- South Korea :

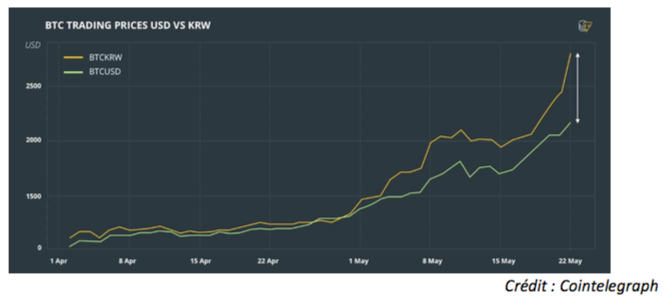

We arrive here in the big leagues. After the United States and Japan, South Korea is the world's third largest market for cryptocurrencies. Despite its relatively small population (50 million inhabitants), South Korea has more than a dozen exchange platforms such as Bithumb, Korbit and Coinone. Crypto demand is such that prices are regularly up to 30% higher than in other countries.

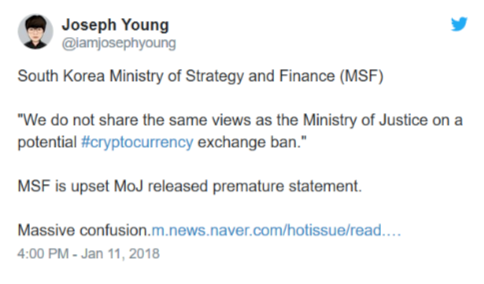

On January 14, Korean Justice Minister Park Sang-Ki proposes to ban trading platforms. Reuters reporters jumped at the opportunity to distil FUD into the markets by reporting an imminent ban. Our journalist friends forgot to mention a quotation from the South Korean Department of Strategy and Finance, the same day, reported by Joseph Young:

We must also point out the remarkable mobilization of the Koreans who launched a petition calling for the refusal of the cryptocurrency ban which quickly gathered more than 200,000 signatures.

On January 31, South Korean Finance Minister Kim Dong-yeon confirmed in a statement that the government has no intention of banning or suppressing the country's cryptocurrencies. New rules are however put in place:

Anonymous exchanges are now prohibited. Korean exchanges must now identify their members (KYC) and measures to combat money laundering are in place (AML).

These trading platforms will be taxed at 24.2%, in accordance with South Korean tax rules for any company with an annual income greater than 20 billion Won.

Foreigners and minor Koreans can no longer be held accountable for Korean trade.

We are very far from the ban reported by the mainstream media. South Korea is a huge market, but the impact of their ads has had a significant impact on the overall picture. However, we could see that the drop (-40% in 24 hours) was followed by a significant rebound.