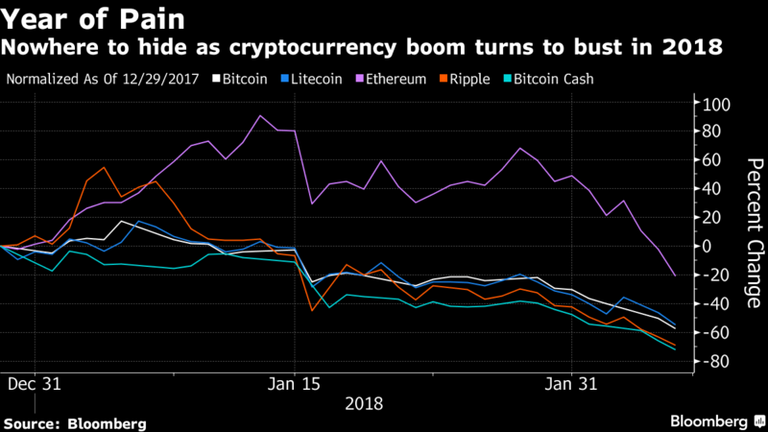

Bitcoin Breaches $6,000 as Cryptocurrency Exodus Accelerates

Digital coins have lost $500 billion since January peak

Regulators in focus before U.S. Senate hearing on Tuesday

The rout in cryptocurrencies deepened on Tuesday, sending Bitcoin to its lowest level since November, as worries over tighter U.S. regulation gave traders another reason to sell after a brutal start to 2018.

The rout in cryptocurrencies deepened on Tuesday, sending Bitcoin to its lowest level since November, as worries over tighter U.S. regulation gave traders another reason to sell after a brutal start to 2018.

The biggest virtual currency sank 16 percent to $5,981 at 8 a.m. London time, according to Bloomberg composite pricing. Alternative coins Ripple, Ether and Litecoin also tumbled at least 16 percent.

The slump followed a Bloomberg News report that America’s two top market watchdogs are planning to ask Congress to consider federal oversight for digital-currency trading platforms, many of which have been operating in a regulatory gray zone. Chiefs of the Commodity Futures Trading Commission and Securities and Exchange Commission will appear together at a Senate Banking Committee hearing to discuss cryptocurrencies on Tuesday.

“The market is feeling regulatory pressure,” said Zhou Shuoji, a founding partner at FBG Capital, a Singapore-based cryptocurrency investment company.

Cryptocurrencies tracked by Coinmarketcap.com have lost more than $500 billion of market value since early January as governments clamped down, credit-card issuers halted purchases and investors grew increasingly concerned that last year’s meteoric rise in digital assets was unjustified. This week’s selloff has coincided with a rout in global equities, with markets in Asia extending losses on Tuesday following a white-knuckle day for U.S. stocks.

Some technical indicators suggest the rout in Bitcoin has further to go. The cryptocurrency’s Moving Average Convergence Divergence indicator, the most profitable of 22 trading signals tracked by Bloomberg over the past year, is flagging further downside after turning bearish in December.

Bitcoin also dipped below its 200-day moving average for the first time in more than two years on Tuesday. The last time that happened, in August 2015, the cryptocurrency sank as much as 24 percent over the following two weeks.

For more on cryptocurrencies:

Bitcoin Crash Sees Miners Fried in This Game of Chicken: Gadfly

Bitcoin Trading Signal That Returned 1,152% Is Flashing Sell

Cryptocurrency Rules From Congress Sought by U.S. Market Cops

Bitcoin Selloff Among Biggest in Digital Coin’s History: Chart

Why Bitcoin Goes Down as Well as Up (Plus What It Is): QuickTake

Power-Hungry Crypto Mines Clean Up as Cost of Electricity Grows

— With assistance by Justina Lee

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/news/articles/2018-02-06/bitcoin-slumps-below-7-000-as-cryptos-hit-by-risk-asset-rout