I have been dealing with the basic income and Silvio Gesell for years. He had developed the money system in which the value of money diminished over time. His project had great success.

About 8 years ago I developed a system that brings both things together. There is a basic income and, at the same time, the money on the account becomes less (roughly like fruit that loses quality over time).

If the user does not do anything, the basic income and the "loss of the value" are compensated over time.

The idea I developed further, but then never tried to realize. There was no crypto currencies and using real coins and paper money, it is not possible.

The combination of both systems has the great advantage that the amount of money can only be increased by the amount of users (and per user even by a limited amount). Because the money loses value, the user would like to spend it quickly to get the full sum of the basic income. This leads to a good dynamic.

I would like to try to translate parts of my notes from that time. I had also thought about taxes, health expenditures and loans.

(The thoughts of 2009)

How it works

Daily payment

Every day $ 100 is credited to the personal account (I used the size at the time and will be there for the explanation). You do not need to do anything, just have a personal account.

Loss of value

From the capital of the account (daily payments and other merits), 1% is deducted every day.

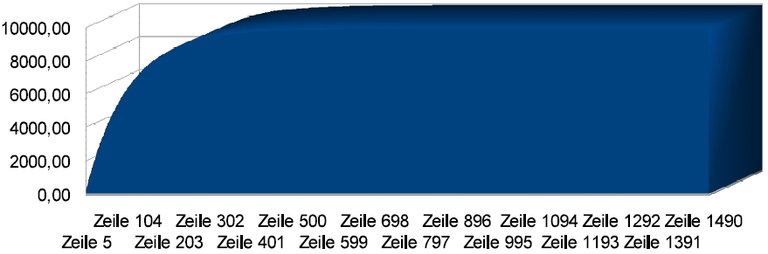

If money is not transferred or withdrawn from the account, the account balance behaves as shown in the following graphic.

On the left you see the sum in $ and below the days (in the graphics as "Zeilen").

The increase is rapid and is flattening towards the top. After a year, about $ 9,750 are in the account. After about 4 years the maximum sum, which can be achieved by the daily payments, is reached. These are $ 9,900, which are calculated as follows: To the already $ 9,900 come $ 100 daily payment = $ 10,000. Of these $ 10,000, one percent is deducted = $ 100, which means we are back at $ 9,900.

So there is no advantage to simply leaving the money on the account. It is better to have little capital in order to make full use of the daily payments. This ensures that the money flows.

If one has more than $ 9,900, the one-percent deduction is higher than the daily payments. It is therefore advisable to spend this money and to invest in something worthwhile.

The account

The account should have a graphics function as well as the account balance. Which makes it easy to see how capital develops in the future. You can also use a configuration option to include regular payments or income.

The inclusion of States

If states are willing to accept this money as a currency, you can grant taxes in a separate system. These taxes would be paid to the state as daily payments and would be exactly calculable for the state (not the current estimates). Whether they are calculated from the population or the size of the country should be discussed. The percentage decrease in the amount of money should be clearly less than 1%, so that the state can plan in the long term.

Lending

Loans are indispensable for larger investments. The funds for the loans should only come from assets. It must be arranged in such a way that you can lend your money to other people. The money is transferred to an intermediary. This intermediary looks at the borrower that the latter can also repay the money. If this is the case, the credit is granted.

In order to take account of processing and transfer times, the money for the intermediary and the money from the intermediary to the borrower should be worth one month each.

This procedure has three advantages:

- The lender shall be refunded the same sum as he has lent.

- Money flows and does not simply lose value. The money therefore has no loss of value for credit.

- The borrower can make his investments and only repay the loan sum.

Health spending

Expenditure on health care measures, as well as taxes, can run separately. The link between merit and health expenditure is no longer available. However, the question remains open as to what is to be paid.

(In 2010 I have made further considerations, which some thoughts concretise)

Five parts:

- The tax system operates independently of a basic income for the state.

- Each citizen receives a basic income.

- Money loses value over time (similar to a vegetable).

- The health system is being re-integrated.

- There is no speculation or money growth over interest.

The money is personal. Each account holder receives $ 100, - per day minus 1% / day of the account balance. At $ 9,900, the two are balanced against each other.

The government also receives $ 100, - / day minus 0.5% / day per person. At $ 19,900, both are balanced against each other. Depending on it, it would also be conceivable to design a key per square meter of land area for the personal key. This would be a good balance between states with a small area and a dense population and states with a large area, but small population.

Expenditure on health

A parallel account is set up for each person. This may only be used for expenses such as doctors or naturopaths. All persons who wish to receive money from this account must register with the state. Depending on the training, the fees will be fixed.

Prescribed medications are entirely paid for by this account. Pharmaceutical drugs may be paid for half of this account.

In order to be able to pay at a higher cost, this account is funded. How high this should be must be discussed. In addition, the account is credited to X $ per day and nothing is deducted.

If the money is fully used up, an application for the costs can be submitted. After which selection should be followed, must be discussed.

Business accounts

You can open any account you like. For each account, 1% / day is deducted.

Loans

To protect money from the 1 percent deduction, you can make it available as a credit. For this you have a "credit account" on which you can transfer money. The value of the money remains the same until a borrower is found. If you transfer the money back to the normal account, the percentages are deducted according to the time the money was in the credit account. The borrower pays the money back without interest. The selection of which money is borrowed from this total pot is based on the deposit date. The amount paid is irrelevant. Thus it is excluded that a very rich person takes the whole credit market for himself. (Other control mechanisms can be installed here.)

If there is more need for loans than money is available, the government can possibly lend (should be discussed).

Death

If a person dies, the entire sum of the account for health will be forfeited. All other sums can be inherited.

Today

My reflections have already gone quite a long way.

Instead of saving something, a loan must be taken. In order to keep the value of the money stable, there is also the possibility to invest in "real" values and sell them later. This is also a risk factor, as the rich are strengthened. In order to prevent this, a reform of the land reform, further changes of the law, and generally a change of man (for man is always looking for influence - in our time over the money) would have to take place.

So it is somewhat utopian :-)

This is great Gregor. Combining Gesell's Freigeld and basic income in my view is the most important concept now. Did you hear about $solidar? If not, please check out their website https://www.winc-ev.org