ABSTRACT

The advent of blockchain technology allows for the creation of asset-backed tokens, where each token can be pegged to the value of a corresponding security held in reserve. Blockchain technology also enables the transcending of old geographical barriers to entry. Tokens can be traded online from anywhere, quickly and cheaply, and can be sold as fractionalised assets, further lowering financial barriers to entry. Ankorus will establish an online exchange populated by any financial asset currently available worldwide. Various auditing measures will be taken to establish transparency, and customers will be able to validate that tokenised assets are fully backed and held by Ankorus. Ankorus prioritizes responsive customer care as a core value.

INTRODUCTION

MISSION

Ankorus will forge a vital new connection from the crypto sphere to the established world of finance, enriching both with enhanced levels of opportunity and security.

EXECUTIVE SUMMARY

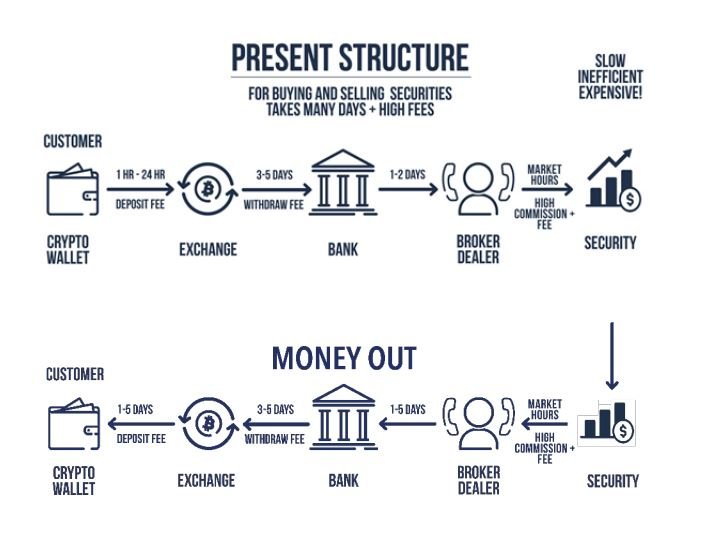

Ankorus will enable cryptoholders to buy real world financial assets. In exchange for cryptocurrency, Ankorus will create and allocate tokens that are exactly value-pegged to their corresponding assets. The natural result we expect to be a radical disruption to the traditional financial world, which too often serves too few.

Where some rivals simply expose their customers to assets, Ankorus will actually secure and hold them for you. Cryptoholders could truly diversify their portfolios across multiple asset classes. Harnessing innovative technology, Ankorus is initiating a new landscape of frictionless trading, beyond geographical boundaries and prohibitive financial barriers. Vibrant markets require liquidity, and by our plan to link the crypto world with that of finance, trading volumes will assuredly – and markedly – increase. Ankorus will open multiple new channels for the movement of wealth, and this additional fluidity will also facilitate exits to more stable holdings from volatile markets. Where previously cryptoholders found themselves lost at sea, Ankorus will empower its users to anchor in a safe harbour of their choice. It is worth noting that the still immature and evolving crypto sphere has too often been caught napping when it comes to the matter of security. A pervasive sense of vulnerability gnaws at many there as they know, at any time, their gains might fall prey to hackers or other misfortune.

With Ankorus, peace of mind will be bestowed by our next generation smart wallets and innovative exchange procedures, where we will set new – and needed – standards in security and service. Twenty-four hour multilingual customer care will be on hand to attend to any account issue customers might have, whether breached security or simply a mislaid password.

Ankorus intends to become a fully registered broker-dealer and acquire membership on a large and reputable exchange, securing the cheapest commissions for our customers and enabling all the best practices. Assets purchased and held by Ankorus will be insured and audited on a regular basis, for we recognise that trust and transparency are two of the most crucial ingredients in fostering sustained growth. Additionally, we will also establish AnchorNet, our unique trading platform that will form the nexus between the crypto and finance worlds.

With all the requisite track records, our core team and advisors are well positioned to lead the crypto expansion into the financial world. The brainchild of seasoned trader CEO John Cruz (a veteran of global exchanges such as CME, CBOT and Eurex), Ankorus was born from a deep personal dissatisfaction with the old model. The resulting solution arises from a natural synthesis of breakthrough technology and more than two decades of hard-won trading experience.

The Ankorus team is filled with experienced professionals from the financial community, including a former member of Morgan Stanley’s global FX business, and senior software innovators from the frontiers of technology, including one of Zynga’s original engineers. Our solution is the inspired but logical crystallisation of where we’ve been and where we’re all to go next. In common, we share a conviction that the time is both right and ripe to disrupt the legacy financial order, to potentially supplant it with an update more fitting for the twenty-first century.

Ankorus will flatten barriers, level the playing field and seed a new ecology, cultivating true fair play for all participants.

WHAT SPARKED THE ANKORUS REVOLUTION? - A Message from John Cruz, CEO

A trader’s job is to be right about a lot of things at the same time. That alone is hard enough. Add to the mix the challenges of learning new trading platforms, coupled with poor onboarding and customer support from vendors and exchanges, and it’s no wonder that trading is so frustrating, expensive and difficult to get right. All that was before 2013 and the advent of cryptocurrencies. But this new trading arena is sadly even worse. Vendors and exchanges have substandard, and occasionally criminal, levels of competency, security and support. And that's not counting the ever present threat of hacking.

I’ve traded stocks, bonds, futures, options, metals, commodities, currencies and cryptocurrencies. I’ve also been trading electronically for most of that time, beta testing almost every platform ever used. After 25 years, I cannot go through this rebirth all over again. So, I am creating this platform for me and to share with the world. And my team can make it happen.

The advent of the ICO is the key to this endeavour because it can provide the stimulus to build my team and bring my ideas to life. I'm sure we can do it because we have the knowledge between us to do it right.

No one is more demanding of a platform than I am. Bells and whistles do not make you money, they cost you money. I want us to make money. Friction makes things slow and expensive and I'm familiar with the friction points in trading. This blockchain revolution eliminates them. Trading therefore becomes easier. Ankorus is the logical next step.

My career has been long and profitable because I have been a successful spread trader, and arbitrageur. I look for and find low-cost entries and market inefficiencies. Trading is my job and I constantly work at it. Anchoring my money is a part of what I do. You must preserve your capital. Crypto trading doesn’t scare me. Incompetent, unreliable crypto exchanges and no-support

platforms scare me. I am not only building Ankorus for me, others can benefit from it too. The time has come to act.

TECHNOLOGY AND PROCESSES

The Anchor Token system will be an alternative investment ecosystem that tokenises and makes available any financial instrument, including stocks, bonds, futures, options, gold, silver, commodities, REITs, ETFs and sovereign debt.

When our customers purchase Anchor Tokens, we will immediately purchase the corresponding asset. Ankorus, as trusted custodian, holds this asset in reserve. Token holders can exchange their Anchor Tokens on the Ankorus token exchange, AnchorNet, or redeem their value directly from us.

SECURITY TOKENIZATION

Ankorus will be able to tokenise into an Anchor Token any financial asset that’s currently available. Ankorus will also take requests for Anchor tokenisation in return for a one-time tokenisation fee. Ankorus will make available for purchase any financial assets currently traded worldwide, such as AMZN, FB, SBUX, BIDU, AAPL, US T-Bills and Bonds, USD, CHF, JPY, SPY, GLD, ZKB Gold, Crude Oil.

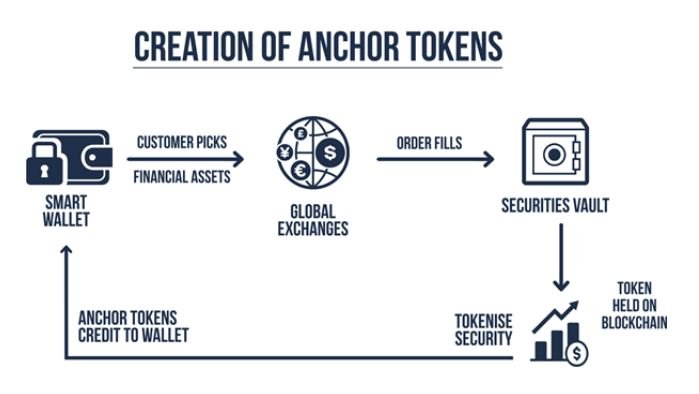

CREATION OF ANCHOR TOKENS

- The customer selects a financial asset to tokenise.

- Customer pays Ankorus for their purchase in any one of a number of currencies (this will include BTC, ETH, Ripple's XRP, BCH, Litecoin, Dash, NEO, Tether and ANK).

- The Ankorus broker-dealer purchases the underlying securities, as selected by the customer. Orders are filled at the security’s currently traded price.

- The equivalent value of Anchor Tokens for that security is then credited to the customer’s account in their smart wallet, minus a small fee and commission. Anchor Tokens will be credited to the customer’s wallet within minutes of receiving the order.

- Any earnings derived from underlying securities will be either automatically reinvested back into those securities, giving the customer a larger number of Anchor Tokens, or credited to the customer’s wallet. The customer can choose which of the two options they prefer.

Ankorus is the only entity that can create or destroy Anchor Tokens, thereby maintaining their exact

pegged value in line with the underlying security.

TRADING ANCHOR TOKENS

Token holders will be able to trade their Anchor Tokens for other Anchor Tokens on AnchorNet, our planned proprietary Anchor Token exchange platform (see The AnchorNet Trading Platform) and also on any other available cryptocurrency exchanges.

ACCREDITED BEARERS AND BENEFICIARIES OF ANCHOR TOKENS

The owner of Anchor Tokens is referred to by Ankorus as the Accredited Bearer. The Accredited Bearer will be able to redeem Anchor Tokens from Ankorus or trade them on the secondary market, AnchorNet. The Accredited Bearer will be either the initial purchaser of the Anchor Tokens, a beneficiary of the initial purchaser, or a purchaser from the secondary market AnchorNet. The Accredited Bearer will be able to nominate and identify beneficiaries to whom the Anchor Tokens are to be bequeathed. Once the Anchor Tokens have been transferred to the beneficiary, the beneficiary becomes the new Accredited Bearer.

ACCOUNT FUNDING

Customers will pay into their accounts and redeem their holdings in either traditional fiat currency or cryptocurrency. The currency of redemption will be determined by the currency of account funding and must remain the same. Whichever currency is used, both Ankorus and its customers are obliged to adhere to the relevant local regulations regarding financial transactions in that currency.

FUND WITHDRAWALS

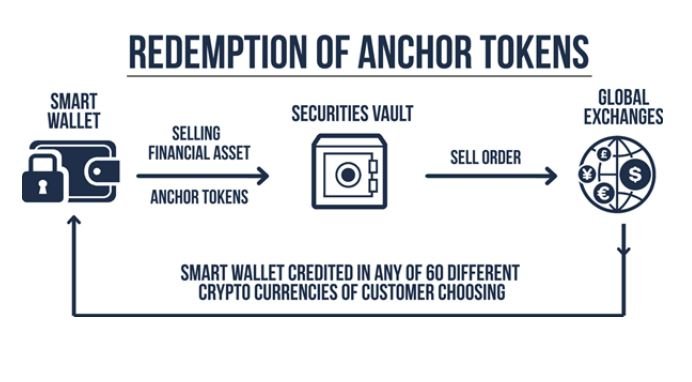

The Accredited Bearer of Anchor Tokens may redeem them directly from Ankorus, into their customer account, for the equivalent value of their underlying security. After Anchor Tokens have been redeemed, or if there is a balance of currency in a customer's account, the customer may request for withdrawal of funds from their account.

MARKETS AND PRICING

Ankorus will create both a primary and secondary market for Anchor Tokens.

*Primary Market. Customers buy and redeem Anchor Tokens directly from Ankorus. Orders are filled for customers according to the current market price. Likewise, tokens will be redeemed at the current market price.

- Secondary Market. Ankorus will create an orderly market for secondary trades of all Anchor Tokens. These will be traded on AnchorNet, to be developed in Phase Three (see Roadmap). Here, customers will be able to exchange Anchor Tokens for a variety of anchored securities and all cryptocurrencies.

GENERAL LEDGER

Ankorus will use a specialised general ledger to achieve the necessary high levels of security and trust required for an online exchange.

*The general ledger will track token creation, possession, transactions and redemptions.

- Rights of token possession will be tracked at all times.

- All transactions that occur must be valid transactions, completed through the general ledger.

PROOF OF INTEGRITY

To ensure a proper link is maintained between existing Anchor Tokens and their underlying securities, and maintain the requisite transparency of operations, Ankorus will employ various mechanisms:

- We will be audited by the exchange.

- We will be audited by all the necessary monetary authorities.

- We will invite existing reputable auditors to examine our books.

In addition to these measures, Ankorus customers will be able to inspect the general ledger to compare total tokens created against the total value of securities held. Daily brokerage statements will also be issued for confirmation of transactions done and securities held.

GLOBAL CUSTODIAN

Ankorus will act as the depository for all underlying securities.

- Ankorus, as custodian, will ensure the secure holding of all underlying securities that are purchased through any global exchange.

- A “Proof of Asset” dashboard will be maintained in real-time at AnchorNet, enabling complete transparency.

- The Ankorus clearing firm will provide a daily statement, available from Ankorus.

- The custodian will be SIPC insured.

- The custodian will be independently audited on a regular basis to ensure that proof of reserves match all tokens

created.

ARBITRATION

Ankorus will be the final arbiter of all disputes regarding loss, theft or fraudulent transactions of Anchor Tokens, and will annul

and reverse any invalid transactions.

SMART WALLET

Anchor Token holders will store their tokens in highly secure and reactive Ankorus smart wallets. Ankorus smart wallets will leverage proprietary technology to achieve an unsurpassed level of security within a presently immature and predatory cryptocurrency environment. Vulnerability to hacking is vastly reduced.

Smart wallets will employ Reactive Portfolio Management (RPM), providing a display that enables users to monitor in realtime

the current value of their Anchor Tokens, in their chosen base currency, and the value of any held fiat currency. Account

statements can also be requested. In the event of fraudulent transfer, RPM technology will automatically trigger the self-destruct algorithm built within Anchor Tokens. Further, each party will be made whole via the annulling of invalid transactions and awarding of replacement tokens.

CORE TEAM

The core team is comprised of five individuals, from the US, UK and South Africa, who together also comprise the founders of Ankorus.

TOKEN ALLOCATION

Ankorus will begin accepting contributions on the 25th November 2017. Interested parties can contribute cryptocurrencies to Ankorus, which will be the only form of contribution accepted. The contribution period will last for 30 days, after which the ANK tokens will be allocated to the contributors. Contributors will be able to view their contribution in their smart wallet. The "hard cap" is set at 150,000 ETH. 100 million ANKs (the maximum supply) will be created and apportioned as follows:

- 50% available to the public.

- 24% allocated to the Ankorus treasury.

- 15% allocated to the Ankorus founders*.

- 5% allocated to Ankorus advisors*.

- 3% allocated to bounties.

- 3% allocated to marketers costs.

- ANKs allocated to the Ankorus founders and advisors (totalling 20% of total ANKs) will be electronically locked up for a period of 12 months. This lock up will be built into the smart contract and visible on the blockchain.

Shortly after the tokens have been apportioned, the ANK will be listed for trading on a major exchange. After a period of approximately six weeks, Ankorus will list the ANK on a further two exchanges.

The ANK will perform several crucial functions within the Ankorus “ecosystem”. Customers wishing to use the Ankorus platform must possess a minimum of five ANK tokens. Possession of ANK tokens will also count towards favourable commissions when purchasing Anchor Tokens.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ankorus.org/wp-content/uploads/2017/10/Ankorus-Whitepaper-Print.pdf

WoW! This was very interesting and unique. Looks like your new like me and this platform is so COOL!