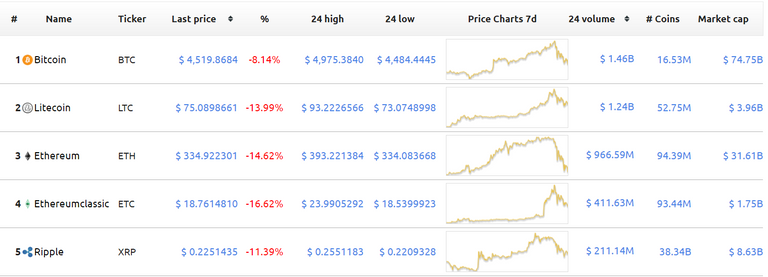

With the recent all-time high of around $5000 for one Bitcoin, some massive profit taking was triggered, resulting in a bloody Saturday for most crypto's.

That is not a pretty picture. Unless if you would be comparing the prices versus what they were about a week ago.

Now the question in many traders' heads is:

Is this decline a larger multi-day correction or even the start of a bear market like we had 2 months ago or is this a bear trap?

I guess everyone understands what a correction means, but for completeness lets bring out the definition from Investopedia:

"A correction is a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation. Corrections are generally temporary price declines interrupting an uptrend in the market or an asset. A correction has a shorter duration than a bear market or a recession, but it can be a precursor to either."

Lets also bring out the definition for bear market:

"A bear market is a condition in which securities prices fall and widespread pessimism causes the stock market's downward spiral to be self-sustaining. Investors anticipate losses as pessimism and selling increases."

So what happened 2 months ago? To refresh our memories, lets look a t the graph of BTC prices versus the US Dollar.

In my view we entered a brief bear market (for many cryptos) rather than a correction, but we came out of it relatively quickly.

Back to the present, we lost about 10% today, more than that in many altcoins. So in which situation are we now?

Lets discuss the 3rd option in the traders heads before i answer that. The bear trap. A a word that is buzzing around at the moment.

Lets bring out the definition from Investopedia one last time:

"In the capital markets, a bear is an investor or trader who believes that the price of a security (or securities) is poised to go down. A bear may also have sentiments that the overall direction of the capital market is headed downward. Bears, therefore, attempt to profit from a decline in the value of a particular security or the market in general. In order to do this, a bear could employ a short position on the security."

Could this be happening now? In my view it could very well be although some gains could have been made taking a short position. So not much of a trap in that sense. But they might be lost quickly too. There are some very solid fundamentals out there for BTC and cryptos in general.The fact that BTC has reached $5000 (although not officially on many exchanges) will create a buzz of media coverage and could bring in additional investors. Not to mention the institutional investors who keep piling in at the moment, largely due to increased ways to participate via derivatives etcetera.

I certainly don't believe $5000 is the top and will stay 'long' as I was. Who knows, the correction might take some more profits away, but I am convinced we are not suddenly going into a bear market now. People shorting during these couple of day might find themselves in a bear trap indeed. But if they are careful, the might avoid the trap altogether.

I wish I had a crystal bowl...

Good luck trading all and stay tuned!

Images:

https://price.bitcoin.com/

http://www.investopedia.com/terms/b/beartrap.asp

http://www.investopedia.com/terms/c/correction.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186

http://www.investopedia.com/terms/b/bearmarket.asp

With BTC reaching the $5000 milestone, the rapid 10% drop that happened this past weekend would "in my opinion" be the very definition of a correction. I figured we were in for a price drop sooner rather than later - and to be honest, I expected it to be slightly larger than it was. Just goes to show how strong Bitcoin really is, and gives an indication just how much all other cryptos are tied to it (or dependent on it).

The bulls are pushing back and who knows, next week we might even have a "stampeed", so to speak. Something tells me, looking beyond next week and into the next two or three months, the gains are going to be epic...

Cool post... Upvoted...:)

Thanks. I tend to think the same. Big carnage today with the Chinese regulation around ICO's. Hope we will get bullish soon again.

Rebuy positions!

Wish i had the money ;)

Bitcoin usually follows a correction before any psychological barrier like the $5,000 mark. From that the alts also collapse, this drop was due anyway.

True points. This was coming. question is how fast will it be on the boards again ;)

Thanks for upvoting!

I think this is just a slight pullback as result of the rapid growth of bitcoin and many of the Altcoins, I think everything should return to normal next week. I hope.

Agree with you. Hope we are right ;)

Hopefully this is just another "Sale Day" instead of a long bear trend like a few months ago... Thanks for shedding light on this (:

my pleasure. thanks for taking the time to read and comment.

Hard to say whether we're in a bear market based on a single day price change. I know most people don't share my sentiment but I'd love to see a large price drop to pick up more BTC.

haha yeah, looks like you might be too late buying already.

@attalis got you a $1.27 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

This post has received a 0.78 % upvote from @drotto thanks to: @attalis.

This post has received a 4.00 % upvote from @buildawhale thanks to: @attalis. Send 0.100 or more SBD to @buildawhale with a post link in the memo field to bid on the next vote.

To support our curation initiative, please vote on my owner, @themarkymark, as a Steem Witness

This post was resteemed by @resteembot!

Good Luck!

Learn more about the @resteembot project in the introduction post.

Check out the other content resteemed by @resteembot.

Some of it is really cool!

I don't know what it is, but I've always felt people get emotional about "significant numbers".

Not significant as meaning large numbers, but more like specific points.

For example, why does $19.95 feel so much better than $20 to people?

It's all mental/emotional. You're really not saving that much.

Take that thought into trading now.

If a coin hits $41.23 I really don't care much, but if it's close to hitting a rounded out $50 or $100...it feels different.

It's like a magical barrier IMO that people get in their heads that oh it hit this magic number I feel like it's too high I should take some profits off the table.

I know that might sound super stupid and I have ZERO data to back it up at the moment, but I feel like that's a weird thing for people.

In other words, I not only think people pulled out of bitcoin because it was an ATH, but because it got close to hitting the magical "5k" number.

~nX