How sure are you that the money you deposit in bank is your money as soon as you deposit it? And why do you think that a $10 bill is actually worth $10.

Before breaking the above question, let’s go way back in time to see how this banks existed in first place.

How Banks Came Into Existence.

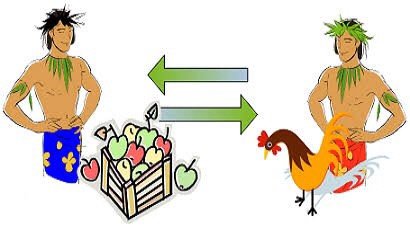

In your grandparents or great-grandparents generation, people didn’t had a good financial framework. They had this thing called barter system where people actually used to exchange goods and services in exchange of other goods and services. For instance, people used cattle for exchange of rice or land. It was kind of like “I’m doing you a favor for which you’ll do me a favor and we’ll be even” kind of thing.

Later people discovered that barter system was not working out great cause it wasn’t divisible. Like if someone wanted 2kg of rice and the other person has a cattle with him, he just simply cannot cut the cattle and pay for his 2kg of rice. Moreover there was one more big problem with that system. It wasn’t portable. I mean imagine a situation where you need to carry your cock to the supermarket for exchange of your groceries.

Because of all those problems related to barter system, people started using and accepting precious metals such as gold and silver. As they are PRECIOUS metals, they were worth much.

But the preciousness of those metal attracted a lot of thieves. To overcome this situation and to prevent theft, people started up depositing their gold to their goldsmiths.

While depositing it to a goldsmith, people got a receipt back on which the amount of gold deposited was written.

Later people started to exchange those receipts for goods and services. It actually made sense because better than going to a goldsmith, exchanging the receipt for gold and giving the person gold, they can exchange the receipts. Moreover this solved the issue of portability. But it gave rise to another issue. Since there were a lot of goldsmiths, it was hard to believe on those receipts.

This system continued for generations and later, the goldsmiths turned into bankers, those receipts turned into currency notes. The Bank was now a central Authority which would authorize the notes. But this led to a another situation. There were a lot of notes to authorize which was a burden for the authority.

The solution was simple. The central authority started printing their own notes. That’s how FIAT currency was born. So now the money that we are using is known as FIAT money which is printed by central banks.

Breaking Down FIAT Currency.

Well heading to the question quoted in the beginning. Why do you think that a $10 bill in your pocket is actually worth $10. Well the answer is simple. It’s just because you trust the authority that prints it. It is worth the amount it is written on it because of people’s trust. Suppose the central banks told that from tomorrow $10 bills are illegal and that they have printed new $15 bills which will be legal (which is known as demonetization) the next thing you do is deposit your old currency with the bank in exchange of a new one. So if the authority says that $10 bill is illegal, people loose trust on that and they won’t accept that currency in future. So if people loose trust, what you carry in your pocket is a piece of paper with a number printed on it.

Inflation And Hyperinflation of FIAT.

Well the central authority of a particular country can print notes whenever there is need to do it so. When they start printing notes above the threshold, it leads to inflation and hyperinflation.

Due to inflation and hyperinflation, a FIAT currency starts to loose its value when it is compared with the economical value of currency of other country. Which leads to major drop in the economy of the affected country.

A more recent example of hyperinflation is Zimbabwe, where, from 2007 to 2009, inflation spiraled out of control at an almost unimaginable rate. Zimbabwe’s hyperinflation was a result of political changes that led to the seizure and redistribution of agricultural land, which led to foreign capital flight. At the same time, Zimbabwe suffered a terrible drought that combined with the economic forces to virtually guarantee a failed economy. Zimbabwe’s leaders attempted to solve the problems by printing more money, and the country quickly descended into hyperinflation that at its peak exceeded 79 billion% per month.

Is the money you deposit in the bank is still your money?

Well , the answer is no. As soon as you deposit your money into the bank, it’s the bank’s money. They just show you some digital numbers on a computer making you believe that you have money in your account. But in reality, it isn’t yours anymore.

Ever wondered what would happen if all the people on planet asked their deposited money in bank for a withdrawal. Can they process it?

Well again, the answer is no. They cannot give you the money because they don’t have it.

Either they have lended it to someone else or might have spent it somewhere.

If you take a look at the cash to deposit ratio of major banks such as JPMORGAN, Goldman Sachs, Wells Fargo , approximately 98% of the deposit is not covered. Which means if you had deposited $100 in a bank. You’ve got only $2 with you. They just enter the amount you deposited in a computer which stores it in your account database and that is what you see every time you check your balance online. In reality you own only 2% of the amount you deposit in banks.

Ever swiped a card and it showed declined even though you had balance in your account? Well now you know why.

What do I do then.

Well the simple solution to this is changing the entire payment system.

Ever heard of Bitcoin of Virtual Currencies?

Yes they are scalable, divisible and portable. As they are limited in number, it is inflation resistant.

I see VC’s as the future of payment system. It solves almost every problem from the barter system to current financial system.

It uses Blockchain which in simple words maintains a ledger about every transactions made. It is transparent and it doesn’t need any third party to confirm your transactions. So we can totally eliminate banks from here.

PS: Not a financial advisor but I totally believe in Bitcoin.