What is network valuation? Why do people talk about network valuation in regards to Bitcoin? Isn’t Bitcoin money? How can I easily see the value of the network in real time?

**Please Note:

Bitcoin is a network. Per the whitepaper, Bitcoin is the network. "coins" are the on network currency. In everyday language, we call those coins "Bitcoin" because it's easier than "Bitcoin coins", "Ethereum coins", "Litecoin coins". **

Here's a few key points to understand:

- A network's value is determined by the number of users.

It can be the best network ever, but if noone is using it, it has no value. - A network must have at least 2 users to have value.

Think Alexander Graham Bell (inventor of the phone), who was he going to call? His assistant, with another phone. - A single user adds more than 1 additional connection (past the second user).

I have a phone. My sister has a phone. That's 1 connection.

me-----sisterThen my brother gets a phone. That's 3 connections, 3 users.

me ---- sister

me-----brother

sister-----brotherThen mom gets a phone. 4 users. 6 connections.

me ---- sister

me-----brother

me-----mom

sister-----brother

sister-----mom

brother-----momHere’s a handy dandy table to visualize this:

User # # of Possible Connections # of Possible Connections Added with User # 1 0 0 2 1 1 3 3 2 4 6 3 5 10 4 25 300 24 100 4950 99 - Bitcoin is a network.

Look at the table above. If I have coins to use on the Bitcoin network and no one else is using Bitcoin, does it have value? No, it doesn’t. Each additional person that uses Bitcoin adds a huge amount of value because it greatly increases the number of connections each person can make. Imagine that chart taken all the way to 100,000 people. 1 million people. 5 million people. - Each user has a value

To you, a phone wouldn’t be worth much if the people you wanted to talk to didn’t have one right? Who are you going to call? Bitcoin is the same way. Where are you going to spend your money? Who are you going to buy from? If we added your landlord to the network, then suddenly Bitcoin has value to you beyond an investment. If we added your power company to the network, same thing. Your landlord may only be your landlord and that means it only really increased the use of the network for you. Your power company though, they serve hundreds of thousands of customers, which increases the use of the network for all of those people who are both served by the power company and who are in crypto. - There’s an average value per user

If you look solely at an individual or solely at a power company as a user, then you don’t really have an accurate representation of the average user and the value of an average to the network. A power company may make a hundred thousand connections, but an individual user may only make 5. The number of connections determines the value the user adds to the network. You know this already on a common sense level. You know that a store that accepts crypto is a better addition to the network than your brother in law. Both add value. One adds significantly more. In the aggregate, all of the users can be averaged to find an average number of connections per user. - Connections have value

Like users, each connection has value, and connections have an average value. If the only person you knew that had a phone was the person you wanted to talk to, you’d have a phone. If the only person you knew that had a phone was someone you definitely didn’t want to talk to, you’d probably skip having a phone because it wouldn’t be a connection that had value. This is one of the issues with Bitcoin right now. Who does the network have value for? The answer to that is growing slowly over time. It has value to people moving money internationally. It has value to people limited by the traditional banking system (and while that includes criminals, most users are not criminals). It has value to those who don’t want to be involved with the banking system. - Bitcoin Coins have value

The on network currency, which we commonly call “Bitcoin”, has value because it’s how you use network resources. When you use a phone, you either pay by the minute, by a service period, or by both. When you pay your phone bill or purchase time for a phone, you’re purchasing network resources. When cell phones were newer to the market, there was reduced use on nights and weekends because business people weren’t doing business then. Cell phone networks incentivized users to make calls on nights and weekends instead of during the day by making it free to call at those times. Since there was no natural penalty for demanding resources during peak times, the network created one. The on network currency is how you bid for and purchase network resources (bytes in a block) on Bitcoin. Because there is an auction system, where you bid for your place in a block, when there is greater demand for network resources, you either pay more per byte or you wait. - The capacity of the network impacts demand

When the network is near capacity and there are large bids for the limited network resources, Bitcoin price tends to rise. Bitcoin does have a limited, but increasing, capacity. - If a connection has enough value, people will pay more to make it happen. If it doesn’t, people will wait.

In the cell phone example above, business people couldn’t wait. They had to make their connections during the day time which meant they found enough value in those connections to make them with the additional cost. People calling home or chatting with friends, they were willing to wait to make that connection because the cost difference in the delay of making the connection was worth it to them. Remember, they also had the option of other methods – landlines which charged for long distance, snail mail, etc. - Adoption impacts network value

In the examples above, you’ll note that adding users increases the value of the network. It’s important to understand this because people think the only way to raise Bitcoin’s price is by buying buying buying in a speculative manner. Bitcoin is a network. The value of the on network currency rises because there is demand for it. Want higher prices? Increase adoption. - Adoption of an alternative network requires the 3 C’s.

Cost Effective. Control. Convenient. Existing networks that are similar to Bitcoin are MoneyGram, Paypal, Western Union, ACH/Bank Transfers, Paypal. Bitcoin is usually much cheaper than percentage based transfers like Paypal and Visa and services like MoneyGram, Western Union, and as quick as or quicker than them. The only thing that Bitcoin is not quicker than is Visa (and similar) in retail transaction confirmation, however this speed comes at the cost of chargebacks, percentage based fees, and other issues because settlement takes far longer. It’s quicker than a check. It’s quicker than ACH. It’s quicker than wiring money via Western Union (at normal speed/next day, you can pay to upgrade). The only two barriers to adoption unique to crypto are perception and the learning curve. One is a huge barrier that it will take time to conquer. The other is being conquered with consumer level solutions that decrease the level of knowledge needed. - Value of connections, users, and networks can be determined

The value of the Bitcoin network can be determined using mathematical formulas that count the number of users(addresses) that are active and the connections they make. Average values are determined and used to establish both historical and predictive models. These are useful in analysis and prediction of price action, identification of anomalous activity like price manipulation, and user behavior. - The only users that matter are active

In addition to being used to value telecom networks, they're also used to value social networks like Facebook, Tencent (China), Twitter, Steem, and so on. Myspace is a good example of why only active users matter. Does it matter how many users they once had? No. What matters is the value of the network presently and that is based on the users presently active. In network valuation, we mainly look at activity on a monthly basis. - Users are called nodes

In network valuation, users are actually called nodes. In the instance of a business with one phone number but many extensions, the extensions are internal, and the business is one user or "node". These nodes are not to be confused with a Bitcoin mining node. When we're talking about nodes in the context of network valuation, we're discussing addresses, unique addresses that were active over the past month. In some network valuation writeups, you'll see this referred to as "Monthly Active Users" or "Active Nodes" or " MAU's".

Links about Network Valuation:

https://www.technologyreview.com/s/610614/how-network-theory-predicts-the-value-of-bitcoin/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3078248

https://arxiv.org/pdf/1803.05663.pdf

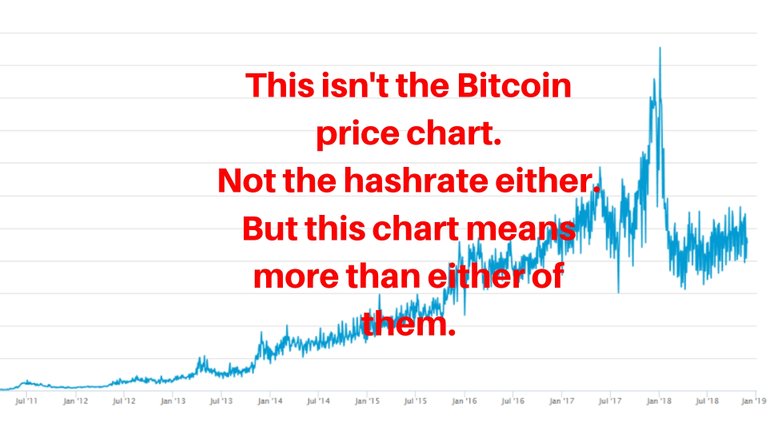

The Only Chart That Matters

In simple terms, the best way to increase the value of the coins we use on the Bitcoin network is to increase the number of people using the Bitcoin network.

Out of all of this math geekery, the most accessible real time chart that shows you what's going on without requiring you to do math, compare it to the price chart:

https://www.blockchain.com/en/charts/n-unique-addresses?timespan=all

Thanks .

Thanks for the valuable information.

Excellent article! You're one of my favorite authors on Steemit.

Brilliant!

Posted using Partiko iOS

Thanks :)

Really smart and informative post. Keep up the good work.

This is stupid. By this logic so many other crypto networks would be worth way more.

Hey @blowmywhistle , each chain has their own metrics. You can establish valuation for each individual chain, you don't have the same metrics for each chain. Resources on each chain have different values and values change as conditions change. One big example of this is lightning network. Because a transaction no longer requires network resources, we see a lower value per user and a lower value per connection formed.

Read up on the netoid formula and the applications of metcalfe's law in the links provided.

If you check out the transactions on chain, the only chain doing more is ETH and there are subnetworks that use the ETH chain that have their own valuation. It's backwards to consider all tx on ETH to go towards the ETH network value and therefore ETH price when there are countless other on chain currencies that dilute the value. Second, to compare to the active unique addresses like I pointed out for Bitcoin above, here's a handy chart:

https://bitinfocharts.com/comparison/activeaddresses-btc-eth.html

If you'd like to look at other potential competitors, there are buttons in the bottom left that add additional currencies.

WHile I agree on principal on most things. Reality is different to what OP is saying. Eth seems to be used far more than bitcoin onchain.

Hi @evilmonkey, you seem to be confusing tx volume with # of users:

Tx volume:

https://bitinfocharts.com/comparison/transactions-btc-eth-eos.html#1y

Unique active addresses:

https://bitinfocharts.com/comparison/activeaddresses-btc-eth.html

Also, as noted in my comment to "blowmywhistle", the only chain doing more is ETH and there are subnetworks that use the ETH chain that have their own valuation. It's backwards to consider all tx on ETH to go towards the ETH network value and therefore ETH price when there are countless other on chain currencies that dilute the value. To get a good idea of the ETH network valuation, you'd have to total the value of ALL on chain currencies.