Up until now, bitcoin has actually largely been acting as an uncorrelated property. This obtained a lot of individuals excited, classifying bitcoin as a future electronic gold or a safe house property. The most awful thing about this recent dip in cost ($5,873, GDAX) was not the decline in the price itself. Much more discouraging for bitcoin, was that the price dip accompanied the dip of the US stock market.

This graph shows the Dow Jones Industrial Average overlaying the bitcoin cost (red line). A large part of bitcoin's value suggestion to institutional investors is that bitcoin possibly brings low or negative beta. That's finance promote a property having low or an inverted relationship with the marketplace all at once (e.g. the S&P 500).

Property managers like assets with reduced or unfavorable beta. Asset managers' performance is continuously being gauged versus the stock exchange indices. If the assets they handle are associated, it's hard for them to exceed the marketplace. That's why it's extremely important for bitcoin to not dip when the stock market does. But it did.

Why?

"The assumption of bitcoin as an uncorrelated asset may be the most essential motorist in why Wall surface Road intends to enter to bitcoin, however ironically, the extremely reality that Wall Road hasn't entered yet may concurrently be a crucial consider why bitcoin still is an uncorrelated property in the first place."

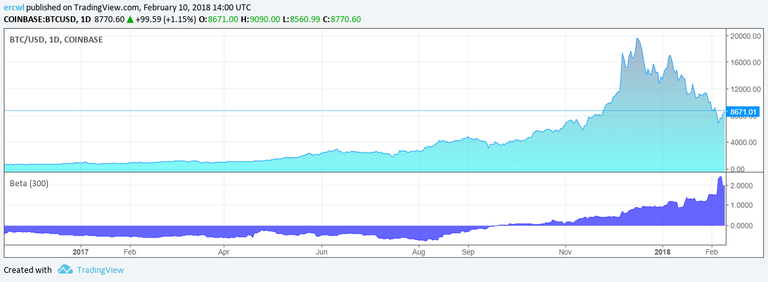

Currently let's story the beta (in purple) for the time period before as well as after bitcoin futures trading began on the CME

A beta of 1 indicates that the possession relocates with the market. A beta in between 0 and 1 means that the asset moves with the market, however dampened. A beta over 1 suggests that the asset moves with the market, yet enhanced. A beta of 0 ways that the property does not move with the marketplace. An unfavorable beta means that the asset moves inversely to the market.

Considering the chart, beta boosted substantially in December, surpassing 2 in February. As a comparison, allow's take a look at the beta of gold, which rarely ever exceeds +0.15.

Trading Pointer 'The Wall ´ - Bitcoin's Beta as well as the Bearishness

Is it then secure to claim that institutional financiers are the reason bitcoin dipped this week? As compelling as this theory appears, evaluation shows that this is more than likely not true. The volumes of CME & Cboe are still also unimportant to move the rate of bitcoin. Bitcoin is still an asset primarily held by retail capitalists.

I would suggest that it is much ahead of time to earn verdicts from the information now. Focusing on this previous week in particular, we can see that bitcoin had already been collapsing for fairly a long time prior to the securities market adjustment took place, and their dips coinciding can be completely coincidental.

Trading Tip 'The Wall surface ´ - Bitcoin's Beta and also the Bear Market

Nonetheless, it is still a distressing growth, as well as if institutional capitalists possibly are exempt for this, there's still been a modification in demographics of the retail investors. Historically, bitcoin has actually been a property generally held by geeks interested in the modern technology, with little passion in the stock market. Currently, traditional capitalists that speculate on the securities market could also hypothesize in crypto. When their stocks crash, they might market the decentralized money to offset their losses, or to get the dip of the stocks they comprehend much better and have a stronger belief in.

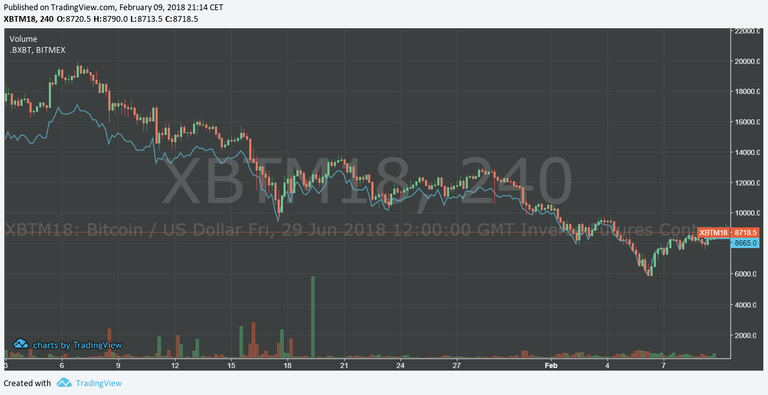

A second thing that gives a bearish outlook on bitcoin is that the costs of the Bitmex June futures XBTM18 vanished entirely this week. Ever since they were noted, they had actually been trading at a premium of several hundred dollars, indicating a bullish sentiment amongst traders. The futures contracts are a less liquid tools on Bitmex mainly engaging for medium/long-term settings as they have no financing fees (as compared with their main, perpetual tools). The loss of that premium recommends that traders are no more favorable on bitcoin in the tool term.

Trading Tip 'The Wall surface ´ - Bitcoin's Beta as well as the Bear Market

I am not bearish on the electronic property in the medium to long-term, yet I would love to point out that while we are experiencing a recover to $9,000+, that does not mean we're out of the woods fairly yet. Allow's look at a graph from the bear market of 2014:

Trading Suggestion 'The Wall ´ - Bitcoin's Beta and also the Bear Market

In the weeks after the accident from $1,163, after which the lengthiest bearish market in bitcoin history would follow, we still experienced bounces. After dropping to $382, the price recoiled to a tremendous $995 before advancing downwards to $185. In today's terms, that type of intermittent bounce would convert into a $17k healing. Normally, you cannot contrast 2014 and also 2018, but this a minimum of mosts likely to show that you should not interpret post-crash volatility as anything greater than simply that; volatility.

What are your thoughts on market manipulation? Let us know in the comment section below!

Cool, following you. Whats your current favorite coin/token?

steem lol $

Dear steemer,

nice post and I followed you :) Please follow me :)

Dear steemer,

nice post and I followed you :) Please follow me :)