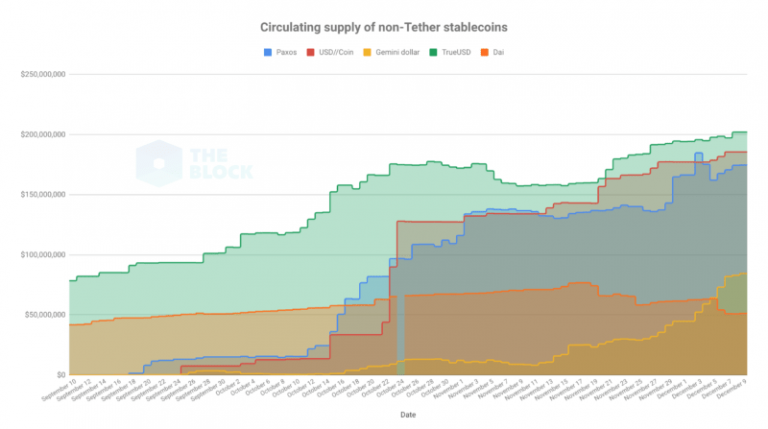

2018 has been a big year for the stablecoins, as many alternatives to Tether have begun to launch and are now available on most popular exchanges.

These include TrueUSD, USDcoin, Paxos, Gemini’s GUSD and more. Each new coin has emerged with an aim to increase the level of transparency in the stable coin market, something that Tether has been notorious for failing to provide over the years.

As a result of this space, which is becoming more crowded, Tether’s dominance over the market has predictable weakened, from 96% before October 2018, to 73% in December.

.jpeg)

TrueUSD, USD Coin and Paxos now all have a circulating supply north of $170 million while Gemini is trailing with nearly $85 million.

Although the idea of multiple stable coin options may seem redundant, they actually serve an important market function by reducing the overall risk of one stable coin failing to stay pegged to the USD. Smart investors who want to keep their crypto pegged to the USD will most likely divide it amongst 3 or 4 stablecoins to manage the risk of one coin experiencing volatility for whatever reason.

The need for alternative stable coins was made very apparent when Tether experienced a 2.1% decline to the US dollar, causing rival stable coin TrueUSD to experience a 4% increase when paired with Tether. It was most likely not a coincidence that this was also the time when Tethers dominance over the stable coin market dropped from 96% to 73%.

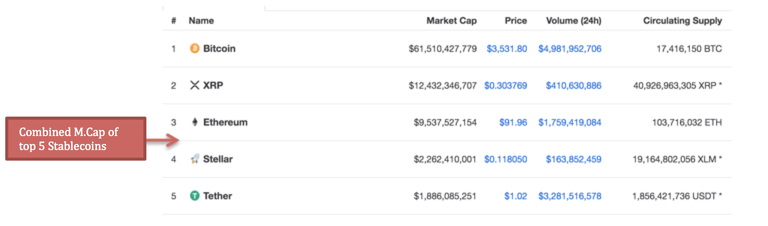

What’s also very interesting to observe about Stable coins is the positions that each hold on the crypto’s Coinmarketcap list:

Gemini is #48 with a market cap of $88 million

Paxos is #28 with a market cap of $178 million

USD coin is #26 with a market cap of $194 million

TrueUSD is #25 with a market cap of $209 million

Tether is #8 with a market cap of $1.8 billion

This means that we have a combined market cap of $2.46 billion for the top 5 stable coins, which places the total value of these 5 stablecoins at #4 behind only Ethereum, XRP and Bitcoin:

Since all of these stable coins are pegged 1-to-1 with the US dollar, this data is an indicator proving the demand for US dollars among crypto investors. The bear market is likely a significant contributing factor to the rise of stable coins, and we can anticipate that a bull run would push their combined market cap a lot further down as investors would feel more confident in placing their funds back in cryptocurrencies that are experiencing upward volatility.

Source - CRYPTOPOTATO TEAM 2016

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://satoshinakamotoblog.com/tethers-dominance-had-dropped-to-a-three-years-low

WARNING - The message you received from @robin.evergreen is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-site-reported-steemboostup

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.