Index - https://steemit.com/tax/@alhofmeister/accounting-and-finance-blog-index

Introduction

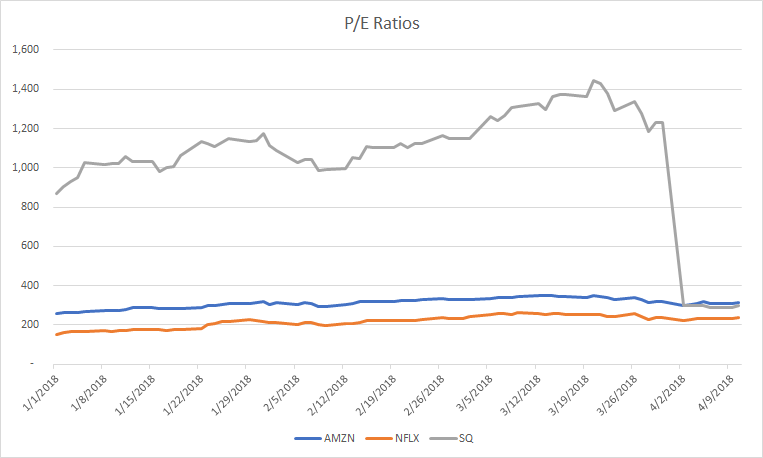

In this post, I wanted to present two graphs. The first graph shows the price to earnings ratio for companies that have high P/E ratios. Note that the earnings is calculated on historical data, so the high P/E ratio for Square (SQ) represents the increase in earnings since the last reported period. The second graph shows the year to date performance of each of the 3 companies (current market cap / market cap as of January 1). As demonstrated by the second graph, each of these stocks have performed very well since the beginning of the year. In a second post, I will examine the performance of stocks with a low P/E ratio.

P/E Ratio

YTD Performance

References

https://www.zacks.com/stock/chart/AMZN/fundamental/market-cap

https://www.zacks.com/stock/chart/NFLX/fundamental/market-cap

https://www.zacks.com/stock/chart/SQ/fundamental/market-cap

https://www.zacks.com/stock/chart/AMZN/fundamental/pe-ratio-ttm

https://www.zacks.com/stock/chart/NFLX/fundamental/pe-ratio-ttm

https://www.zacks.com/stock/chart/SQ/fundamental/pe-ratio-ttm

@contentvoter

Hi :) Keep up the good work! It's always nice to see good content here on Steemit! Congratulations!

informative post. thanks for knowing us.keep sharing.hope people will be benefited on this.keep it up.

im much intrested to about litecoain. what u think as a expart is it growing up??

I am not an expert on Litecoin or cryptocurrency investment in general. It's impossible to tell what's going to happen with cryptocurrency as a form of investment (speculation). In my opinion, there's a large financial bubble in crypto investment that hasn't fully deflated. It's difficult to value, however, as there are no tangible or intangible assets which contribute to crypto valuation.

Followed and Upvoted, Keep up the good work and looking forward to more from you.