services make it faster to settle wages, compared to legacy systems that require lengthy bank transfers. For freelancers with international clients, this solution offers a cheaper and faster means to receive salaries, compared with traditional bank transfers. The platform even provides tools for employers to manage their remote workforce.

“Workforces are increasingly becoming decentralized,” says Jonathan Chester, founder and CEO at BitWage. “Payments and trust are areas where Bitcoin and the blockchain offer an advantage.”

Accept Bitcoin from customers

Now the other side of the coin (see what I did there?) is accepting cryptocurrencies as a means of payment if you are running a business. Understandably, setting up yet another payment method might be taxing in terms of cost and onboarding involved. The above-mentioned CryptoPay actually offers this service, offering API access so that you can incorporate Bitcoin payments into your business website or platform.

Another option is e-commerce service Shopify, which offers a white-label solution wherein you can establish your own branded store with multiple payment options — yes, Bitcoin included!

Make or raise a coin-based investment

Sure, people are going crazy over how Bitcoin’s value has more than doubled just this May 2017 from $1,300 to around $2,700. However, seasoned investors, entrepreneurs and venture capitalists are now more interested in how businesses can use cryptocurrencies and the blockchain to raise capital for their businesses.

Herein lies the potential of initial coin offerings or ICOs, which enable businesses to crowdfund capital using cryptographic tokens and leveraging on the value gained from buying these at a discount. However, with the number of ICOs being launched, the question is whether this is a viable means of growing capital for investors.

According to George Basiladze, Founder and CEO at CryptoPay, it’s a matter of properly executing an ICO and ensuring its sustainability. “Many companies are launching their ICOs at early stages, but we believe that the companies that will benefit from an ICO are those that already have products that already work with business models that are already tested,” he says.

He adds that it is also a good idea to do due diligence not only on the company but also on the people investing in the ICO. “In our case, only verified users are allowed to invest in our upcoming ICO. We also plan to tie the ICO to the CryptoPay service performance metrics, which means that the tokens each person could get would be tied to their contribution and engagement in the platform.”

In conclusion

Bitcoin and other cryptocurrencies have the power to touch the lives of practically anyone. It’s a matter of finding practical applications and practical tools that give value to its users. The financial tools I mentioned here are truly empowering as they can potentially change lives by helping people save on fees, earn a decent living, and even make a small investment. It’s a matter of taking advantage of the technology even without an in-depth knowledge of how it works.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thenextweb.com/contributors/2017/08/07/going-beyond-bitcoin-wallets-apps-give-better-control-cryptocurrency-based-finances/