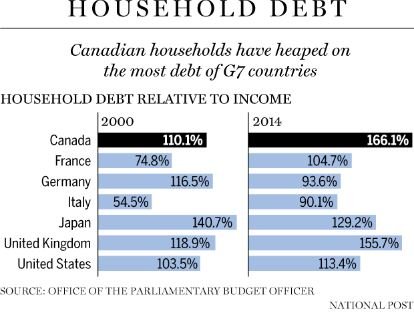

The Debt Crisis ..

Because the amount of savings has greatly decreased over the past few decades, the banks are forced to virtualize their profits and growth based on these debt products.

UNSUSTAINABLE!

Modern Slavery

These offerings, once limited to house, car and small business loans, are now more often for debt consolidation. They are designed to keep people in a constant, even life-long, state of paying interest on credit cards and credit lines, without touching the principle .. in other words, you now work for the banks .. you are a profit machine for the banks, forget the dream of ever owning your own home .. this is a far better arrangement for the banks than any 20 year mortgage.

Profit-seeking Organizations Are Naturally Short-sighted ..

If it works for them today, why change it? See how far we can ride this donkey until it quits, right? Well .. this type of thinking is what led to every crash, crisis, depression and other man-made disasters throughout history. If you catch a bank economist away from the office and ask him over a drink what they think the future has in store .. they will say, well .. "a total f***ing train wreck, where no one escapes becoming a casualty! but I can't say that to my bosses, because .. you know .. gotta keep it positive!"

Some Are Waking Up ..

Lately we have seen a tonne of money flood into the crytpo-universe, and it is not all from random hipsters who finally woke up to this because they don't want to work at McDonalds forever. It is institutional money coming in, through their backdoors, to boost profits and to test whether they can take money offline, to store it safely and to grow it as well, through trading and natural increases in price.

When it hits the fan, you have to know one thing .. that the capital moved into crypto will be sudden and unimaginably large ..and every viable coin or token will benefit. The risk management people, the forecasters, the people responsible for saving the system after collapse, are paying attention and they are learning about us .. they are no longer walking around with very large question marks over their heads - they see BTC and ETH, they see STEEM and they are examining EOS .. they know LTC, ZEC, and even DASH... ;-) .. they know the differences and measured each's chances of remaining relevant.

Gain and Hold As Much As You Possibly Can!

Soon, thanks to @officialfuzzy and the Whaleshares team, we will have means to accelerate our obtainment of STEEM!

WhaleShares ..

You have seen many posts on the subject lately, so all I will suggest is that you prepare for the arrival of this very helpful mechanism of gaining substantive upvotes from participating whales. The first thing you must do is open a Bitshares account, which is where these WhaleShare tokens will be distributed.

Follow the link below, and prepare to make a brighter future for yourself and yours ..

@zentat Thank You 4 Your post and tend to agree with your suggestions AND certainly hope you are correct.

UpVoted & Following...please consider following me. Thanks again

@sacred-agent agree with you and @zentat followed both follow and upvote .thanks buddies

@ermoonvictor Thank You... Hope You had a Great Weekend !!

Agreed, the current ecenomic model isn't sustainable!

Crypto, will be the way forward to keep the these modern slaveowners in check!

We critique a proposal to use catch shares to manage transboundary wildlife resources with potentially high non-extractive values, and we focus on the case of whales. Because whales are impure public goods, a policy that fails to capture all nonmarket benefits (due to free riding) could lead to a suboptimal outcome. Even if free riding were overcome, whale shares would face four implementation challenges. First, a whale share could legitimize the international trade in whale meat and expand the whale meat market. Second, a legal whale trade creates monitoring and enforcement challenges similar to those of organizations that manage highly migratory species such as tuna. Third, a whale share could create a new political economy of management that changes incentives and increases costs for nongovernmental organizations (NGOs) to achieve the current level of conservation. Fourth, a whale share program creates new logistical challenges for quota definition and allocation regardless of whether the market for whale products expands or contracts. Each of these issues, if left unaddressed, could result in lower overall welfare for society than under the status quo.

But they already are, my dear @zentat. Subjective blindness of profit-seeking organizations does not negate objective performances of crypto.

Depends on what you mean by soon, @zentat

Has the market capitalization of all cryptos together crossed USD 100 billion?

How long will BTC take to reach USD 1 trillion, as compared with USD 8 trillion of gold already mined?

How much fiat USD do you need to manipulate the crypto market and/or to move it? Like Palpatine's demand for BTC?

Does not a hedge protect value?