Another examination by Recorded Future has discovered that Bitcoin is losing its position as the main cash on the Darknet markets. The Internet tech organization dissected 150 of the most dynamic message loads up, commercial centers, and unlawful specialist co-ops and saw that the Darknet people group suppositions toward Bitcoin have gone ahead.

The Darknet economy

The Darknet is an Internet that utilizations non-standard correspondence conventions and ports to make it more troublesome for the computerized personalities of clients to be uncovered. The Darknet expects clients to run an extraordinary programming, the most well known being TOR. to interface with the Internet. One of the principle reasons for utilizing the Darknet is to make the data supplier and the individual getting to the data hard to follow. Due to this protection include, the Darknet has turned out to be well known for its Darknet markets like Silk Road that enabled clients to viably trade anything, lawful or unlawful over an Amazon-like commercial center. The unknown Internet is said to pull in culprits and those inspired by bootleg market exercises also

.

A backlogged network

In mid-2016, Recorded Future saw that the 150 elements they were investigating were all communicating concerns with respect to the usefulness, ease of use and security of Bitcoin in the Darknet economy. Despite the fact that it was a generally mellow increment contrasted with the expansion in enthusiasm for Bitcoin in the last 50% of 2017, the Bitcoin arrange was starting to wind up noticeably over-burden with movement which brought about higher exchange charges for those utilizing the Darknet markets. On Dec. 23, 2017 exchange expenses were $52.18.

Recorded Future found that the normal exchange estimate on the Darknet is $50-$300. On the off chance that an individual endeavored to execute on Dec. 23, 2017 – it could have been the situation that the exchange charge was more exorbitant than the sum being executed. One individual from a Darknet message board posted this on the discussion he employments:

"What's occurring right now is unfathomable. In spite of that I've utilized the prescribed commission expenses, my exchanges have stayed pending for as far back as three days, and my work has been incapacitated. Dear merchants, please execute elective installment choices; else, I will pass up a major opportunity for this Christmas season."

A Christmas miracle

The accumulated line on the Bitcoin arrange was making it troublesome for a few people in the black market to direct their business. This clients exchange was logged so far back in the line that it took a few days for it to end up plainly checked. To battle twofold spending assaults, most merchants on the Darknet embraced a manage requiring three affirmations previously regarding exchanges as entire. Since an exchange can't be finished until the point when the installment has been affirmed, this client was adequately solidified out of directing his "business."

Despite the fact that he was stressed he would "pass up a major opportunity for this Christmas season," his Christmas supernatural occurrence was going to happen. To battle, the abundant exchange expenses that were expanding day by day, sellers started tolerating elective installment alternatives. The investigation found that Litecoin was the second most well known cash with 30 percent of all sellers tolerating LTC, and Dash the third most mainstream money, with 20 percent of all merchants tolerating DASH.

Other Darknet studies

In 2016, financial analyst Tuur Demeester was examining the Darknet markets. Demeester swung to r/DarkNetMarkets to check whether the group could furnish him with the measurements he was searching for: what level of exchanges on the Darknet was directed with BTC? Was DarkCoin utilized and how regularly? What number of Bitcoins were spent on the Darknet on an every day/month to month/yearly premise? Be that as it may, Demeester was not met with any helpful answers from the group.

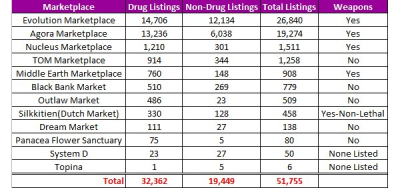

Preceding Demeester's undertaking, The Digital Citizens Alliance discharged a table with measurements about the quantity of medication postings on the Darknet showcases in August 2014, yet this table gave no data respected costs, exchange volumes and favored installment strategies.

Moreover, Nicolas Cristin, a partner look into educator in the School of Computer Science and in Engineering and Public Policy at Carnegie Mellon University (CMU) together with Kyle Soska, a Ph.D. hopeful in CMU's school of electrical and PC designing in 2013, directed an examination from 2013-2015 to understand the Darknet showcase economy.

At the point when the Silk Road was closed down in October 2013, Cristin and Soska saw that the bring down generated the improvement of mysterious online commercial centers, which keep on evolving right up 'til today. Cristin and Soska utilized long haul estimation investigation on 16 unique commercial centers for more than two years (2013– 2015) to ascertain the development of the online mysterious commercial center biological system. Their exploration archived the kinds of products being sold, the impact – or need – of ill-disposed occasions, for example, law requirement tasks and expansive scale fakes, on the general size of the economy. The two likewise picked up bits of knowledge into how sellers are broadening and recreating crosswise over commercial centers, and how merchant security hones (e.g., PGP selection) are advancing.

Installment strategies are developing

Recorded Futures think about finished up by expressing that the endeavors that merchants are taking to expand adequate installment strategies on the Darknet markets will proceed. Despite the fact that installment strategies like Litecoin and Dash are ending up more well known, Recorded Future still anticipates that Bitcoin will have a place in the Darknet economy-only a significantly littler piece of the pie than it at present has. Recorded future likewise cautions that with expanded notoriety in computerized monetary standards will come an expansion in malignant instruments like ransomware that will attempt to exploit the standard patterns in digital money.