Most of the existing cryptocurrencies have an issuance cap and artificially create coin deficit to increase the value of the tokens issued. Unlike them, the volume of coin issuing in Ethereum was never capped, but at the last DevCon3 conference in Cancún, the platform creator Vitalik Buterin said that in the future he plans to limit the issuance.

The platform team is now actively working on choosing the best way to permanently destroy tokens. In order to remove ETH from circulation, it is planned to apply commissions for applications based on Ethereum blockchain. According to the young genius, such charges would eventually “burn” redundant Ether.

The model of tokens availability reduction/burning by means transactions fees described by Buterin is already implemented in the Neuromation project.

“The mechanism of progressive deficit in flotation is squeezing the tokens offering: The more transactions — the fewer tokens, and the higher the demand for them,” Neuromation CEO Maxim Prasolov explains the concept choice. Unlike a fiat currency, the token’s divisibility is unlimited, each Neurotoken consisting of 100 million fractions, “Neurotokes”. There is a platform commission fee and a “burn” factor applied to each transaction in Neurotokens — the flotation reduction occurs as the customer pays for the platform services.

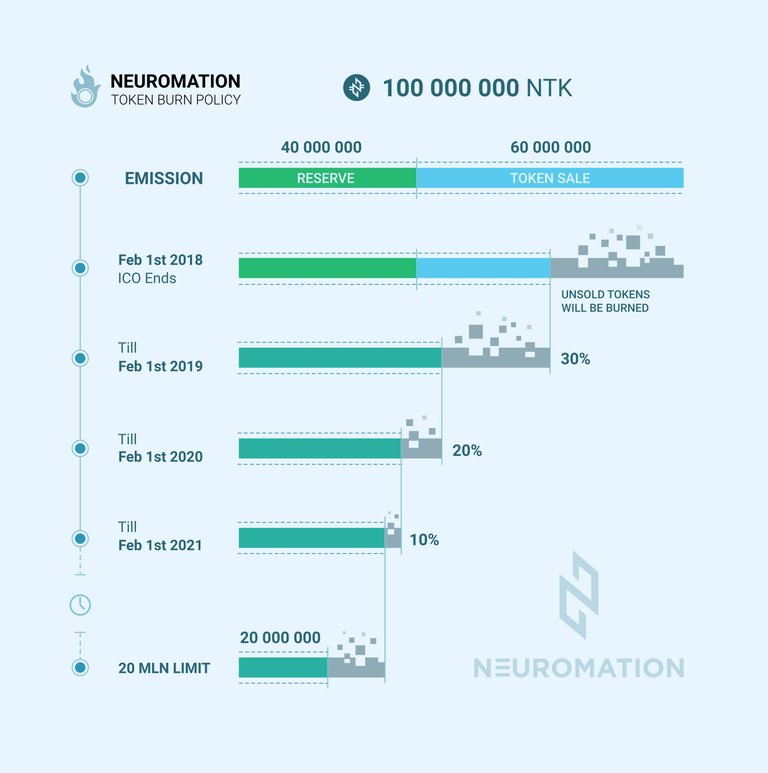

The amount of the initial offering on the platform equals Neurotoken 100 million. In the first three years of development, when the investment potential is formed, it is planned to burn up to 50.4% of the total emission. In the future, the amount of Neurotokens in circulation will be reduced to 20 million.

First, it is planned to “burn-up” the Neurotokens from the liquidity reserve, and further, once the allocated reserve is exhausted, the practice of buying tokens on the market (buy-back) will start in order to withdraw them from circulation. The lump amount of Neurotokens burnt depends on time and quantity factors, the time of issue and the intensity of transactions affecting the calculation.

Such method of flotation regulation is an example of an effective mechanism to prevent excessive inflation and a guaranteed way to support interest in the issued token. The development model chosen by Neuromation is still an innovative approach to “tokenomics”, but after Buterin’s speech (and considering the Ethereum popularity) it has a good chance of becoming an accepted standard in less than a year.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/neuromation-io-blog/neuromation-burns-it-up-efec889dc455